Savage Bear attack shaves off Rs. 2 lakh crore of investors’ wealth

Yesterday’s savage crash on the Bourses spooked not only the novices but even the veterans.

“Nifty 400 points off high — all in a matter of half hour!!!!,” Anisha Jain said, her voice trembling even as she struggled to keep a poker face.

Nifty 400 points off high — all in a matter of half hour !!!! https://t.co/Sbq0RWyPJB

— Anisha Jain (@_anishaj) September 21, 2018

NIFTY BELOW 11000 — what panic in markets !

— Yatin Mota (@YatinMota) September 21, 2018

NBFCs thrashed

— Darshan Mehta (@darshanvmehta1) September 21, 2018

#nifty 160 points off high ; 11200 taken out

big cuts in #nbfc and #financials#DHFL down 40%

Indiabulls housing down 20%

Rupee back at 72 levelThis is when :

Asia close to high point

Shanghai is up 2%

Hang Seng almost 500 points higher

Europe opened higheer— Anisha Jain (@_anishaj) September 21, 2018

Even Samir Arora, the battle-hardened fund manager with Helios Capital, was spooked at the savagery of the Bears.

“Stupidity across the board,” he mumbled helplessly, at a loss for words.

Stupidity across the board.

— Samir Arora (@Iamsamirarora) September 21, 2018

By the EOD, Dalal Street was in tatters.

As many as 400 stocks, including Yes Bank, DHFL, Adani Ports, Jet Airways (India), Apollo Tyres, JK Tyre & Industries and Rane Holdings, hit 52-week lows on the NSE.

The loss to investors is conservatively estimated at a colossal sum of Rs. 2 lakh crore.

DHFL & Yes Bank hammered

DHFL, the apple of Rakesh Jhunjhunwala’s eye and a crown jewel in his portfolio, bore the brunt of the savagery.

It collapsed a colossal 50% and wiped out a fortune of Rs. 10,000 crore in the blink of an eye.

.@DHFL_India tanks 50%, loses Rs 10,000 crore m-cap pic.twitter.com/Mc1jBX8Ttm

— ETMarkets (@ETMarkets) September 21, 2018

Dewan housing down 40%

— Darshan Mehta (@darshanvmehta1) September 21, 2018

DOWN 20% NOW… whats going on here ? https://t.co/qYnpefY4Dl

— Yatin Mota (@YatinMota) September 21, 2018

Surabhi Upadhyay and her colleagues in the media sprung into action with a view to salvage the situation.

They summoned the top brass of DHFL and extracted a statement that all is well and there is no cause for panic.

#CNBCTV18Exclusive | DHFL sees a recovery of over 40% as company denies defaulting on any repayment #OnCNBCTV18 pic.twitter.com/8PQPrCuLLZ

— CNBC-TV18 (@CNBCTV18Live) September 21, 2018

Investigation revealed that DSP Mutual Fund was the culprit. It had indiscriminately dumped a massive quantity of DHFL paper and caused panic.

#CNBCTV18Exclusive | DSP Mutual Fund tells CNBC-TV18 exclusively it sold papers worth Rs 200-300 Cr of DHFL recently to improve liquidity & reduce overall maturity. Adds that it did not sell DHFL paper due to any concern regarding management or company pic.twitter.com/EOH8Lih3PG

— CNBC-TV18 (@CNBCTV18Live) September 21, 2018

It was also claimed that the crash was because of “rumors”.

Dewan Housing Finance & Indiabulls Housing Finance blamed rumours for the sudden plunge in shares on a day the benchmark Sensex swung the most in more than four years.https://t.co/tT3kj648hV

— BloombergQuint (@BloombergQuint) September 22, 2018

However, some seasoned watchers were not convinced that the situation was as simple as was made out by DHFL and DSP Mutual Fund.

It was suspected that more sinister reasons are responsible for the crash.

WHAT A DAY… A Mutual Fund (@dspmf) sells debt paper to prepare for a possible contingency (#ILFS), the panic spills over on the equity side (given risk aversion) I UNDER STAND THAT. But this causes a 50% crash in the stock… DON'T get that.. Will #SEBI explain this.. #DHFL

— Surabhi Upadhyay (@SurabhiUpadhyay) September 21, 2018

Anyway, the contagion spread to other NBFC stocks, with all of them tanking like a ton of bricks.

All housing finance companies crack!

DHFL now down 25%

Indiabulls Housing down 10%

Repco down 5%

Can Fin down 5%— Mubina Kapasi (@MubinaKapasi) September 21, 2018

Chola Fin, Dewn Hsg, Indiabulls Hsg, Shriram Transport – all these stocks down and how !!

— Yatin Mota (@YatinMota) September 21, 2018

Yes Bank was in an equally sorry state of affairs.

