Adani Ports & SEZ (APSEZ) has transformed from a pure-play port operator into India’s...

We believe Coforge’s strong executable order book and resilient client spending across verticals bode...

As per our DCF analysis (WACC: 10.5%), at CMP, PLNG is pricing in an...

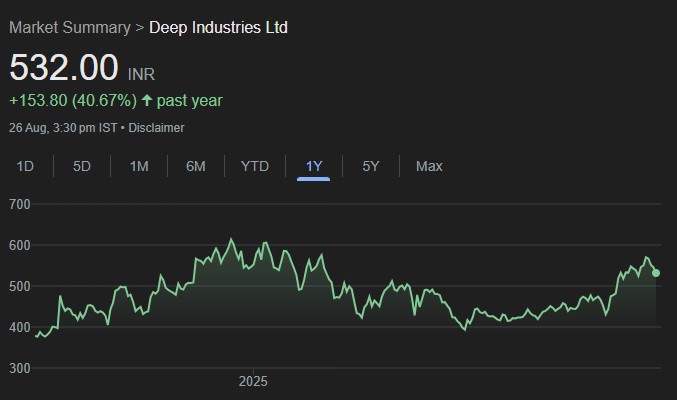

Ahmedabad-based Deep Industries Ltd. (DIL) began in the 1990s as a pioneer in gas...

ITCH has a strong debt-free balance sheet with a net cash position of INR...

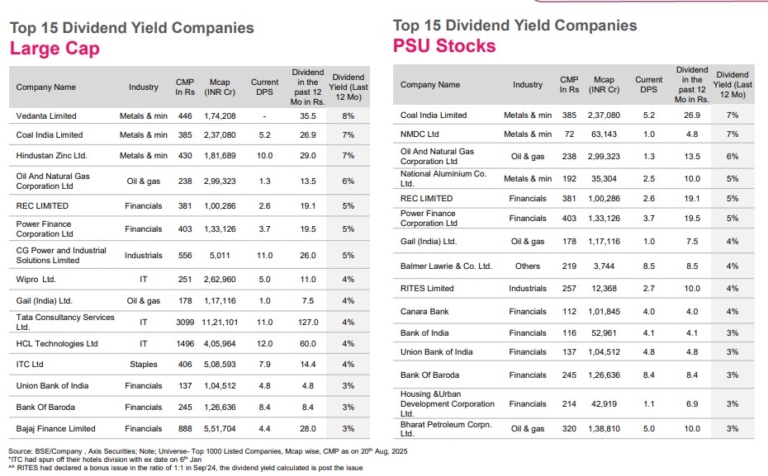

Top 15 Dividend Yield Companies as of 21st August 2025 segregated from the Large-Cap,...

Hi-Tech Pipes has strong growth prospects in the structural steel tubes space given its...

Sunteck Realty (SRIN) is on a project acquisition spree with an aim of doubling...

We recently hosted Piramal Pharma Ltd at the JM Financial Promoter Conference, represented...

ETHOS is expected to continue delivering strong topline growth in the coming years, driven...