Onerous responsibility to make stock recommendations

Porinju is well aware that the prestigious title of “Small Cap Czar” awarded to him by ET carries it with the onerous responsibility of looking after the interests of novice investors and of periodically recommending potential multibagger stocks.

To his credit, Porinju has been discharging his responsibility in an admirable manner by recommending only those stocks that have the perfect potential to give mega gains.

Of course, the regrettable aspect is that we have so far turned a deaf ear to his recommendations and have lost out on multibagger gains which were handed over on a platter.

Waterways theme will be the next multibagger sector

Porinju suddenly surfaced in March 2016 to declare that the “waterways sector” would throw up multibagger stock opportunities.

Porinju’s theory was so revolutionary that even Latha Venkatesh, the veteran journalist with CNBC TV18, was taken aback. She called it “unprecedented” and admitted that she was “excited by the theme”.

Latha’s reaction is not surprising because few people would have regarded waterways as having the potential to shower multibagger gains on investors.

“This is a sector which was ignored in the last 60 years in this country because the geographical position of this country with something like 7,000 km of shore, it is amazing. The transportation in this country feeding our 1.3 billion people, we would have done it decades ago. At least I am so glad, it is happening now. The recent past, there are very decisive moments in this regard to us our hundreds of rivers. Now, government has announced about 111 rivers converting into national waterways. It is a very important step,” Porinju said, giving a glimpse of his visionary outlook.

“Today, the cost of transportation, Nitin Gadkari was once showing it where per unit transportation cost of cargo by road comes to something like Rs 1.5 per unit, kilogram, whatever it is. And, by railway, it is Rs 1, whereas by water it is only Rs 0.25. So, it is a very important thing on a macro level. I think it is in the right way and there is something like Rs 70,000 crore kind of funding is arranged for the first phase of this development. Around Rs 50,000 km of waterways out of which Rs 35,000 km is inland waterways converting more than 100 rivers and something like 14,500 km of coastal waterways,” he added, making it clear that he had carefully researched the subject.

Two top-quality waterways theme stocks recommended

Porinju knows that talking general theory is of no help to novice investors. We need tangible and actionable information.

So, he helpfully recommended two top-quality stocks to enable us to move forward.

Dredging Corporation – Blue Chip Monopoly PSU stock

“Dredging Corporation is priced at around Rs 900 crore today. It is a government company and it is a healthy balance sheet, some Rs 700 crore kind of debt and it is a very good company. It can grow fivefold or tenfold in the next 2-3 years time. That is the kind of potential is there,” Porinju said, hinting that buying a blue-chip PSU stock is a fail-safe investment.

ITD Cementation – professionally managed company with a healthy balance sheet

“ITD Cementation is already highly performing company. ITD means Italian Thai Development Company and it is a very professionally managed company with a healthy balance sheet. They are having monopoly in some of these maritime structures kind of segment. So, this company is also likely to benefit immensely going forward,” Porinju said, his voice brimming with confidence.

ITD Cementation & Dredging Corp give solid gains

The astonishing part is that both stocks have taken off like rockets since Porinju’s recommendation.

While Dredging Corporation is up 108%, ITD Cementation is up 79%.

Understandably, Porinju is gung ho about his achievement.

“There are 50 such ‘themes’ to multiply your wealth in World’s most diversified Economy!”, he said in a joyous tone.

Dredging doubled in 1yr; there are 50 such 'themes' to multiply your wealth in World's most diversified Economy!https://t.co/EO5RejJ3tX

— Porinju Veliyath (@porinju) April 23, 2017

@porinju big thank u. Dredging corp is at all time high today, with no sellers ????. Still rmbr ur words " sector ignored for 60 years"??

— Abhishek Kaicker (@kaickerabhishek) March 16, 2017

Sun TV: 160% gain in 12 months even as peers languish

Porinju laboriously explained that the media industry would also sparkle.

“Media as an industry has a long way to go from the market capitalisation point of view … There is a growth projected something like 15 percent for next 5-15 years time. That is a huge growth in today’s global environment in a particular economic segment of a country. I believe investors can make big money very cautiously perhaps and in a conservative way if you look at the listed space. Many of the companies may come to get listed again. So, I think that space as such can grow very big. It can give 20-25 percent kind of a compounding return for investors,” he said.

Again, Porinju knew that talking abstract theory is of no use to novice investors. So, he short-listed Sun TV as an attractive investment candidate.

“When you look at reasonable or attractive valuations, I find Sun TV looks good … They have a got a very large market share in south. They have a very high profit margin too …. it is a very reasonable market capitalisation – Rs 13000-14000 crore kind of a market cap. It is available at below 10 PE,” he said, systematically listing out all the virtues of Sun TV.

