GRASIM has a compelling structural long-term investment case

Management has revised its FY26 revenue guidance downward by up to ~5% from the...

With decades of experience in food additives manufacturing and marketing, FOIL has established itself...

GROWW is increasingly building optional growth levers to diversify revenues and improve earnings quality

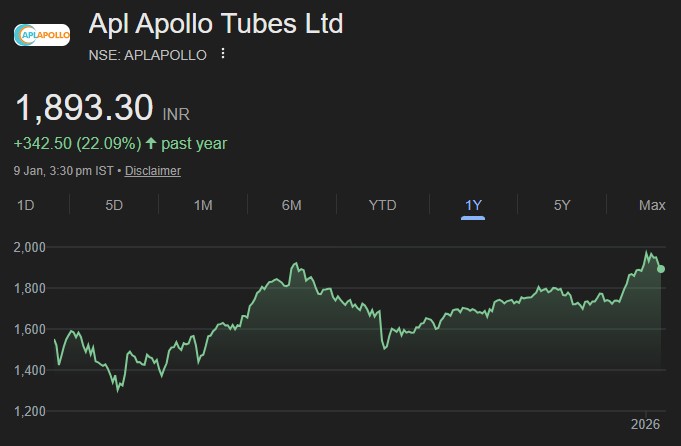

APAT is India's most compelling structural steel tube operator with commanding market dominance (55%...

BAJEL is on the cusp of a healthy growth trajectory

Luxury travelers are increasingly planning trips around experiences such as celebrations, wellness, culinary immersion,...

With levers of growth, Sandhar trades inexpensive at <20x P/E and <10x EV/EBITDA on...

The company aims to capitalize on the strong structural tailwinds within the hospitality space...

The ultra-pure water segment is an emerging segment and is expected to be an...