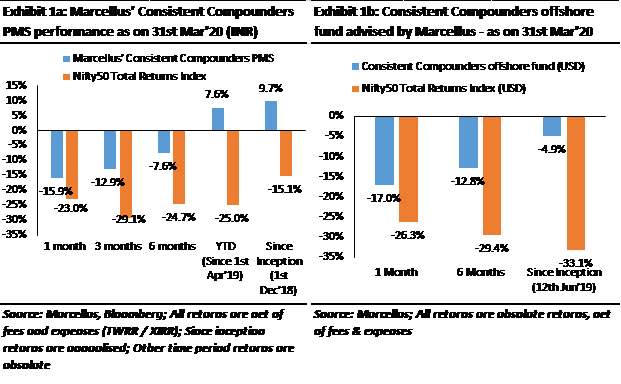

Consistent compounder stocks have lost only 4.9% while the other stocks have lost 33%

Saurabh Mukherjea‘s fascination for the high-quality franchisee stocks can be well understood when we see the data.

The CoronaVirus has wrecked havoc with the Nifty50 stocks.

It has pulled them down a bone-crushing 33.1% (since 12th June 2019).

However, the Consistent Compounder stocks have emerged virtually unscathed, losing only a paltry 4.9%.

Even in the periods of 6 months and 1 month, the Consistent Compounder stocks have heavily outperformed the Nifty.

The Nifty has lost 26.3% while the Consistent Compounders have only lost 17% in the last one month.

“Consistent Compounders deliver the most resilient share price performance with recovery in their stock prices being much sooner and sharper than the rest of the market,” Saurabh has stated, based on an analysis of irrefutable data.

“Marcellus’ CCP portfolio has not only remained resilient compared to the broader market, it has also delivered a healthy absolute return of +7.6% over the past 12 months, unlike the -25.0% return of Nifty50 over the same period. This is neither surprising nor unusual,” he has added with justified pride in his tone.

“Consistent Compounders deliver a positive return only because of their stronger fundamentals compared to the broader market,” he has explained.

Incidentally, it is a global phenomenon that the high-quality companies always outperform their low-quality counterparts.

This is confirmed in a recent report by Morningstar.

“The shares of the highest-quality companies, as defined by Morningstar Equity Research, have lost less than the broad U.S. stock market and considerably less than low-quality stocks,” it is stated.

Will not the NPA crisis cripple HDFC Bank and Bajaj Finance?

It is no secret that two of the warhorses in Saurabh’s portfolio, namely HDFC Bank and Bajaj Finance, are presently in the doghouse and have become pariahs.

Both stocks have lost huge chunks of their valuation over fears that there will be a massive spike in NPAs owing to the lockdown and slowdown.

Leading experts have rushed to downgrade both stocks.

Bernstein downgrades HDFC Bank to 'underperform' due to exposure to unsecured credit risk.

Read all market updates: https://t.co/HoprKnSYSx pic.twitter.com/GUe1ymb3yL

— BloombergQuint (@BloombergQuint) March 20, 2020

Bajaj Finance falls for second day

"At this stage, it would be conservative to assume that first quarter of FY2021 would be a near complete economic freeze and a crawling recovery post that", Bernstein wrote in its downgrade note for the stock. #BQStocks https://t.co/WbWsIdqcgw

— BloombergQuint (@BloombergQuint) March 30, 2020

However, Saurabh made it clear that he is not much perturbed by the concerns of NPAs.

He stated that while there would be a rise in NPAs and reduction in loan book growth rates for the great lenders during the lockdown period, they are best placed to consolidate their market share once the crisis is over.

“We believe that Bajaj Finance, HDFC Bank and Kotak Mahindra Bank are best positioned to consolidate lending market share over the next 3-4 years because of a combination of:

a) a strong liabilities franchise with favorable Assets Liabilities Management (ALM) profile;

b) comfortable capital adequacy ratios;

c) superior quality of loan book compared to their competitors; and

d) superior collections capabilities vs peers.

Hence, any short-term moderation in earnings growth trajectory of these firms is likely to be more than offset by acceleration in earnings growth through market share gains over the next 3 years,” he stated.

What about recession in the Western Countries?

The World Bank has sent the nerve-chilling warning that a “major Global recession” is unfolding at the moment.

