Company Overview:

Canara HSBC Life Insurance Company Ltd (CHLICL) is a leading private life insurer in India, jointly promoted by Canara Bank and HSBC Insurance (Asia–Pacific) Holdings Ltd, a subsidiary of The Hongkong & Shanghai Banking Corporation Ltd. As of Mar’25, the company ranked 3rd among public sector bank-led life insurers in terms of the number of lives covered and held the third-largest AUM among peers. Its product suite spans across multiple segments, catering to both individual and group customers, comprising 20 individual products, 7 group products, and 2 optional rider benefits, in addition to offering coverage under the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY). The company’s Embedded Value (EV) as of Jun’25 stood at Rs 6,353 cr.

Key Highlights:

1. Established parentage and trusted brand: CHLICL derives significant strength from the backing of its promoters, Canara Bank and the HSBC Group, which enhances customer confidence and enables robust business generation. The contribution of these two key bancassurance partners to the company’s total business premium has been steadily rising—from 63.6% in FY23 to 74.8% in FY24, 78.9% in FY25, and further to 82.1% in 1QFY26.

2. Extensive distribution network enabling pan-India presence: The company’s multi-channel distribution network ensures strong outreach and accessibility. CHLICL’s product range is available to both individual and group customers through three primary channels—bancassurance, brokers and corporate agents, and direct sales. The strategic tie-up with Canara Bank provides access to an extensive retail base of 11.7 crore customers across 9,849 branches in India (as of Mar’25). In addition to this, CHLICL has also expanded its presence through 13 insurance broker tie-ups and 3 corporate agent partnerships, further diversifying its sourcing channels.

3. Well-diversified and customer-centric product portfolio: CHLICL’s product range is designed to meet customers’ evolving needs across their life stages—from early career to retirement. Its portfolio includes protection, savings, investment-linked, retirement, and group insurance plans, ensuring a balanced business mix.

4. Focus on Long-Term Value Creation: CHLICL remains focused on building sustainable long-term value through consistent growth, strong underwriting standards, and prudent risk management. Between FY23– FY25 period, the company delivered a CAGR of 14.7% in Individual WPI premiums and a 16.7% CAGR in AUM, reflecting both growth momentum and disciplined execution.

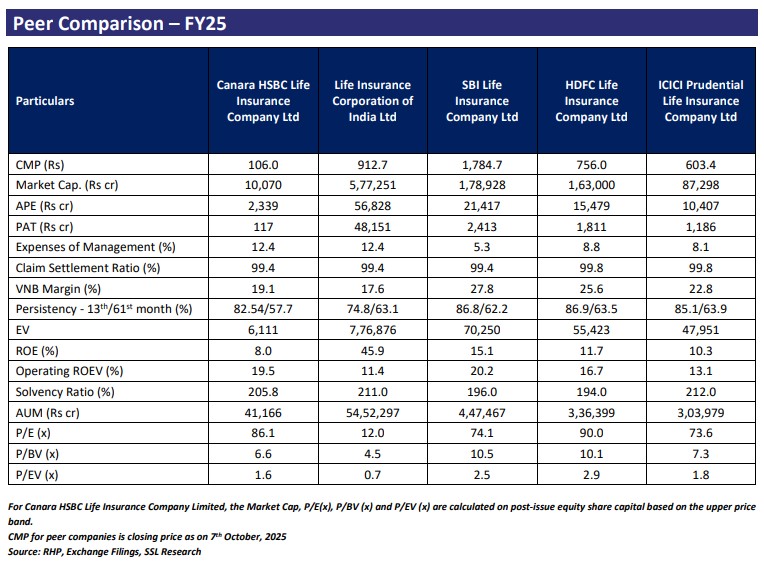

Valuation: CHLICL stands out as a well-positioned life insurer leveraging its strong promoter lineage, deep bancassurance network, and balanced product mix to sustain growth momentum. Its growing contribution from bancassurance partners, improving persistency, and consistent premium growth provide visibility for continued profitability. The company’s focus on technology integration and product innovation supports scalability and enhances customer engagement. At the upper price band, CHLICL is valued at a 1QFY26 P/EV multiple of 1.6x. Furthermore, the Life Insurance premium for bank-led players is expected to grow at a CAGR of ~22%-25% between the forecast period of FY25 to FY28P, reaching Rs 5.4 tn – Rs 5.7 tn. The company is expected to benefit from the sector’s tailwind.