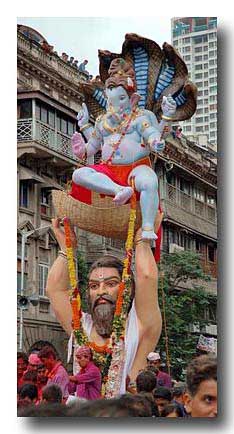

At Mumbai’s Chowpatty Beach, sea facing buildings tower over an effigy of ‘Ravana’ waiting to be burnt to symbolize the victory of good over evil. The paradox of India is its extreme disparity. While poverty is a fact of everyday life, the real estate prices are sky-high, perhaps higher than first world cities.

At Mumbai’s Chowpatty Beach, sea facing buildings tower over an effigy of ‘Ravana’ waiting to be burnt to symbolize the victory of good over evil. The paradox of India is its extreme disparity. While poverty is a fact of everyday life, the real estate prices are sky-high, perhaps higher than first world cities.