Abbott India, the “cash machine” MNC stock, is surging

First, we have to compliment Saurabh Mukherjea because his last stock pick, Abbott India, is doing quite well.

He has fondly described Abbott as a “cash machine” which should form part of every “classy Indian portfolio”.

“Abbott is a cash machine. It makes it to my consistent compounder portfolio. It has got almost a quasi monopoly in some elements of therapeutic care, but it is a domestic play and I like it for that. It is in the consistent compounder portfolio …. as a steady compounder over the next three, four, five years, Abbott should be in there in a classy Indian portfolio,” he said.

In fact, Saurabh has opined that the entire Pharma sector has bottomed out and that the time is ripe for us to dive in.

“Pharma is a beaten down sector that has been thrashed badly in the last three years but the fundamentals in terms of ROCs are very strong; cash generation is strong and the last three-four months of channel check that we are doing suggest that an export-driven pharma recovery should be round the corner and this is a sector where at the top of my head, I can think of four of five names where the ROCs are north of 25%,” he said.

Divis Labs, which is one of Saurabh’s favourites, is also coasting at new highs.

Big surge take Divis to record highs….Its been the best performing stock in the Nifty Pharma Index from start of the year

— Darshan Mehta (@darshanvmehta1) November 27, 2019

A similar view about the Pharma sector has been expressed by Gautam Shah, a leading expert on technical analysis.

Friends, as I study more sectors I realise that the pharma index which has been in a bear mkt for 3 years could have bottomed out. The index lost 50% (insane) in this period. Foundation laid for a large recovery over the next many weeks/months.

— Gautam Shah, CMT, CFTe, MSTA (Distinction) (@gshah26) November 7, 2019

Auto ancillary stocks are “absolutely smashed” and will be first to surge

Saurabh opined that if one wants to bet on economic recovery, it is better to bet on auto stocks rather than on power, metals, real estate etc.

In fact, the demand and production figures for October 2019 indicate that a revival is around the corner.

Bajaj Auto reports highest ever retail sales of all businesses in history of co. Festive season growth at 28% YoY. November sales could decline because of a strong festive season, says Bajaj Auto pic.twitter.com/GLobruMvjx

— CNBC-TV18 (@CNBCTV18Live) November 1, 2019

Congratulations to our Tractor sales team and dealer partners for achieving the highest ever monthly deliveries last month. I hope this is a sign of things to come in the next few months. @MahindraRise

— Pawan K Goenka (@GoenkaPk) November 1, 2019

Saurabh opined that two-wheeler stocks are better placed than cars and trucks and are likely to recover quickly.

This is because their ticket sizes or purchase price are smaller and customers will have lesser hesitation in buying them.

“Two-wheelers is probably the biggest sector if one wants to play a potential economic recovery,” he stated.

He also emphasized that the valuations of several good auto ancillary stocks are “absolutely smashed” and are available at throwaway valuations.

He also pointed out that the companies have strong balance sheets and are cash generative.

“So, auto and auto ancillaries would be my favourite play on economic recovery as and when we get visibility on that,” he said.

It is notable that top-quality auto and ancillary companies are already surging like rockets and have posted handsome gains in the past three months.

Performance Of 11 – Leading Auto N Auto Ancillary Stocks During The Past Three Months:

1. Maruti +16%

2. Eicher Mot +52%

3. M&M +3%

4. Ashok Ley +38%

5. Bajaj Auto +16%

6. Hero Moto -6%

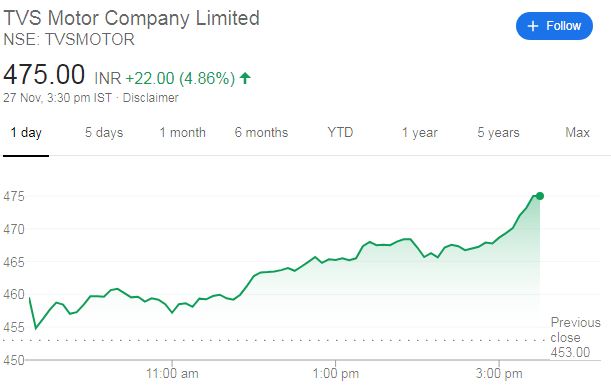

7. TVS Mot +25%

8. Tata Motor +49%

9. Bosch +20%

10. Motherson +34%

11. Wabco +2%— Pankaj Parekh (@DhanValue) November 26, 2019

Bought a two-wheeler stock which is “too deliciously cheap to be ignored”

Saurabh revealed that he has bought a two-wheeler stock with a top-quality franchise, high ROCs, high cash generation and good corporate governance.

“The two-wheeler company was just too deliciously cheap to be ignored,” he said.

Saurabh did not reveal the name of the stock.

However, it appears that he is referring to TVS Motors, which is one of his all-time favourite stocks.

In the past, he has lavished praise on TVS Motors.

