Mansoor Rafiq Khanda and Firoz Rafiq Khanda, two young siblings in their mid-20s, are as clueless about stocks as the average Raju is. However, by pretending to be experts in stocks, and offering stock tips for a small fee, the duo has been able to rake in a fortune.

The modus operandi followed by Mansoor and Firoz was ridiculously simple. They would send hundreds of messages on WhatsApp and email to the general public professing to be experts in stocks and offering stock tips.

A typical message sent by the duo reads as follows:

“sir I give u monthly 4 call 1 week one call 4 day holding call sir. I give you no free trial sir. My company Indian trading company. 25000 deposit payment profit 30% share sir. Monday 10 clock 35 paise call target today 21 target achieved sir 50000 only investment sir. 200% Sure guarantee call .. 1 rs no loss my company sir”

In addition to the “200% sure guarantee call”, the duo claimed that their stocks calls had yielded mind-boggling gains. “2 Days Positional Target Hit In ICICIBANK 1140 cal Buy @ 20 Booked Profit @ 40 Total Profit Rs. 2 Lakh In Rs 2 Lakh Capital Call Now For Next Tip – Earn More Than 25 To 50 Lakh Per Monthly In Our Super Jackpot Stock-Mcx-Currancy Tips” the message read.

The tipsters also set up a website called “fullonoption.com” to further their nefarious activities.

The astonishing aspect is that despite the obviously bogus nature of the messages, novice investors and punters flocked to Mansoor and Firoz in large numbers to sign up for the advisory service. The duo was making money hand over fist.

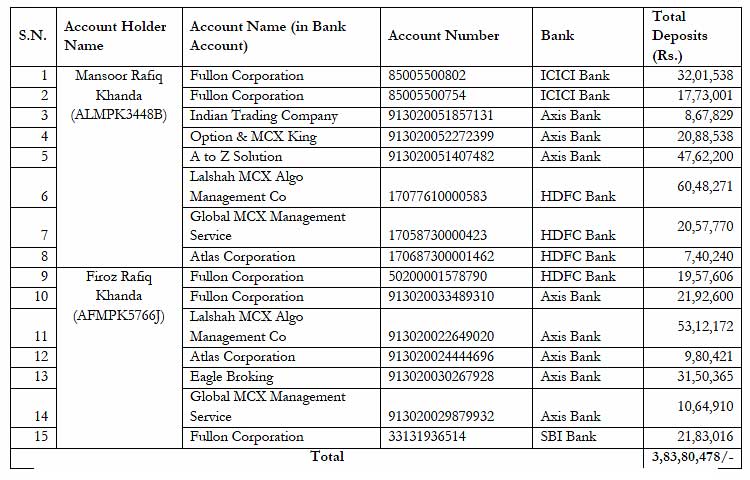

On last count, the duo had raked up an eye-popping fortune of Rs. 3.83 crore during the period between July 19, 2013 to January 21, 2014.

When SEBI launched a crackdown and demanded an explanation from the duo, Mansoor and Firoz broke down and candidly admitted that they are novices themselves and have no expert knowledge of stocks or options.

Mansoor said “I am not highly educated person. I have no knowledge to get what kind of license for business. … Right now, my age is 30 years and at the time of starting of business, I was only 28 years old and after getting huge loss in the business, I am facing financial crises. Right now, I am doing brokerage of flats & shops. I have received summons from you. But I have not any kind of documents which have demanded by you, because I did not get success in my business and I have close my business. If you have find any mistake from my side, please forgive me. Right now, health of my mother is continuously not remaining good that is why, I am submitting my reply today”.

Firoz echoed the same defense as Mansoor and said that he is also not “highly educated person” and has “no knowledge to get what kind of license for business”.

The amusing part is that while one claimed to be doing “brokerage of flats & shops”, the other was doing “brokerage of unstitch cloth”. How, the duo thought up the brilliant idea of offering stock tips is not known.

At this stage, we have to lament at the laborious manner in which the legal process has worked. SEBI sent Firoz and Mansoor an ex-parte order as far back as on 5th June 2014 restraining them from befooling more novice investors. Thereafter, nearly 24 months later, SEBI has sent a final order asking the duo to pay a sum of Rs. 5.04 crore, comprising of Rs. 3.83 crore for “unlawful gains” and Rs. 1.20 crore towards “interest”.

Now, whatever may be the lack of expertise of Firoz and Mansoor in the stock market, one cannot deny that they are crafty and have the uncanny ability to pull the wool over people’s eyes. In fact, one can see that the duo had anticipated SEBI’s order and have prepared for it by claiming that they have suffered “huge financial loss” and are “facing financial crises”.

So, in all probability, the bank accounts painstakingly identified by SEBI will now be empty and SEBI’s chances of making recovery of any part of the prized sum of Rs. 5.04 crore from the duo are as good as zero.

The important question to be asked is that if semi-literate youngsters like Firoz and Mansoor were able to entice the public and raise such large funds for their advisory service, what is the scale at which more sophisticated advisories are running?

HBJ Capital, for instance, ran a very sophisticated operation in which they provided bogus research reports as well to attract investors. They also had smart talking salesmen and a comprehensive website. Their earnings must have been in tens of crore. In their case as well, the law is taking its own sweet time.

Also, there are several other advisories which have obtained registration from SEBI and are legally offering stock advisory services. These services must be minting money at a level that is much higher than that of the illegitimate advisories!

they cannot be “novices” even if they do not have knowledge of stock markets. To run a operation of this kind requires great skills. You can check the accounts. The accounts are in names of entities not individuals so certainly if they managed to open these accounts they really had great resources at their disposal or they were the “fronts” for somebody else who was running the operation.

They were only following the foot steps of other ‘star investors’

#NivezaReview::

There are so many Firoj and Mansoor in the market. On a daily basis, we can find hundreds of fake advisers in the market. In the recent times we have heard so many similar stories. Investors are always after the gains especially the new bees in the market. Even with the advisory companies, investors need to cross check every thing before investing their hard capital. My belief is only person who can think better for our capital could be our self only. Most important thing for the advisory company is SEBI registration. The registration number should be verified properly. Investors should visit offices of the advisory companies to make sure the company is providing the recommendations after the detailed analysis of their certified research analysts. So that the fraud of such Firoj and Mansoor can be avoided.

Stock Market Tips

This website also gives information about several stocks invested by star investors if I have interpreted the term correctly. Does that mean the owners of this website are trying to “con people” ? If any investor is following a tip advice it is his responsibility to assess the quality of the stock before investing. It is their money. Two things are common in stock markets , there is always risk of capital involved and there are no guaranteed returns. Also we know SEBI is “toothless tiger”. In fact even that is over estimation of its powers. We all know the Ricoh India case.

But this site is free

No dearth of such thugs who make money from gullibles.They seem to be fronts to somebody.Also those who want to offload their stocks find enough suckers in the market who blindly follow their so called expert advisories.