The stock lost a colossal fortune of $3.1 Billion in market capitalisation.

Yes Bank loses $3.1 billion in market value after RBI curtails CEO's term https://t.co/eYp1OqgHyr pic.twitter.com/FNZbyVUvH2

— Reuters India (@ReutersIndia) September 21, 2018

Knowledgeable observers predicted that dark secrets relating to hidden NPAs will now be unearthed after Rana Kapoor’s exit and send the stock on the path of no-return.

I think the @YESBANK story is slowly coming apart…to paraphrase the soothsayer from Shakespeare’s Julius Caesar, “Beware the ire of the RBI”. Besides, the incumbent CEO’s happy hours last all day…

— SUHEL SETH (@suhelseth) September 21, 2018

Trouble in one bank/NBFC does not mean entire financial sector is in trouble: Basant Maheshwari

Basant Maheshwari was not spooked by the crash in NBFC stocks.

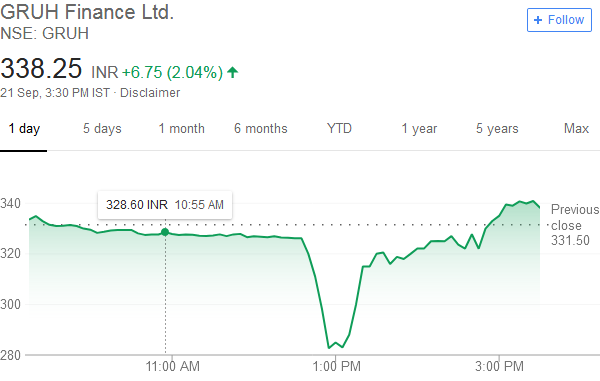

Instead, he stayed tall and hinted that we should take advantage of the crisis in DHFL to aggressively buy high-quality and fail-safe quality names like Gruh Finance and Piramal Enterprises.

Basant is right because both stocks plunged nearly 10% and shot right back up, leading to fantastic gains for the handful of brave hearts who dared to dive in.

Trouble in one bank/NBFC does not mean entire financial sector is in trouble, says Basant Maheshwari (@BMTheEquityDesk)

Read: https://t.co/Ek82Kv9snV pic.twitter.com/V2pCd6O6LV

— BloombergQuint (@BloombergQuint) September 21, 2018

#TheBigSellOff | Low quality stocks are declining and large quality stocks are tagging along. As a fund manager & investor, is this time to buy the fear? asks @nikunjdalmia to Basant Maheshwari. Listen in! pic.twitter.com/vg95U6FgCY

— ET NOW (@ETNOWlive) September 21, 2018

Technical sell-off has created brilliant opportunities to buy high-quality companies: Madhu Kela

Madhu Kela, the visionary stock-picker, rushed to Dalal Street, all guns blazing.

He described the mayhem as a “technical sell-off” and “speculative unwinding”.

“This looks like speculative unwinding and for a long-term investor, if you really understand the company and if you have faith in the management, these are brilliant opportunities to buy these companies,” he roared with an assuring smile.

“Wherever the management is solid, they will be able to weather this storm and come out stronger,” he added in a soothing tone.

#CNBCTV18Exclusive | Madhu Kela says temporary tightness in the money mkt would not have a long-term impact & @Lakshmi1876, CIO Debt, @KotakMF says current panic offers good opportunity to MFs to buy bargains in the market@_prashantnair @SumairaAbidi pic.twitter.com/0HtG6pDxtw

— CNBC-TV18 News (@CNBCTV18News) September 21, 2018

G Chokkalingam & Sanjiv Bhasin endorse theory of “technical sell-off”

Veteran investors G Chokkalingam and Sanjiv Bhasin rubbished fears that there are fundamental reasons for the crash. Instead, they advised that the selling is overdone.

“The selling seems to be overdone and the NBFC stocks should stage recovery soon. They are already off from the day’s low,” Chokkalingam said.

A selloff in non-banking financial companies (#NBFC) is a lot to do with the fiasco around IL&FS, @sanjiv_bhasin of @IIFLMarkets told @moneycontrolcom. “The real weakness is due to this, and not a depreciating #rupee,” he said.#LIVEupdates from Sensex: https://t.co/Rtf7cOJ6Cj

— moneycontrol (@moneycontrolcom) September 21, 2018

However, IIFL advises caution

IIFL rushed out a note titled “NBFC Mayhem” in which they warned that “the panic in NBFC stocks has not settled completely” and that we should “wait and watch” for a clearer picture to emerge.

It was also stated that broker margin calls may lead to further selling pressure on Monday.

NBFC stocks are a gold-mine in the long-term

Nobody can dispute that over a long period of time, NBFC stocks have been a gold mine and have created incalculable wealth for investors.