“For a long time now, TVS Motors continues to be a company which has gone from strength to strength, their BMW bike is shaping up pretty well and I think TVS will continue to be an interesting stock to have,” he said.

Sakshi Batra has conducted a brilliant 3 point analysis of TVS Motors in which she has highlighted all the core points of the company and its outlook.

Best Auto ancillary stocks to buy

Taking a cue from Saurabh, we have to scout for high-quality auto ancillary stocks to tuck into.

Thankfully, leading experts have recommended two such stocks with the assurance that they will deliver magnificent gains in the foreseeable future.

JBM Auto – quoting at “tempting valuations”

HDFC Securities has recommended JBM Auto on the basis that it is quoting at “tempting valuations” and has the potential to deliver 90% gain.

The logic is as follows:

JBM Auto (JBMA) delivered decent numbers in 2Q amid challenging environment for PV segment. Consolidated Revenue (Standalone+JBMAS) rose 10% YoY to Rs. 4.5bn led by strong growth in tooling (+24%YoY) and bus division.

Despite slowdown in PV sales core sheet metal business grew by 3% YoY led by new business acquired from Tata Motors, M&M, Fiat and Toyota. EBITDA grew 8% YoY to Rs 547mn with margin at 12%(-30bps YoY). APAT came at Rs 209mn (+10% YoY)

We remain positive on JBMA, based on

1) Sustenance in Sheet metals business led by incremental wallet share from M&M, Ford, Tata Motors, VECV, RE and HMSI

2) Strong revenue potential in tooling business(high margin+30%), owing to increasing localization and outsourcing of tooling requirements by major global OEMs (cost-benefit of 25% in India)

3) Economies of scale coming in bus division, will foster margins and profitability going ahead. Moreover, the recent amalgamation of its subsidiary JBMAS and JV JBMMA (likely to be effective from next quarter) into a single entity will be synergetic and EPS accretive.

We cut EPS by 5% for FY19E factoring in 1H performance. Expect 27% EPS CAGR over FY18-21E; fuelled by improving operating leverage, richer product mix and acquisition of new clients At CMP stock available at 13/10x for FY19/20E EPS vs 5 Yr mean at 15x. We value stock at Rs. 560 (17x Sept-20E EPS) and maintain BUY.

Key highlights

❑ Sheet metal division: Delivered 3% YoY growth in 2Q in revenue and EBIT led by acquisition of new businesses for Mahindra Marrazo and Tata Nexon. Ramp up in CV segment also supported revenue growth led by higher revenue from Volvo-Eicher.

❑ Tooling division: Witnessed 78% jump in 1H to Rs 676mn backed by new launches and large orders secured in FY18. This segment enjoys 2.5-3x higher margins compared to sheet metal division.

❑ Bus division: The business, which was a drag (Rs 102/118 mn losses at EBIT level for FY17/18) on the JBMA’s financials, is gaining momentum with improving sales volume. The company sold 50 buses in 1H and to attain EBITDA breakeven, the company needs to sell 120 buses annually.

Jamna Auto – undisputed leader of suspensions

Stewart & Mackertich has recommended a buy of Jamna Auto on the logic that it has the potential to deliver gain of 80%.

The logic is as follows:

Jamna Auto Industries Limited (JAI) is the undisputed leader of the Indian automotive suspension space with a mammoth 72% share in the OEM segment. It is the India’s largest and world’s second largest manufacturer of tapered leaf springs & parabolic springs for Commercial Vehicles (CVs) in India with an annual production capacity of 240,000 MT and produces over 500 modes of springs for OEMs.

It has been a trusted and preferred supplier of Leaf and Parabolic Springs to all major CV manufacturers for over 50 years. The Company has 9 strategically located state-of-the art manufacturing facilities at Yamuna Nagar, Malanpur, Jamshedpur, Pune, Chennai, Pilliapakkam, Hosur, Pant Nagar and Lucknow.

It supplies to auto OEMs across the globe and boasts of a strong clientele consisting of Ashok Leyland, Tata Motors, General Motors, Kamaz Motors, SML ISUZU, Mahindra & Mahindra, Volvo and others.

Key Highlights

-Consolidated revenue for Q2FY19 reported at INR548.4 crore, up 42.4% YoY owing to the strong volume growth in the CV segment. It has managed to beat our estimate of INR521 crore.

Despite having a strong market share, rising raw material prices have dented its gross margin by 144 bps YoY to 36%.

-Absolute EBITDA for the quarter under review stood at INR68 crore, up ~35% YoY, which is marginally lower than our estimate of INR70 crore. Despite optimization in employee benefit expense and other expenses, EBITDA margin dipped 66bps YoY to 12.4%.

-Co. reported a PAT of INR35.5 crore, up ~21% YoY, which is marginally lower than our estimate of INR37 crore. However, PAT margin dropped by 117bps YoY to 6.5% due to higher higher financing cost and effective tax rate.

-The Board of Directors has declared an Interim dividend of INR0.50 per equity share of INR1 each amounting to ~INR20 crore on the paid-up equity capital.