Kya Mutual Funds sahi hain?

Madan Kaka, an intellectual on Dalal Street, was an ardent believer in mutual funds.

“Mutual Funds sahi hain boss. Isme solid paisa banta hain,” he used to tell youngsters and novices.

However, he is now sporting a glum face.

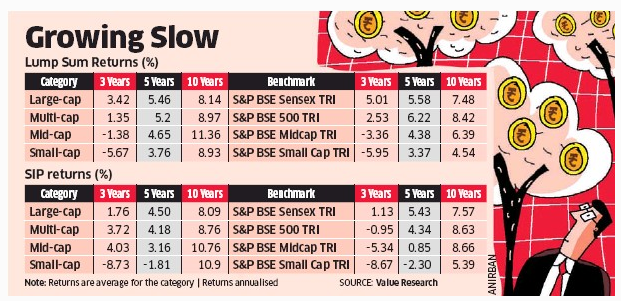

This is because the ET has made the explosive revelation that investments in equity schemes in the past five years have fetched lesser average returns than fixed deposits of the best banks or the popular Public Provident Fund (PPF).

According to the study, the average SIP returns from the large-cap, multi-cap, mid-cap and small-cap categories for three and five years are below 5%.

In contrast, SBI’s fixed deposit offers a higher rate of 5.3% per year.

Anup Bhaiya, an expert, eloquently voiced the disappointment of the hapless investors.

“Investors who came into equities post demonetisation and have completed three years of investment are losing patience due to poor returns. They had come in on the back of investors making a 15-17% from their SIPs in the past three years, with stellar performance from mid- and small-caps,” he said.

Other noted experts also expressed their disappointment at the sorry state of affairs.

“Mutual fund सही हे क्या यह कहना क्या सही हे ?????,” they asked in a poignant manner.

Million doller question is…. Whats Mutual in it?????

Paisa client ka ……. Risk client ka …… Returns Nahi mile to Fund Manage ka kya gaya??? Kuch Nahi …. their hefty salary is geting credited… so they always in Profit— Manish (@ManishSR_) July 10, 2020

म्युचल फंड में लोगो को लूटा ही जाता है, चार्जिस मार मार के, 8 साल की SIP का कचरा कर दिया इन लोगो ने मकान के लिए फंड इकट्ठा किया वो भी नफे बगैर 9,60,000 का कल 9,92,000 ही आ रहा है इसे तो रिकरिंग में 16,40,000 लाख हो जाता,

म्युचल फंड गलत है— godgiftedjagu (@godgiftedjagu) July 10, 2020

However, some did come out in support of mutual funds.

This was not expected from you….how can you say when we all know that this downfall is temp. let's wait for few more months…

You will say…Sahi Hai..

— GYC – Grow Your Capital (@GrowGyc) July 10, 2020

आज मच्युल फंड की रिटर्न कम है तो एफडी अच्छी हो गई कल mutual fund की रिटर्न अच्छी हो जाएगी तो बैंक एफडी की रिटर्न कम लगने लगेगी एक्सपर्ट कितना भी बड़ा हो बस पोस्टमार्टम ही करते है