Vinit Sambre of DSP Mutual Fund explained the situation eloquently in his latest interview.

“We get excited looking at the long-term trends and given the opportunity size, we have backed them up …

the opportunity is still very wide and the interest rate cycle will keep having its own cycles. It is sometimes high and sometimes low, but these NBFCs have displayed strength during the last 10 years and have also maintained their asset quality quite well“, he said.

So, there is no reason for us to feel apprehensive about the wealth-creating abilities of NBFC stocks.

Conclusion

Prima facie, it does appear that there is nothing more than a “technical sell-off” in the NBFC stocks. Assuming the so-called “broker margin calls” leads to further collapse in NBFC stocks, we should dive in and start nibbling on high-quality NBFC stocks as advised by Basant Maheshwari and Madhu Kela!

Oh, what a day. Every NBFC worth its salt was down except of course HDFC twins.

What explanation by the fund managers and analysts. No idea. Everybody talking about keeping calm and nerves both. No idea what will happen on Monday when further margin calls are triggered.

Quality will become more scarce and costly, and it seems India has very less no of companies with good governance. Now on it is dangerous to invest in lower order and better to invest only top company of the sector and dangerous to go down in order. Also it is dangerous to have concentrated portfolio, earlier I used to have around 40 stocks but later on I reduced it to 20,which resulted in more weight of few stocks and two of them Yes Bank and DHFL has backfired. Now again to basics, to go up in order ie only top stocks with widely held portfolio of around 40 to 50 stocks with no stock having weight of more than 5 % and most of them having weight below 3% to avoid blood bath like in Yes Bank and DHFL.

Ramdeo Agarwal and Basant Maheshwari have been professing concentrated bets in only 10 stocks because they are managing other people money. All successfully investors managing their own wealth have distribution over atleast 40 stocks to manage risk. Hign margin of safety is other paramer practised by those who manage their own money. Concentrated bets with low margin of safety can wipe off all you have earned in 5 years in one month

You are right.

AAA rated paper spreads have risen 60 bps in 1 months. AA – 100 bps.

Sometimes liquidity risk may risk solvency risk. Any way the way yield are rising, NBFC can not grow the way it was growing earlier. People are overweight in HFC and NBFC industries. Obviously this correction was in the making.

Money market sentiment once impacted does not recover quickly. If no corrrctive action is taken by govt or rbi early next week, this could get very ugly

DHFL credit rating of borrowing instruments reaffirmed next day, i.e. on 22.09.2018 by ICRA/ICRA.

Selling CP by DSP @ 11% yield is clearly a mistake by a dealer in the dealing room of DSP. Listen to what Mr. Hemendra Kothari has to say, ” If market spread is 10.50 – 11.00%, and one of my trader or fund manager sold at 11%, I cannot blame him.”

Well this tells the whole story.

Margin calls and further selling of pledged stocks will make the market go lower. Better to put buy orders at 10% below spot every day and wait till they get hit.

This is golden opportunity to buy. Market may cross 40k by December

Golden opportunity to buy what? no on wants NBFC stocks -FMCG are all over there in the sky-what are u going to buy?

Today HDFC is also down by 7 odd percent. Nowhere to hide.

While a loss situation is sad, I feel like laughing at some comments of ‘visionary’ investors like Samir Arora. He calls this sudden fall ‘stupidity across the board’. He never questioned the illogic of buying scrips well past PEs of 50. That was no stupidity!? He seems to be living in a la-la land where everything goes up only, never to crash! Some of the scrips are at such filthy high valuations, bloated balloons, the crash was inevitable. And I feel pity on companies like Bajaj Finance – so desperate for business, I receive 100 calls a day. What that suggests? Balloon is getting ready to burst.

Second point is on Yesbank and RBI behaviour. First of all, why a promoter of the bank himself is allowed to be a MD by RBI? And once allowed, now why he does not get an extension? Are there any serious irregularities on him? If so, make it public. Why hush-hush? What joke is this by the RBI? Have they done the same to Aditya Puri of HDFC or Uday Kotak, and will they do the same to others like RBL Bank (Ahuja)? Why be selective, without proper explanation to the public/investor community?

Earlier it was SEBI that rocked the Midcap/Small cap boat by ordering MFs to exit from them and focus on Large caps. Now, RBI is doing this.

But hardly we see any action taken against fraudulent companies that are fooling the investors daily. Its easy to see how share prices are being manipulated for their own benefits – bring them down to help do a preferential placement to their own people, raise it up and take further moneys from institutions and individuals. Take huge salaries disproportionate to their performances (see ILFS story) etc.

I agree with rather harsh but true comments by the author. We Indians are expert in spoiling good things for nothing and relish self deprecation.