Sixth sense of Dalal Street punters warns of impending doom

Today morning, as I made my way to the plush offices of the RJ Fan Club, I could sense that something, somewhere was drastically wrong.

This was evident from the body language of the punters who loiter around Dalal Street.

Usually, one can see the punters having animated conversations in small groups around the tea stall, chewing pan and gutka, and debating loudly about which stocks should be bought or sold.

However, today, the punters were silent, with a somber expression on their faces. They were listless and were not even chewing pan and gutka.

What was troubling the punters became clear to me as the day wore on.

RCom defaults on loans

The ET was, as usual, the first to break the shocking story.

“The plight of Reliance Communications is more serious than what credit rating agencies believe. The Anil Ambani-owned mobile phone operator has defaulted on its loan servicing obligations with more than 10 local banks, some of whom have categorised the exposure as “special mention account” in their asset books,” the reporters said in a grim tone.

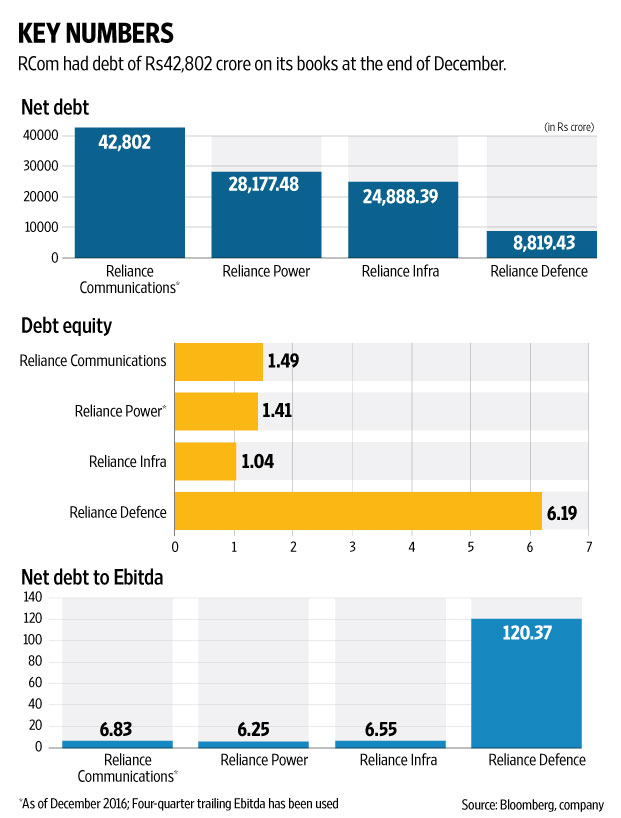

(Image credit: Mint)

ADAG stocks head for free fall

Understandably, investors rushed to Dalal Street to dump the ADAG stocks and recover whatever little was possible to be recovered from them.

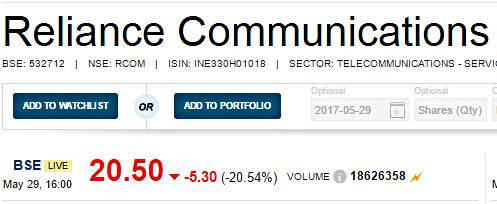

By the EOD, Reliance Communications (RCom) had lost 21%, Reliance Infra had lost 11%, Reliance Capital had lost 9%, Reliance Power had lost 8% and Reliance Defence had lost 6%.

The collective loss to the beleaguered shareholders of the ADAG companies runs into several tens of thousands of crore.

Ashwani Gujral predicted that ADAG was in trouble and recommended short-sell

Ashwani Gujral, the noted technical analyst, had sensed that something was rotten in the ADAG stocks.

On Wednesday, 24th May, he made the bold pronouncement that “ADAG in massive trouble” and advised his followers to short-sell the stocks of the group for “solid gain”.

ADAG in massive trouble, short that group for some solid gain!!!

— Ashwani gujral (@GujralAshwani) May 24, 2017

The prediction has come true and those that followed Ashwani Gujral’s advice are basking in hefty gains.

@GujralAshwani superb call sir on reliance made 10000

Good to see this time around i will be a big tax payer all tha ks to you 🙂— Rahul (@rahul_trader) May 26, 2017

Investors distraught with worry

Understandably, investors are worried sick that their investments in the ADAG stocks may be irrecoverable.

What happening in Anil Ambani stocks?? Carnage? #Rcom leads the fall #Relinfra #Relcap following ? @Geetu_Moza @Sethinomics @Equiideas09

— Pankaj Dhawan (@PrivateFortune) May 29, 2017

Chotu gone (Relinfra)590 to 450 Traders became investor now ;p #ADAG

— Vishal Shah (@vishi2210) May 29, 2017

I wrote in the morning that Anil Ambani is next vijay mallaya …. this is the beginning … all ADAG stock crshed

— @kapil jain (@moolchandgolchh) May 29, 2017

After Today's Fall

ADAG to be renamed as DAAG

RCAP to be renamed as CRAP

Fwd

— Ankit Chaudhary (@entrepreneur987) May 29, 2017

Nifty is up 300 pts in 1 mth..

ADAG group stocks down 25%…

Discipline imp. .forget investing, never even trade in bad stocks..— Vivek Pandey (@IVivekPandey) May 29, 2017

Some even reached out in desperation to Madhusudan Kela, the financial wizard of the ADAG group.

@MadhusudanKela I made the biggest mistake of my life by investing in ADAG stocks. Markets at all time high and ADAG stocks at lows. SHAME

— Sumit (@steelalum) May 29, 2017

Obviously, Madhu Kela is in no position to reply to individual queries though he appears to have anticipated the risk to the group if one goes by his generic philosophical tweet posted only a few days ago:

Risk is an inescapable part of investing. Any approach/investment that promises substantial gain"without risk is simply too good to be true!