— vinay sirohi (@vinaysirohi7) July 10, 2020

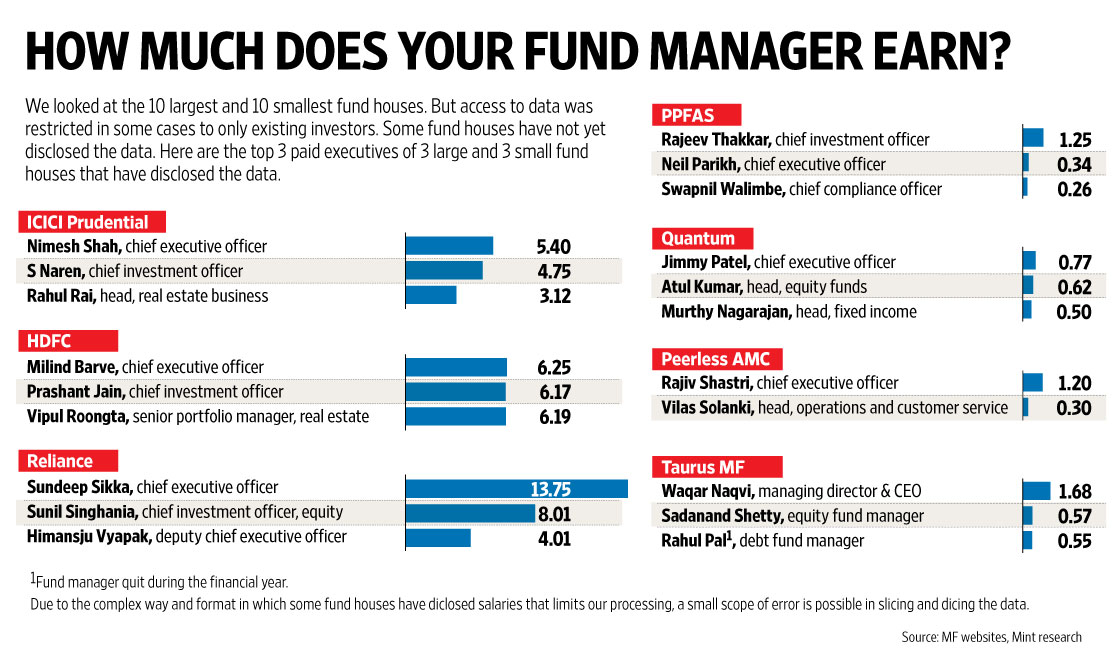

Mutual Fund managers get more salary than Mukesh Ambani & corporate bosses?

It is unbelievable but true that some mutual fund managers are taking home more salary than their corporate counterparts.

While Mukesh Ambani and N. Chandrasekaran (of TCS) had to stay content with annual salaries of Rs. 15 crore and Rs. 21 crore respectively, mutual fund managers received more by way of salaries and ESOPs.

Even managers of small mutual funds are raking in mega salaries.

Being small no bar for high CEO remuneration in mutual fund companies! @kayezad @LisaPBarbora @monikahalan @dhirendra_vr @SrikantBhagavat @deepakshenoy @NagpalManoj @MFBALA @KalpenParekh @vaibhavchugh @sundeepsikka @invest_mutual @pvsubramanyam @iRadhikaGupta @AashishPS pic.twitter.com/YccTZVdMi5

— RK Rao (@tigerrao7) May 3, 2018

Losses are also no bar for high salaries.

Mutual Fund CEOs take high salaries despite reporting losses https://t.co/8aluKQ314f pic.twitter.com/wyZL9LADKw

— Business Today (@BT_India) May 2, 2017

Naturally, this has also aroused the ire of investors.

If you understand Equity Market you will certainly say "Mutual fund SahiNahi Hai". Fund managers continue to get their fat salaries losing public money. If you have your own portfolio in the equity market & the same amount invested in MF one can easily see the difference.

— ?? Padmaja (@prettypadmaja) May 28, 2020

This state of affairs had alarmed SEBI and it wanted to put a leash on the runaway salaries though nothing was in fact done.

Market regulator #Sebi may put high mutual fund salaries on a leash http://t.co/2BIKluTUiT pic.twitter.com/D0SVyhz8YF

— Economic Times (@EconomicTimes) August 21, 2015

Warren Buffett & Charlie Munger have warned us against being ripped off by fund managers

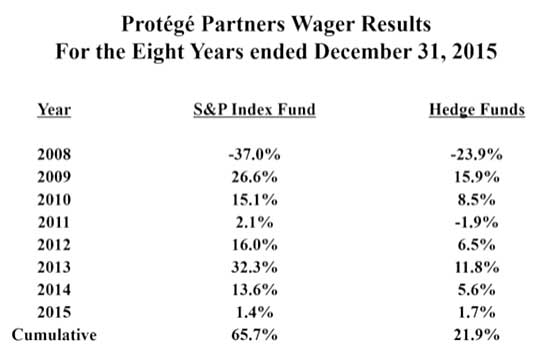

Warren Buffett and Charlie Munger have already sounded the red alert that investors will get ripped off by (Hedge) Fund managers.

“There’s been far, far, far more money made by people in Wall Street through salesmanship abilities than through investment abilities” the Oracle of Omaha said with his characteristic bluntness.

“The compensation charged by hedge fund managers is unbelievable to me” he added.

Warren Buffett took a dig at the concept of hiring consultants for advice on where to invest.

“No consultant in the world is going to tell you ‘Just buy an S&P index fund and sit for the next 50 years. You don’t get to be a consultant that way, and you certainly don’t get an annual fee that way” he said.

He produced evidence that showed that hedge funds have severely underperformed the S&P Index. While the basket of hedge funds had returned 21.9% for the eight years through 2015, the S&P Index had given a mind-boggling return of 65.7%.

Are investors wisening up and bolting from mutual funds?

