First of all you must note that all the savvy investors are busy tucking into rate sensitive stocks. While Mohnish Pabrai stormed the counters of South Indian Bank, J&K Bank and GIC Housing to grab a massive truckload for himself, Prem Watsa has grabbed a slice of IIFL.

Prof. Shivanad Mankekar is in the same camp. He has bought a huge chunk of 13,00,000 shares of SKS Microfinance in the July to September 2014 Quarter. I reported this earlier and I also drew attention to the analysis by Dipen Sheth and other experts on why SKS is a great buy at present.

We should also note that Amansa Capital run by Akash Prakash holds a chunk of 47.20 lakh shares of SKS Microfinance. Akash Prakash has given excellent guidance on how to find winning stocks.

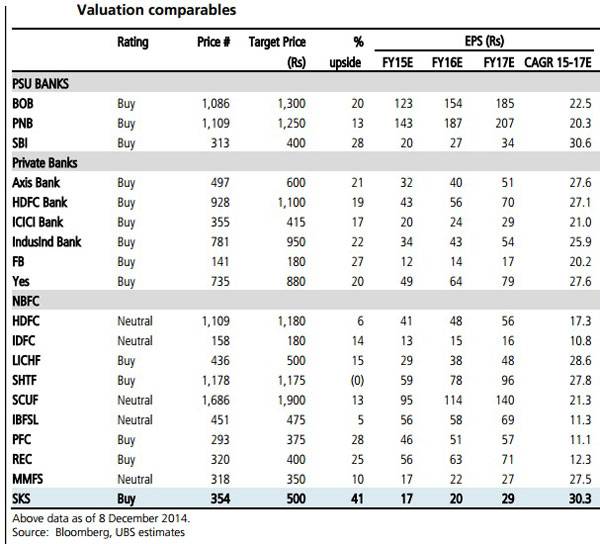

Now UBS has issued an initiating coverage report on SKS Microfinance and recommended a buy with a price target of Rs. 500, which works out to a gain of nearly 40% from the CMP of Rs. 385.

UBS’ logic is that SKS Microfinance has strong growth potential and high ROE amongst the NBFC stocks. It also points out that the low microfinance penetration and a rising market share for NBFC MFIs means that the entire sector will enjoy a loan CAGR of over 25 per cent over the medium term.

UBS adds that SKS Microfinance is the second-largest NBFC-MFI by loan book, and has a diversified loan book and national presence. UBS expect a 32 per cent CAGR in assets under management (AUM) over FY15-17.

It emphasizes that SKS Microfinance provides an attractive opportunity to invest in India’s microfinance industry, which is highly under-penetrated. Estimates points to the fact that, SKS is likely to grow at a much higher rate than other India financials in the medium term.

SKS’ robust earnings outlook (66% earnings CAGR over FY15-17E) and strong ROE are expected to continue in the medium term. There is also re-rating potential.

At this stage, we must note that the biggest risk for SKS Microfinace is the risk of regulatory action. What if there is a repeat of the Andhra Pradesh fiasco and some Government bans recovery from the poverty stricken borrowers of SKS?

So, in one of my earlier pieces, I have drawn attention to three top-quality stocks that experts have recommended as the way to benefit from a benign interest regime.