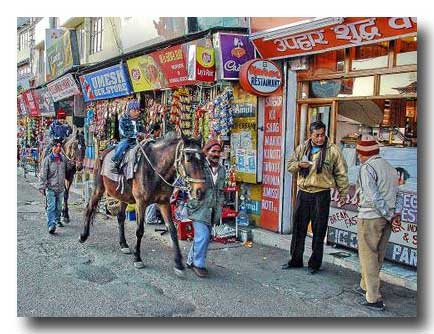

Colourfully painted shop signs entice visitors while two young boys explore the city on a pony. Mussourie boasts of a shopping “mall road” where eager holiday-goers can find good bargains. Mussourie has an enviable number of restaurants serving a variety of cuisine.

Colourfully painted shop signs entice visitors while two young boys explore the city on a pony. Mussourie boasts of a shopping “mall road” where eager holiday-goers can find good bargains. Mussourie has an enviable number of restaurants serving a variety of cuisine.