No PSU or Commodity stocks hitherto in the portfolio of Radhakishan Damani

One of the notable aspects about Radhakishan Damani‘s investing style is that he has so far steered clear of PSU stocks and commodity stocks.

In fact, while his portfolio boasts of Blue-Chip MNC and private stocks, there were hitherto no cyclical or commodity stocks or PSUs in it.

This is in sharp contrast to his peers like Rakesh Jhunjhunwala and Ramesh Damani, both of whom are devoted fans of PSU and commodity stocks.

“It is time for investors to look at commodities & to take bold calls on cyclical stocks. We are going into a very big commodity bull run, which is going to last for the next 5-7 years. Commodity stocks are the best bet, especially steel“, Rakesh Jhunjhunwala has stated.

He has also added massive chunks of steel stocks to his portfolio.

I made very large investments in Tata Steel and JSPL. There is a lot of money in commodities. The commodity cycle is going to last for a minimum of five years. The valuations were absurd. When compared to cash flows, the valuations are still absurd https://t.co/5xf2FeyxTm pic.twitter.com/hzjIuvRcAJ

— RJ Stocks (@RakJhun) May 29, 2021

Ramesh Damani has expressed a similar view.

“There Are Astonishing Bargains In PSU Stocks. They Can Give 3x Multibagger Gains,” he has boldly stated.

There Are Astonishing Bargains In PSU Stocks. They Can Give 3x Multibagger Gains: Ramesh Damani https://t.co/gdecafsIdc pic.twitter.com/2HXF6aTQuB

— RJ Stocks (@RakJhun) October 25, 2019

| Latest Portfolio of Radhakishan Damani | ||

| Company | Nos of shares | Value (Rs Cr ) |

| Avenue Supermarts | 422,159,156 | 139,985 |

| VST Industries | 4,657,118 | 1,686 |

| India Cements | 39,277,768 | 754 |

| Sundaram Finance | 2,630,434 | 703 |

| Trent | 5,421,131 | 465 |

| United Breweries | 3,204,485 | 444 |

| 3M India | 166,700 | 420 |

| Blue Dart Express | 465,770 | 271 |

| Metropolis Healthcare | 891,274 | 263 |

| BF Utilities | 491,000 | 26 |

| Sundaram Finance Holdings | 2,630,434 | 19 |

| Foods & Inns | 2,376,000 | 16 |

| Astra Miowave Products | 896,387 | 15 |

| Mangalam Organics | 186,187 | 14 |

| Andhra Paper | 500,000 | 12 |

| Prozone Intu Properties | 1,925,000 | 6 |

NMDC is the latest stock to be added to Radhakishan Damani portfolio

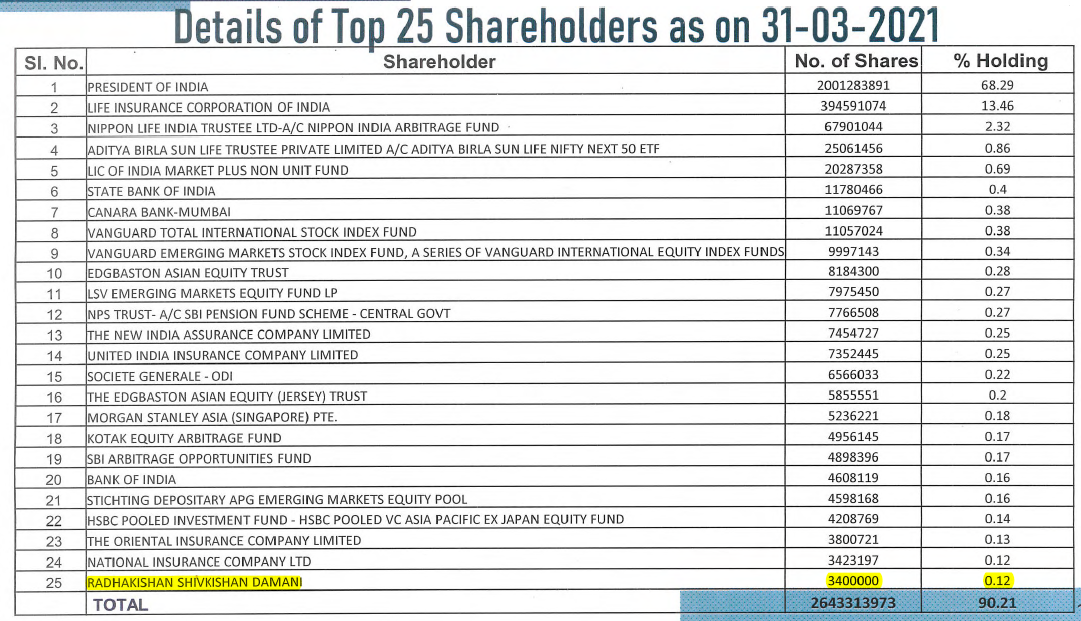

According to the latest information in the investors’ presentation, Radhakishan Damani has added 34 lakh shares of NMDC to his portfolio.

The investment is worth Rs. 61 crore at the CMP of Rs. 178.

