The year 2026 is expected to be more constructive for Indian equities, transitioning from...

India appears to be on the cusp of strong air traffic growth

With completions on track, revenue is poised to clock a 69% CAGR over FY25-28E...

We expect an earnings CAGR of 31% during FY25-28E with an average ROE of...

Both facets of expansion (South/Smaller format) seeing healthy initial traction

Palava is also set to scale up its sales by 20% YoY, supported by...

While softening housing sales volumes in the MMR and Pune are an issue (Link),...

LEELA is one of the largest pure-play luxury hospitality companies in India, consisting of...

Netweb’s portfolio consists of eight segments, of which: 1) HPC (High Performance Computing);...

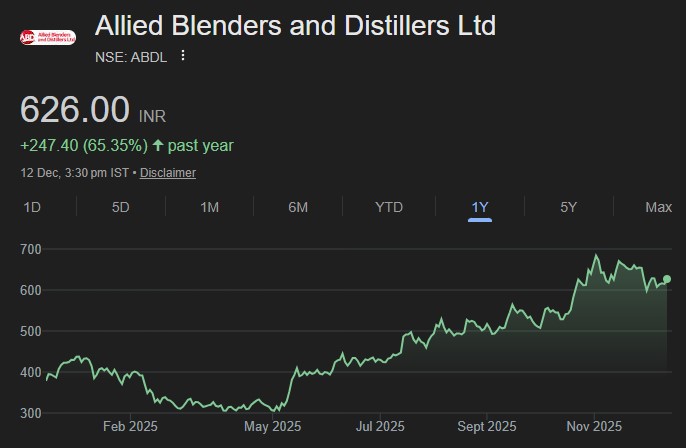

We initiate with a BUY rating and a Mar'27 TP of INR 730 (18.7%...