According to the latest data from AMFI, inflows into equity funds in June 2020 has plunged to a multi-year low of Rs. 225 crore, which is a steep fall of 96% on a month-to-month basis (Rs. 5,246 crore in May).

OK.. this is a shocker — net equity inflows into #mutualfunds at 225 cr!! I cant remember a time this bad#investing #market

— Sumaira Abidi (@SumairaAbidi) July 8, 2020

Unbelievable! I did a double take when I first saw the @amfiindia website… #mutualfund #investing https://t.co/09zTui690t

— Sumaira Abidi (@SumairaAbidi) July 8, 2020

However, Nithin Kamath, the visionary founder of Zerodha, rubbished the fear that investors are bolting from mutual funds.

He opined that it is a case of “how HNI’s, institutions are allocating” funds.

Rs 241 crore net inflows in June for MF doesn't mean retail is switching to direct stocks. It was our largest month in terms of net inflow on Coin, the same with peer platforms. Net inflows falling may be a function of how HNI's, institutions are allocating. pic.twitter.com/SXJ10DyjhL

— Nithin Kamath (@Nithin0dha) July 9, 2020

Why not invest directly in ETFs?

Warren Buffett candidly admitted that even he cannot outperform Index Funds.

Warren Buffett says he can't beat the S&P 500 https://t.co/bbCbjxwZPO pic.twitter.com/lW9xvnDfPh

— CNN Business (@CNNBusiness) February 25, 2019

This is endorsed by Ramesh Damani.

When I came to the stk mkt in 1989, the Sensex was about 800 at that time. Today it is closer to 36k, gone up 50-60X. All kind of events have taken place in last 30 yrs, from Kargil to DeMo to fin crisis. But the index always finds its way higher – Ramesh Damani#indexfunds

— India ETFs & Index Funds (@IndiaEtfs) February 5, 2019

Taking a cue from this, the optimum solution is for investors to buy Exchange Traded Funds (ETFs) directly from the stock exchanges.

These are extremely low cost and can be bought at zero-brokerage from discount brokers like Zerodha, Upstox etc.

There are a wide array of ETFs available which invest in Indices such as the Nifty, Junior Nifty, Bank Nifty etc.

The Nifty Junior has these fail-safe and powerhouse stocks in it, diversified across sectors.

| Top 10 stocks in the Nifty Junior Index | |

| Stock | Sector |

| SBI Life Insurance Company | Financial |

| HDFC Life Insurance | Financial |

| Godrej Consumer Products | FMCG |

| Dabur India | FMCG |

| Shree Cement | Construction |

| Bandhan Bank | Financial |

| Divi’s Laboratories | Healthcare |

| ICICI Lombard General Insurance | Financial |

| HPCL | Energy |

| Petronet LNG | Energy |

| Pidilite Industries | Chemicals |

The performance of the indices is quite attractive over the years.

Since inception from 2000, the #BankNifty has returned nearly 4.07 times more than #Nifty.

While #BankNIFTY has gained 2581.47%, #NIFTY has gained 638.68% over its lifetime from the time it was introduced.#investing #trading pic.twitter.com/1kZxhrdhln

— Milan Vaishnav, CMT, MSTA (@Milan_Vaishnav) November 5, 2019

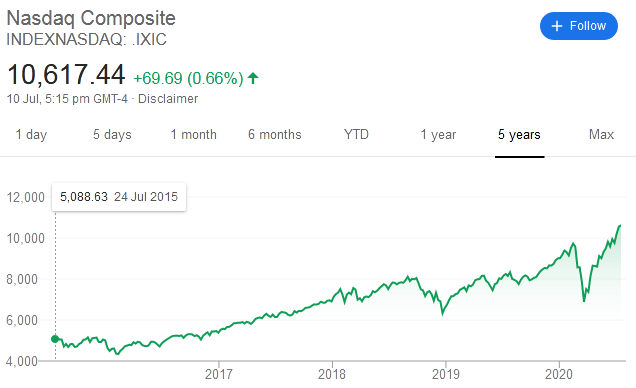

Investors desiring exposure to foreign stocks can consider ETFs such as the MOSt shares Nasdaq-100 ETF.

This will give us exposure to the much fancied FANG stocks such as Facebook, Apple, Netflix, Google, Microsoft etc.

Awesome advice. After listening to videos by Mr. Warren Buffet and Ray Dalio, I came to the conclusion that ETF's and Index funds are the best.

— Virodhanand (@virodhanand) May 31, 2020