World Bank sees 'major global recession' due to pandemic https://t.co/1baaVs9WW1 pic.twitter.com/JwpEq6NMMJ

— Reuters (@Reuters) April 4, 2020

Federal Reserve estimates coronavirus job losses could total 47M; unemployment rate may hit 32%, topping Great Depression peak of 24.9%. https://t.co/00ixBDAnZT

— NBC News (@NBCNews) March 30, 2020

We will have. v-shaped recovery once #COVID19 is gone.

1- oil demand will be way higher than today’s even with a recession

2- Lockdown increased savings, probably in unprecedented amounts, when ch will lead to a major spike in consumption later pic.twitter.com/2agZPLyC6H— Anas Alhajji (@anasalhajji) April 5, 2020

Saurabh explained that most of the stocks in his portfolio will be relatively unaffected by a global recession because they have insignificant exposure (less than 2-3% of revenues) to exports for deriving their revenues.

Divis Labs is the odd one out because it exports APIs to Western countries.

However, given that drugs are essential products and that it has a dominant share (40%-70%), Divis will also emerge unscathed from the recession, Saurabh stated.

In fact, Divis may benefit because the Big Pharma customers in the West are likely to ditch Chinese suppliers and increase their procurement of APIs from Indian Pharma companies, he added.

US recession augers well for India

Saurabh canvassed the brilliant argument that a recession in the US coupled with falling Bond yields and oil prices bodes well for the Indian economy.

“Four times in the last 40 years, a US recession alongside falling US bond yields and falling oil prices has been followed by a strong economic recovery in India. In fact, India has NEVER witnessed an economic recovery without a US recession preceding it!,” he stated.

“Now, all three conditions for an Indian economic recovery – a US recession, smashed crude prices and falling US Government bond yields are – in place,” he added.

Companies making low-ticket items are unaffected even by recessions

It is a fact that while consumers may postpone purchase of big-ticket ‘discretionary‘ items (like automobiles, two-wheelers, A/c, TV etc), they will not hesitate to purchase low-ticket ‘staples‘ (like toothpaste, shampoo, footwear, milk, clothes, medicines, eatables etc).

“All our portfolio companies sell products and services which are small ticket, day-to-day essentials consumed by Indian middle-class households. Unlike spends on tourism / entertainment / leisure / luxury categories, demand for products and services of our portfolio companies is highly utility oriented and hence cannot be cancelled easily,” Saurabh stated.

No doubt, Saurabh is referring to stocks like Nestle, Pidilite, Divis, Asian Paints, Marico, Colgate Palmolive, HUL, BATA, Relaxo etc which produce low-ticket and non-discretionary items.

(ColPal: Immune to CoronaVirus?)

Timing entry and exit into quality stocks is a futile and counter-productive idea

Saurabh is well aware that some investors are thinking that they will dump their stocks today and buy them back later at lower prices.

He sternly deprecated the concept.

“During every such period of distress, Consistent Compounders deliver the most resilient share price performance with recovery in their stock prices being much sooner and sharper than the rest of the market. This makes timing entry / exits in such a portfolio a futile exercise,” he stated.

He also pointed out that investors who had tried such stunts during the 2008 crisis had to cut sorry faces because the markets suddenly surged like a rocket and they were left in the cold.

“Timing entry / exit from a CCP type of portfolio during the global financial crisis of 2008 would have only shifted an investor’s CAGR from 26% to 30% – surely, not worth the effort given the costs involved around: a) risk of getting the timing wrong; b) transaction costs; and c) intense focus on share prices rather than on fundamental research (or your day job) during such times of stock market crash,” he explained.

Forget CoronaVirus, focus on fundamentals

Saurabh suggested that instead of being obsessed about the Covid-19 episode and worrying day-in and day-out, we should focus on only two aspects, namely:

a) will the companies be able to survive this crisis and will the demand for their products return to normalcy few months after the crisis?; and

b) can these companies further strengthen their competitive positioning due to the crisis and hence lead the consolidation of market share over the next 3-5 years?

If the answers to both questions is in the affirmative, we should stay fully invested in the top-quality stocks in order to obtain healthy and consistent portfolio compounding with low volatility, he advised.