Interesting- Radhakishan Damani amongst top 25 shareholders in NMDC

RKD owns 34 Lakh shares of NMDC (0.12% equity)

He is the only individual shareholder amongst top 25 shareholders in NMDC #source – Co presentation @CNBCTV18News @CNBCTV18Live @Nigel__DSouza— Nimesh Shah (@nimeshscnbc) June 23, 2021

NMDC is steeply undervalued & has high dividend yield: Experts

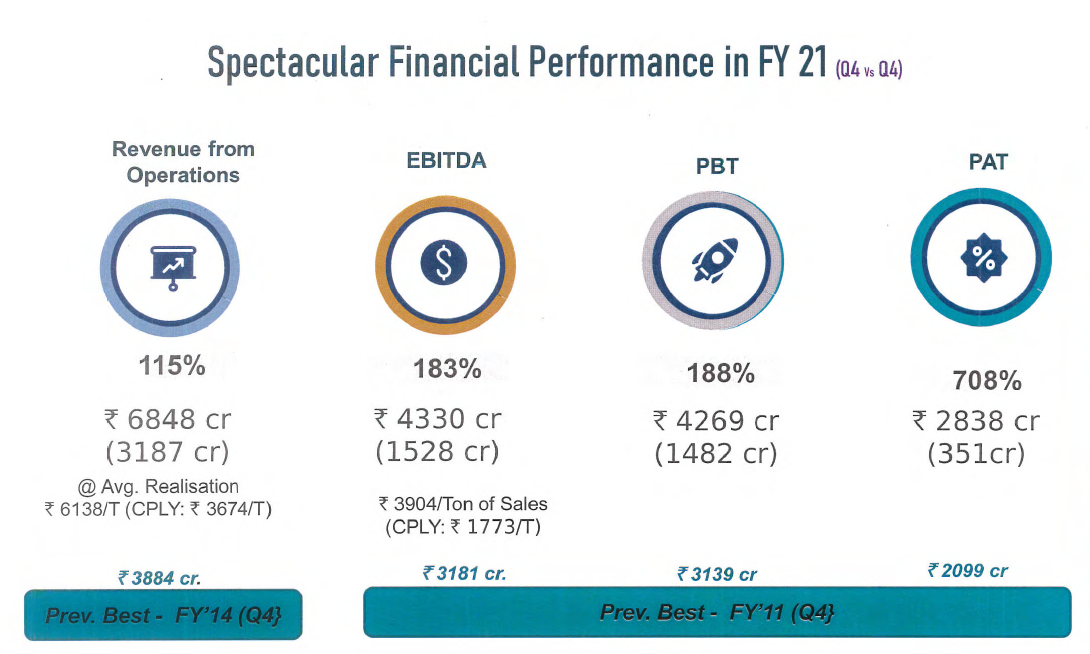

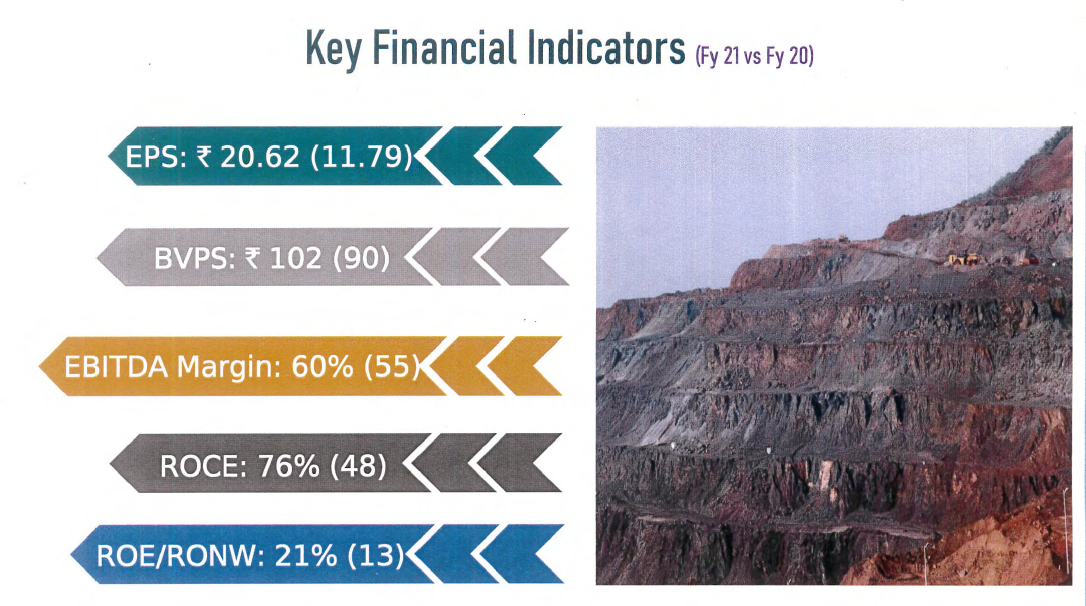

According to the distinguished experts at Sharekhan, NMDC’s valuation of 3.8x its FY2023E EV/EBITDA (excluding value of the steel plant at 0.5x CWIP) is attractive as it is at a steep discount of 28% to average EV/EBITDA multiple of 5.3x for global mining peers.

It is also pointed out that NMDC has earnings visibility and strong return ratios (RoE/RoCE of 22.1%/24.5%).

NMDC is also likely to witness “value unlocking” from the demerger and potential strategic sales of the steel plant. This could add Rs. 30-32/share to NMDC’s valuation as the street is ascribing only 50% value to CWIP of Rs. 18,560 crore), it has added.

Sharekhan has recommended a Buy with a Price Target of Rs. 205.

This opinion is endorsed by Motilal Oswal.

“NMDC is a play on strong iron ore prices and volumes. We expect a strong 14% volume CAGR to 43mt over FY21–23E, aided by the resumption of the Donimalai mines and increased volumes at Chhattisgarh. While the non-renewal of export contracts implies higher domestic volume sales – given the robust demand and iron ore shortage domestically – we expect NMDC would be able to increase volumes in the domestic market,” it is stated.

It is also pointed out that the CMP, NMDC is trading at only 4.0x the core Iron Ore Mining business and provides an attractive dividend yield of ~13%.