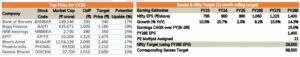

Resilient Performance; Maintain BUY

Est. vs. Actual for Q4FY25: Revenue – MISS; EBITDA – BEAT; PAT– BEAT

Changes in Estimates post Q4FY25

FY26E/FY27E: Revenue: 3%/5%; EBITDA: 8%/9%; PAT: 5%/6%

Recommendation Rationale

• Steady Performance: ITC posted a steady Q4FY25 performance, with revenue rising 9.4% YoY, led by robust growth in the Cigarette and Agri businesses. The Cigarette segment saw a 6% YoY increase, supported by 4% volume growth, while the Agri segment grew 11% YoY, driven by strong momentum in leaf tobacco, value-added agri exports (coffee, spices), and improved rice exports. The FMCG business delivered a modest 4% YoY growth amid weak demand and elevated input costs. The Paperboards segment registered ~6% YoY growth, though profitability remained under pressure due to pricing headwinds from low-cost imports, subdued domestic demand, and a steep rise in wood costs.

• Gross Margins declined by 360 bps YoY to 54.1% due to a sharp escalation in key input materials (edible oils, wheat, maida, potato, cocoa, leaf tobacco, and pulpwood), especially in H2FY25 and subdued realisations in the paper business.

• Long-term Story Remains Strong: We believe ITC’s long-term growth trajectory remains intact, with most segments (excluding FMCG and Paperboards) on a steady path. 1) Cigarette volumes continue to grow, supported by innovations and premiumisation. 2) The Agribusiness remains resilient, driven by strong customer relationships and agile execution in leaf tobacco, coffee, and spices. 3) While FMCG growth has been impacted by muted urban demand and input cost inflation, the sector is poised for a recovery. The government’s recent budget measures, along with expanding outlet coverage, localisation strategies, and premiumisation efforts, are expected to revive growth in the coming quarters.

• Hotel Business has demerged into ITC Hotels Limited (ITCHL) since 1st January, 2025.

Sector Outlook: Positive Company Outlook & Guidance: We have increased our FY26/FY27 estimates considering its resilient performance across the segments despite the subdued demand environment and sharp escalation in input costs.

Current Valuation: 25x Mar’27 EPS (Earlier Valuation: 27x Mar’27 EPS ).

Current TP: Rs 500/share (Earlier TP: Rs 510/share).

Recommendation With an upside potential of 17% from the CMP, we maintain our BUY rating on the stock.

Financial Performance: ITC reported a 9.4% YoY revenue growth, driven by strong performance in the Agri and Cigarette businesses, while Paperboard and FMCG performed modestly. Gross margins contracted by 360 bps YoY to 54.1%, primarily due to higher raw material costs. EBITDA grew by 2.4% YoY, though margins declined by 237 bps YoY to 35.2%. The reported PAT stood at Rs 4,875 Cr, up 0.8% YoY (1.5% on a comparable basis). PAT also reflects a one-time impact of Rs 35 Cr arising from changes in capital gains tax treatment on treasury investments.

Makes sense but is it priced already for perfection

Gokulram arunasalam