Investors make hay in 2019 as stocks surge up to 184%

2019 was not a year of a secular Bull run though a few stocks outperformed and delivered phenomenal returns.

Adani Green Energy, which is promoted by illustrious Billionaire Gautam Adani, thrilled investors with a mind-boggling return of 184%.

Aavas Financiers, a little-known HFC, is second in line with a magnificent return of 94%.

It is worth recalling that Aavas Financiers was recommended to us by Gautam Trivedi of Nepean Capital in the beginning of 2019 (see 16 Eminent Experts Recommend Stocks Which Can Be “Next Gruh Finance” Etc For 2019).

In hindsight, Gautam Trivedi’s rationale for recommending Aavas Financiers was flawless.

“We believe that the Jaipur-based eight-year-old entity is the next Gruh Finance in the making, a stock that has not only created considerable shareholder value, having not only risen 70x over the past 10 years, but has also become the poster boy of semi-urban housing finance,” he had advised in a prophetic tone.

He also pointed out that Aavas Financiers is following the modus operandi adopted by HDFC Ltd to ensure that its NPAs are as minimal as possible.

No doubt, we will have to keep our eyes peeled for Gautam Trivedi’s next stock recommendation.

#AwaazAlert | The Hero’s Of 2019!

Here’s A List Of Stocks That Have Delivered 50% or More Returns in 2019 from the Top-500 Universe.#AwaazMarkets | @SumitResearch | @AshVerma111 | @shail_bhatnagar | @AEHarshada | @YatinMota pic.twitter.com/lzSkpgroP4— CNBC-AWAAZ (@CNBC_Awaaz) December 19, 2019

Even investors in Large-cap Index stocks had much reason to smile.

Reliance Industries, the multi-faceted behemoth promoted by visionary Billionaire Mukesh Ambani, led from the front with a massive gain of 45%.

It contributed in a major way towards the surge of 13% in the Nifty.

Other blue-chip stalwarts like ICICI Bank, HDFC Bank, Kotak Bank, TCS etc played their part in improving the prosperity of investors.

#AwaazMarkets | Nifty gained 13% and is up 1426 points year to date.

Reliance Industries alone contributed nearly 30% to this rally!@cnbcawaaz @yatinmota @shailbhatnagar pic.twitter.com/gyutOfV52H

— CNBC-AWAAZ (@CNBC_Awaaz) December 20, 2019

Novices who invest in IPOs also have much reason to smile.

There have been a spate of blockbuster IPOs like D-Mart, HDFC AMC, IRCTC, IRCON, etc which have filled their pockets with pure gold.

#AwaazAlert | Top IPO’s which have doubled your money in the last 3 years.#AwaazMarkets pic.twitter.com/hcEcUUwaY2

— CNBC-AWAAZ (@CNBC_Awaaz) December 19, 2019

However, a few junkyard stocks did spoil the show.

Yes Bank, which was once touted as a mega-bagger, led the rogues’ gallery by reducing its investors to penury after losing a colossal 71% of its market capitalisation.

#AwaazMarkets | ITC, M&M and Yes Bank contributed towards the 200 point decline in NIFTY year to date. @cnbcawaaz | @yatinmota | @shail_bhatnagar pic.twitter.com/D8zPN69XmN

— CNBC-AWAAZ (@CNBC_Awaaz) December 20, 2019

Academicians ‘puzzled’ at surge in stock markets

Unfortunately, the surge in the stock markets is not palatable to some disgruntled elements.

Earlier, a junkyard politician had blasphemously described the Sensex as ‘Non-Sensex’ when it surged past the level of 40,000.

Sensex crosses 40 K.

It should be called NonSensex. pic.twitter.com/DB5n0EMVmO

— Sanjay Jha (@JhaSanjay) November 1, 2019

Now, Arvind subramanian, an academician and former CEA, has claimed that he is puzzled as to why the stock market is buoyant despite the alleged ailments in the economy.

It's a 'puzzle' for me why stock market is buoyant while economy is sinking: Arvind Subramanianhttps://t.co/WIusmwjBrz pic.twitter.com/Cf13COHcls

— Livemint (@livemint) December 20, 2019

It is obvious that the academicians have no clue as to how the stock markets work.

It is common sense that the stock markets are surging because of a number of positive developments such as the cut in the corporate tax rate, removal of FPI surcharge, resolution of the trade war between the USA and China, etc, etc.

Also, NAMO has taken concrete steps to clean up the business sector and banks. He is also introducing a rules based system and building a risk taking culture so as to trigger the animal spirits of the Indian entrepreneur.

Clear message from PM: India's business sector and banks have been cleaned, and a rules based system introduced. The next stage is to build a risk taking culture & trigger the animal spirits of the Indian entrepreneur. https://t.co/g3TFiZco4q

— Sanjeev Sanyal (@sanjeevsanyal) December 21, 2019

I don't have a PhD like Arvind Subramanian. I cannot talk about Intellectual trash like him. I am not a professional pessimist like him. I don't watch the rearview mirror to tell the obvious. But I can tell you why the market is moving up. Please read this thread completely.

— Deepak Singh (@smarket) December 20, 2019

Why is Stock Market Going up and Economy Going Down? Former CEA Arvind Subramanian doesn't know. That is probsbly why the economy didn't go up during his time at North Block

https://t.co/o8K0okfehc— Madhavan Narayanan (@madversity) December 21, 2019

We are in this position because idiots like Arvind Subramanian were in-charge of our Economy. Nobody asked him why he did nothing during his tenure as CEA.

— Ramesh Kulkarni (@rameshnkulkarni) December 21, 2019

If the economists really understood a lot about economy and finances, then many of them would be the richest in the world! They're mostly confident about theories which are only on paper, and often remain clueless about ground realities.