The astonishing aspect is that Sun TV is up an eye-popping 160% in the 12 months that have elapsed since Porinju’s recommendation.

What is notable is that Sun TV’s peers such as ZEE TV, TV Today, TV18 etc have not put up a similar blockbuster performance. In fact, some like TV18 have barely managed to make ends meet.

Have a common sense approach and forget about price targets and time horizons

“Stock pickers in India should have the common sense approach which sectors and which companies are placed in the new emerging opportunities to take advantage,” Porinju said.

“I never have time horizon and targets in my life not only in stock picking but generally too,” he added.

More gains are due from ITD Cementation: Emkay

At this stage, we have to ask the question whether, having missed the opportunity to effortlessly pocket multibagger gains, there is any more juice left in the stocks for us.

Fortunately, Emkay has assured that more gains are due from ITD Cementation and has recommended a buy.

Emkay’s logic is impeccable:

“Building a strong moat

Strong order book, focus now shifts to execution

As of Dec-16, ITCE had an order book of Rs66bn (2.1x CY16 revenue) including Rs11.3bn of Mumbai Metro 3 order and excluding L1 of Rs17bn from the Udangudi captive port project in Tamil Nadu. Recent L1 order wins in 4 packages of Bengaluru Metro in Q1CY17 worth Rs23bn should enable ITCE to comfortably achieve its CY17E order inflow target of Rs60bn with many projects such as the Mumbai Trans-Harbour Link (MTHL), Pune Metro also up for bidding in CY17. As ITCE shifts to IND-AS accounting from CY17E, many JV projects such as Mumbai Metro and MTHL will not be consolidated in revenue/EBITDA and will directly flow to consolidated profits.

Upgrade to Buy with revised TP of Rs203

We model for 11% revenue CAGR over CY16-19E driven by annual order wins of Rs60bn over the same period and also expect EBITDA margins to trend in the 8.9-9.4% range as legacy projects are almost complete. We introduce CY19E estimates and upgrade the stock to Buy with a revised TP of Rs203 based on 18x Jun-19 EPS of Rs11.3.”

ITD Cementation….looks a good compounding machine of 25% + frm hereon…considering metro and other work carried out in India…

— Kunal Shah (@knlshah22) March 4, 2017

Axis Direct also recommends buy of ITD Cementation

All the salient features of ITD Cementation have been explained in a succinct and cogent manner by the experts at Axis Direct.

What about the stake sale in Dredging Corporation?

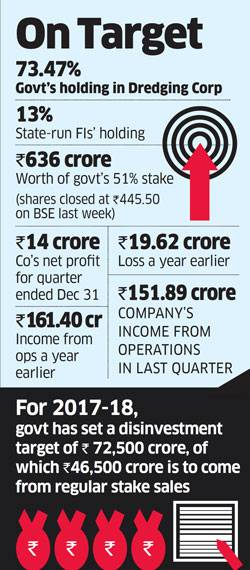

According to a report in the ET, the government is looking to sell a 51 per cent stake in Dredging Corporation of India.

It is claimed that a cabinet note has been prepared on this proposal and is being circulated among key ministries for comment.

It is believed that the strategic stake sale should materialise by middle of the next fiscal year starting April.

It is obvious that if the stake sale does materialize, the stock will rocket into the stratosphere.

Conclusion

It is high time that we also adopt the “common sense” approach advocated by Porinju and home in on the sectors and stocks that will benefit from the new emerging opportunities. Then, we can also boast of a few multibaggers in our portfolios!

Forget about Porinju or Emkay or Dredging Corporation. Invest in 20 Microns. There will be no need for the Porinjus of the world to advise you because you will be doing better than him.

Venky ,The Great,But one can not invest all his money only in 20 micron, pl give atleat 5 multibagger picks to beat porinju comfortably.

No I wont. Do your own research.

well said….after a long time a good comment has been made…cheered me up

Promoters recently decreased their stake by 7% in 20 microns. If it was such a good company, why are promoters selling ??

Dear, not one share has been sold. Please see the “Update” given by the Company to both the exchanges. The update is dated 15th March 2017. It basically states that some of the promoters have been reclassified from Promoter status to Public status and the requisite approval has been obtained. So there is no issue here.

If we should forget Porinju or Emkay, then why do we need an unknown Venky too?

Agree with Kharb. Instead of criticizing somebody who is acting upon what he has been saying, let’s put a credible answer to the issue. And that question is what is your recommendation and how it has fared in the last 3 to 4 years time frame.

Liquidity is making all boats rise. No one can explain why a 200 Cr MCap company operating at full capacity and in a low margin business should trade at 50PE. Very soon we will find out who all have bene swimming naked.