Bahut nuksaan hua hai Bear attack mein

“Maine suna hai Rakeshbhai ka bahut nuksaan hua hai Bear attack mein,” Mukeshbhai said in a nervous tone, tears welling in his eyes.

“Haan, 1300 crore ka loss hai,” Jigneshbhai replied, in an equally nervous voice.

The other punters also had a worried look on their faces.

Shyambhai and Mandakini gave everyone an extra dose of Gutka and kadak adrak chai to calm them down.

However, I was not at all perturbed.

This is because I have been meticulously tracking Rakesh Jhunjhunwala’s portfolio over the past several years and have seen many such Bear attacks come and go.

The Badshah has always triumphed over the Bears because of his flawless stock selection and sectoral allocation.

As far back as in August 2011, when I was a novice (I still am), I had diligently reported that the Badshah had suffered a crippling loss of Rs. 316 crore.

Thereafter, in March 2013, the losses ballooned into a mammoth sum of Rs. 1,000 crore.

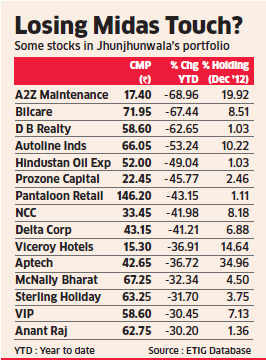

There was so much pandemonium and halla-gulla in Dalal Street that the ET had the temerity to ask whether the Badshah had “lost his Midas touch”.

In hindsight, we can see the naivety of the mandarins of ET because many of the stocks they listed as not having the “Midas touch” have now blossomed into magnificent megabaggers.

VIP Industries, for instance, has surged from the price of Rs. 58 to the CMP of Rs. 413, posting massive gains of 500%+.

Also, what was not appreciated is that some of these stocks are “sundry” stocks in the portfolio.

One should focus on the stocks in the core portfolio such as Titan, Escorts, DHFL, Lupin, CRISIL etc, each of which have given stellar gains since then.

Warren Buffett lost £3bn by doing “dumb things”

However, even Rakesh Jhunjhunwala’s losses seem like petty cash when we compare it with the losses suffered by Warren Buffett, the World’s greatest investor.

According to a report in the Guardian, Warren Buffett lost a mega fortune of £3bn due to his stock picks going awry.

Warren blamed himself for the stock picking buffoonery.

“I did some dumb things,” he said with his characteristic humility.

“The dumbest was buying a large holding in energy company Conoco Phillips when oil prices were near their peak. In no way did I anticipate the dramatic drop in prices that occurred,” he lamented in his letter to the distinguished investors of Berkeshire Hathaway.

Bloomberg sleuths probe Rakesh Jhunjhunwala’s portfolio loss

The sleuths at Bloomberg have conducted a systematic and dispassionate study of the Badshah’s portfolio and identified the performance of each of the crown jewels.

| Top 10 Stocks In Rakesh Jhunjhunwala’s Portfolio | |||||

| Stock | % of holding | YTD loss (%) | 1 Month loss (%) | YTD Loss (Cr) | 1 Month loss (Cr) |

| Rallis | 9.67 | 29.3 | 10 | 145 | 39 |

| Escorts | 8.12 | 18 | 28 | 141 | 251 |

| Delta | 7.48 | 27.8 | 16 | 172 | 85 |

| CRISIL | 7.26 | 6.7 | 1 | 65 | 9 |

| Titan | 7.06 | 4.3 | 7.52 | 231 | 418 |

| Karur Vysya | 4.22 | 29 | 13.1 | 112 | 41 |

| VIP Ind | 3.69 | +23.9 | 29.4 | 44 | 94 |

| DHFL | 2.76 | 50.2 | 56.5 | 253 | 326 |

| LUPIN | 1.95 | +1.3 | 0.5 | 10 | 4 |

| Federal Bank | 1.72 | 35.1 | 11.6 | 130 | 32 |

| Total | 11.4 | 12.3 | 1303 | 1299 | |

As one can see, on an overall basis, Rakesh Jhunjhunwala has suffered a loss of nearly Rs. 1300 crore, both on a YTD basis as well as i-month basis.

All the three finance stocks in the portfolio have been beaten black and blue.

DHFL is the worst affected with a 56.5% monthly loss.

I have already explained that the reason is because DSP Mutual Fund unceremoniously dumped a massive consignment of DHFL paper and sparked panic as to its creditworthiness.

WHAT A DAY… A Mutual Fund (@dspmf) sells debt paper to prepare for a possible contingency (#ILFS), the panic spills over on the equity side (given risk aversion) I UNDER STAND THAT. But this causes a 50% crash in the stock… DON'T get that.. Will #SEBI explain this.. #DHFL

— Surabhi Upadhyay (@SurabhiUpadhyay) September 21, 2018

Federal Bank has lost 35% on a YTD basis owing to the Kerala floods.

However, LUPIN stood out as a bulwark and refused to bow down to the Bears. It stood nearly flat on a YoY and YTD basis.

VIP Industries brought cheer to the Badshah by giving a positive return of 24% YTD.

CRISIL also defied the Bears to some extent by conceding only a loss of 1% on a 1-month basis.

No wonder, the Badshah referred to the entire credit rating agency business as a “Halwa” business.

In fact, inspired by Rakesh Jhunjhunwala, Mohnish Pabrai is buying CARE Ratings in an aggressive manner.

#JustIn | CARE Ratings: Pabrai Investment raises stake pic.twitter.com/W4xzIz3xPx

— CNBC-TV18 (@CNBCTV18Live) September 28, 2018

Sectoral allocation enables out-performance

Rakesh Jhunjhuwala’s sectoral allocation has saved him the blushes and enabled out-performance in comparison to other investors.

The Badshah’s top ten stocks are in six different sectors. These are Auto, Gaming/ Entertainment, Credit Rating, Consumer Discretionary/ Consumption, Banking/NBFC and Pharma.

It is this prudent allocation which has enabled the Badshah to walk away with a nominal loss of 11.4% YTD loss, which he will effortlessly recover as soon the markets resume their upward trajectory.

It is better if we obediently emulate Rakesh Jhunjhunwala both in terms of stock selection as well as sectoral allocation!

How to know performance of other investors portfolio

Portfolio of RJ looks to be very good and in my opinion may recover in future. along with market..DHFL is already in recovery mode.

Although YTD is 11% loss. The moment market comes to know that he is selling particular holding even little percentage, it would be a carnage and big erosion of his wealth. He can’t hide the news unfortunately. Always feel he is riding on tiger.