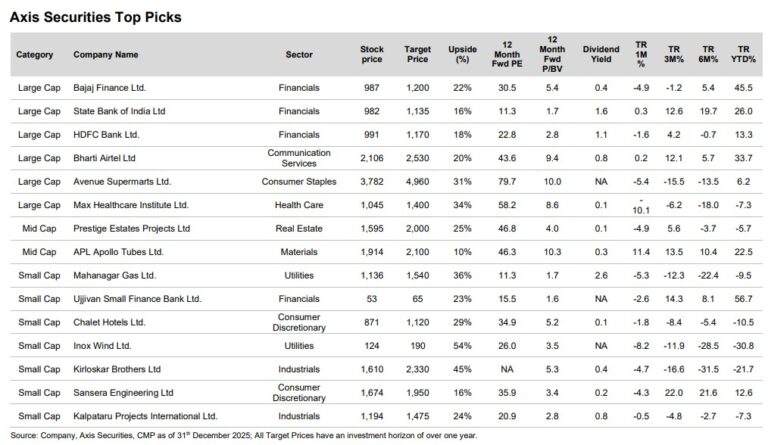

We maintain our Top Picks recommendations unchanged for the month as we continue to...

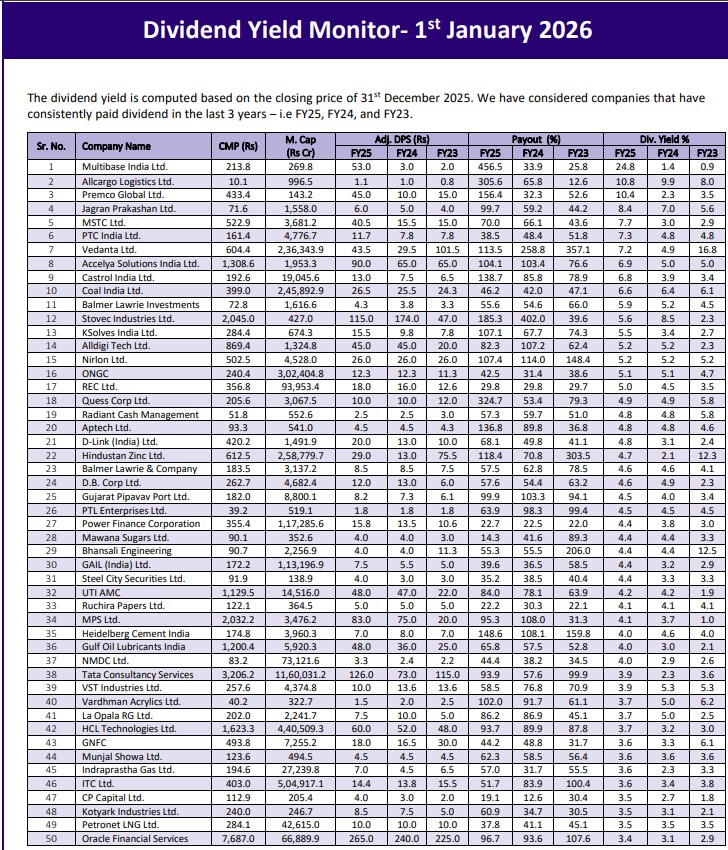

Multibase India Ltd has paid Rs 53 per share as interim dividend in Nov’24

We expect V-Mart to deliver a robust ~18% revenue CAGR over FY25-28, driven by...

Management reiterated its focus on optimising topline mix to yield superior GMV-revenue conversion and...

Going forward, the company has outlined a clear strategy to maintain its leadership position...

The company has multiple triggers & trading at a steep discount to its large...

MIDWESTL's net debt stood at INR2.2b, translating into a Net Debt/EBITDA of 1.3x as...

The hospitality portfolio is also expected to grow to 3,300 keys by FY30

The Indian dredging industry has stringent pre-qualification norms on execution track record, revenue thresholds...

Huge run way of growth as the sector can multiply by 3x over the...