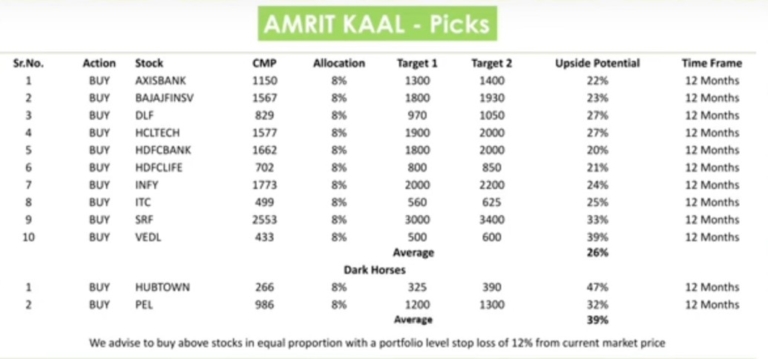

Rahul Sharma of JMFICS has recommended an 'Amrit Kaal' basket of 16 stocks with...

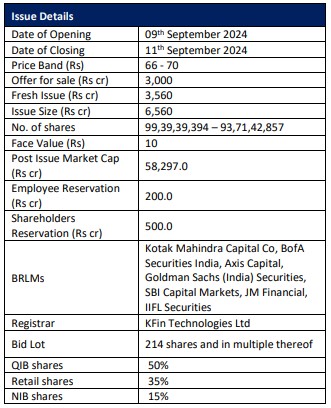

Bajaj Housing Finance Ltd (BHFL) is the second largest housing finance company (HFC) in...

AWFIS sees demand for flexible office space clocking 25–27% CAGR in the coming years...

HG Infra has showcased an impressive 24.2% revenue CAGR during FY18-24, thanks to its...

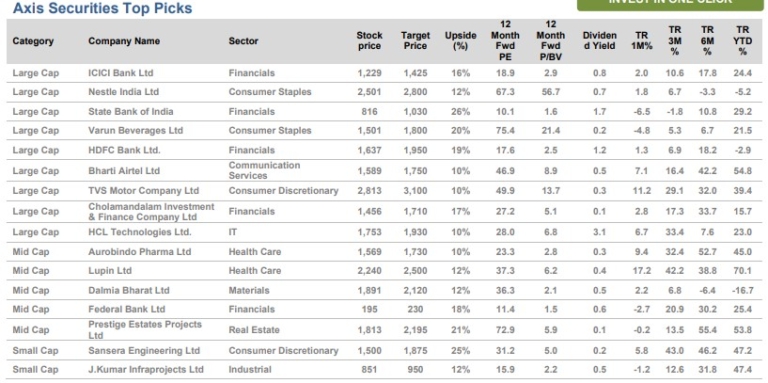

Top Stock Picks, 9 Large-Cap, 5 Mid-Cap & 2 Small-Cap stocks for up to 26% upside by Axis Securities

Based on the above themes, we recommend the following stocks: HDFC Bank, ICICI Bank,...

Long-Term Drivers Intact The total hospitality industry in India currently comprises 212,000 rooms, translating...

We believe Thangamayil Jewellery, a leading jewellery player in Tamil Nadu, is set to...

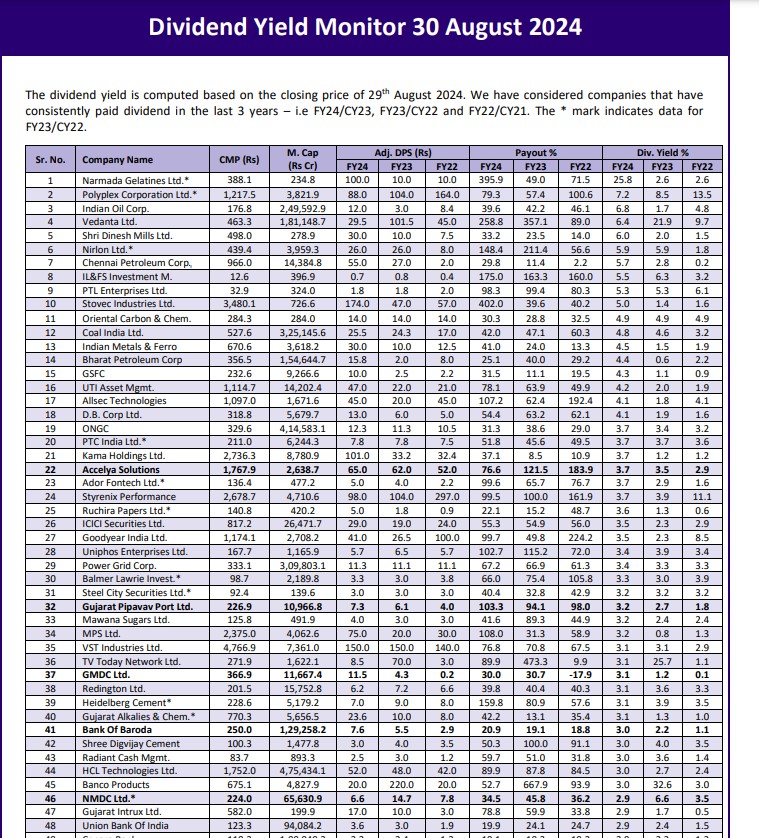

The dividend yield is computed based on the closing price of 29th August 2024....

We recently met with MCX management. We gained more confidence in their strategic direction,...

Archean Chemical Industries Ltd (ACIL) is the leading player in marine speciality chemicals manufacturing...