— Dinesh Shikhare (@tweetrdinesh) December 21, 2019

It is worth recalling that when the markets were in the doldrums, Atul Suri had clearly advised us to ignore such junkyard nay-sayers and buy aggressively because he had foreseen the surge.

No doubt, if we had obediently followed his instructions and bought stocks, we would also be basking in riches today.

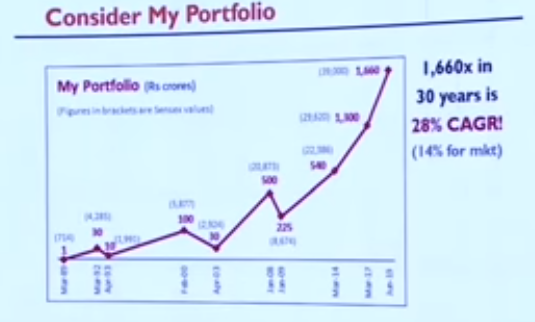

I compounded my wealth 1,660 times in 30 years at an annual rate of 28 CAGR: Raamdeo Agrawal

Raamdeo Agrawal has been inspiring us from time immemorial as to the limitless wealth that we can amass from the stock market if we get our basics right.

He has earlier revealed how he raked in a fortune of Rs. 1000 crore from buying top-quality compounding stocks.

In his latest presentation at the prestigious India Economic Conclave 2019, Raamdeo revealed that by adopting a masterful tactic of buying stocks during periods of adversity, his wealth has increased a mind-boggling 1,660 times in 30 years at a rate of 28% CAGR.

In contrast, Warren Buffett’s net worth has jumped 85,000 times in 58 years at a CAGR of 22 per cent, he said, amidst thunderous applause from the distinguished audience.

It is explicit from Raamdeo’s presentation that if we also walk in his and Warren Buffett’s illustrious footsteps, we will also be able to harvest humongous returns from the stock markets.

Slowdown is a fantastic opportunity to buy stocks

Arvind Subramanian claimed in a somewhat irresponsible and frivolous manner that the “economy is headed for the ICU“.

India facing 'Great Slowdown', economy headed to ICU: Arvind Subramanianhttps://t.co/AqfNMUVqjx pic.twitter.com/4UbA0gMk4Y

— Livemint (@livemint) December 18, 2019

In sharp contrast, Raamdeo rubbished fears that there is a “big crisis” in the economy.

“Indian economy not in big crisis, it will definitely recover within 6-8 months“, he said in an authoritative tone.

“Economy will definitely recover. I am of the firm view that it is not the first time that we are down 4.5 percent and we are not in big crisis,” he added.

“All the jokers who are coming here and talking, nobody has any clue,” he said in a contemptuous manner, much to the enjoyment of the audience.

He explained that as the momentum picks up in the economy, consumers will come back and confidence will revive in the economy.

He also pointed out that while it took the Indian economy 60 years to reach the $1 trillion mark in 2008, it will take only five or six years for it to breach the $5 trillion mark.

“The difference between 10 and 30 years is not three times, but 87 times,” he said, adding a $5 trillion economy would just be a milestone and not a destination.

“The ongoing slowdown is a fantastic opportunity to look at stocks“, Raamdeo added with a big smile on his face.

Top stocks to buy for 2020

It is obvious that we have to stick with the winning horses and not go astray with new and unproved bets.

Raamdeo reminded that banking stocks have been the biggest value creators in the past.

They will retain their dominance in the future as well, he opined.

“The banking opportunity is very large, and of that about 60% is PSU banks. This dominance of banks will continue and give birth to very large banks in India,” he stated.

There is merit in Raamdeo’s advice because private and PSU bank stocks (i.e. the Bank Nifty) have heavily outperformed the other stocks with a return of 2581.47% in comparison to a return of 638.68% from the Nifty.

Since inception from 2000, the #BankNifty has returned nearly 4.07 times more than #Nifty.

While #BankNIFTY has gained 2581.47%, #NIFTY has gained 638.68% over its lifetime from the time it was introduced.#investing #trading pic.twitter.com/1kZxhrdhln

— Milan Vaishnav, CMT, MSTA (@Milan_Vaishnav) November 5, 2019

Raamdeo also advised us to buy insurance companies like HDFC Life, ICICI Pru, SBI Life etc with the assurance that they will be “major wealth creators” in the foreseeable future.

He also opined that three powerhouse stocks stand a chance to attain a market capitalisation of Rs. 20 lakh crore by 2025.

These three stocks are HDFC Bank, TCS and Reliance.

It is explicit that we have to load up on these and the other stocks in a systematic manner to prepare for mega riches in 2025!

After all the experts ,what happened toBINANI INDUSTRIES,LEEL ELECTICALS AND INDIA BULLS etc,what these experts SAY .

I don’t get 1 thing.

When there was US China trade war. “Experts” were giving it as the reason for market going up, because investment would come to India instead of going to China.

And now when there is a deal in progress, these same “experts” are citing that as reason for market going up?

It has to be one or the other.

If Modi is praised by someone then Arjun thinks that guy is wise. If someone makes a critical statement, then Arjun is sure to bash him in one of his articles.

Wonder when he will learn to report objectively, without bringing in personal likes and prejudices.

Ramdeo Agarwal and those who are in the financial services industry will always be positive and rightly so because their livelihood depends on that. Mr Agarwal may be rich but the ones who work for him and in financial services in general, may not be. If they say that the economy will see bad days, the markets will tank (and so will the fortunes of their employees). So they will always talk up the markets even in the bleakest of times.