— Madhusudan Kela (@MadhusudanKela) May 10, 2017

Veritas had warned that RCom is a “house of cards” and predicted a target price of Rs. 15

At this stage, we have to pay tribute to Veritas, the Canadian research agency.

As far back as in 2002, when RCom was still a formidable force to reckon with, Veritas had issued a research report in which it had trashed RCom.

The report makes for chilling reading for the no-holds barred manner in which skeletons were exposed.

The report accused RCom of “whimsical” accounting policies and “poor corporate governance standards”.

It warned that “RCom is entering a phase of maximum uncertainty” and that the macro-economic conditions were “highly detrimental” to RCom’s prospects.

It also stated that “exceedingly high financial leverage, accompanied with debt repayment obligations of approximately $U.S. 2.2B over the next twenty-four months, at a time when EBITDA in core business operations is stagnating, is a significant challenge for the management team”.

At the end, Veritas contemptuously described RCom as a “house of Cards”.

It projected a target price of Rs. 15 for RCom (a 77% downside from the then price of Rs. 66) and recommended a sell.

Anil Ambani and analysts trash Veritas’ sell recommendation

Not surprising, Anil Ambani and the top brass at RCom were not amused with the Veritas report.

They adopted a belligerent stance and trashed the report on the basis that it “lacked credibility” and was “full of factual inaccuracies, baseless allegations masquerading as research“. It was also alleged that Veritas was “destroying investor confidence through sensationalism“.

Surprisingly, senior analysts were also contemptuous of the Veritas report.

SP Tulsian, the veteran stock picker, opined that the price target of Rs 15 “is based on several assumptions and is ridiculously low”.

Deven Choksey suspected that the report was “driven by some ill-gotten motive“.

A similar sentiment was expressed by Ambareesh Baliga.

Today, RCom is within touching distance of the target price of Rs. 15 projected by Veritas.

Prophetic predictions by Neeraj Monga of Veritas

It is notable that Neeraj Monga, the author of the report, has a distinguished track record in predicting doomsday for companies.

In 2011, he correctly predicted that Kingfisher was “teetering on the verge of bankruptcy”.

He also condemned two US companies named Timminco and Yellow Media Inc as being on a “slippery slope” and opined that it would be a “miracle” if they survived.

Needless to say, both companies sank like a stone soon thereafter.

Neeraj Monga got into serious trouble when he alleged that the sole reason for the creation of IndiaBulls’ real estate division “is to bilk institutional and retail investors for the benefit of select insiders. The controlling shareholders are running the organization as a piggy bank.”

Indiabulls came after him with hammer and tongs and not only filed police complaints and got him arrested but also filed civil suits claiming damages for defamation.

He was arrested by the Gurgaon police on serious charges of “conspiracy, extortion and forgery of documents”.

The present status of the proceeding is not known.

No idea what the truth is but two equity analysts arrested for taking on financial services grp,Indiabulls,shocking. http://t.co/8BT8x1QJa9

— Rupa Subramanya (@rupasubramanya) November 27, 2014

Here's the scathing Veritas report by Neeraj Monga and Nitin Mangal, "Bilking India", taking on IndiaBulls. http://t.co/HutsYa3x5D

— Rupa Subramanya (@rupasubramanya) November 27, 2014

Conclusion

The fall from grace of RCom and the other ADAG companies, while traumatic for the hapless investors, is a vindication for Veritas and Neeraj Monga.

There are two important lessons in this sordid episode for us. The first is that we should never invest in junkyard stocks, no matter how alluring the valuations may be. The second is that if we do get ensnared into such stocks, we should keep a red alert and bail out at the slightest sign of trouble. Otherwise, we will be the ones left holding the bag!

Telecom sector is in probem is nothing new and R com was not among strongest in sector .I still guess that Telecom business of both brothers may be merged sooner than later and merged entity will belong to RIL.This suits both and Banks.In my view ADAG will concentrate on Financial,Defence and Power only.Among all ADAG companies Rel Capital is strongest and is trading cheap only because of these reasons and stock may bounce back on business .

Wahts your view on rel capital now? I m holding it.

Should one change view on Rel Capital due to Rel Com?

No I just looking at it from promoter angle and ADAG group company angle?

Just avoid both brothers companies. You never know what is the hidden IED placed within these companies. RIL is saddled with 2.5 lakh crore debt. And for all you know after Jio project gets fully complete, even without getting a positive cash flow from Jio, RIL will embark on the next world scale record beating project it could also bid for a Fortune 10 company. The effect will be loans will now be 10 lakh crores. The shareholder ultimately has to bear the brunt because he will never see any appreciation of his investment. There are so many multibaggers around if the intention of the investor is to make money in the stockmarkets. Why Reliance Group?

Really…. scary times if getting into Ambani cos.

Invest in MCX.

Reliance fiascos are well known from the past. Has anyone forgotten Reliance Power post IPO fiasco? I havent touched a Reliance company thereafter.

And is it (or is it not) strange that the Modi government entrusted big defence contracts to a new defence company in the ADAG group, Reliance Defence? That despite having some of the world class companies in the PSU catering to Aero/Electronics/Heavy Industries sector like HAL, BEL, BEML, BHEL, ISRO, ADE, DRDO etc?!

India is biggest importer of arms in world only due to poor companies you mentioned.Now after privatisation these all companies will follow mtnl ,bsnl,hmt,air India and many more sick PSU .For defence future lies in L&T,Bharat forge etc in Pvt sector..People made money in PSU stocks not due to any performance but due to cheap selling by Govt.That is already over and govt will still be happy by exiting from all these third class PSU stuff even at throw away prices.All PSUs are snake around govt neck.