ITC falls from grace, becomes inspiration for memes

At one time in the distant past, ITC commanded such respect in Dalal Street that it used to be referred to with hushed tones by investors and punters.

However, it has now become the butt of ridicule and the subject of memes.

ITC investors be like :- pic.twitter.com/jxbwi0N4Fy

— Abhinav (@Abhinav323334) September 4, 2020

ITC (untill 188): pic.twitter.com/0mvJsLUw2V

— Anurag Jaiswal (@AanuragJ) September 2, 2020

ITC investors after share jumps 1 re : pic.twitter.com/o4zjOJgujx

— RR (@rwt737) August 27, 2020

People after taking position in ITC ?? pic.twitter.com/j6lMBE719L

— ° (@ankitjain_3) August 27, 2020

ITC – Visit our page ?@riyansh_joshi , @Qid_Memez @StocksResearch @safiranand @MunkThePunk @hafizul09 pic.twitter.com/kbRM1zEF9A

— drprashantmishra (@drprashantmish6) August 28, 2020

This sorry state of affairs has come about because ITC has failed to live up to expectations and has severely underperformed its peers.

The stock has lost 31% over the past three years despite the raging Bull market.

The woes plaguing ITC have been explained in a simple yet brilliant manner by Finshots.

Super article on ITC by @finshots. Markets generally value companies showing potential growth more than those that generate cash. Btw large investors from this FY have to pay tax at >40% on dividends, so dividend-paying companies even lesser attractive https://t.co/361xlIGBrk

— Nithin Kamath (@Nithin0dha) August 30, 2020

ITC is over-diversified, such companies can never earn a good ROI

It is notable that Saurabh Mukherjea had himself recommended ITC to us in the past.

“ITC is the perfect Coffee Can Investment portfolio stock with 10% revenue growth and 15% ROC,” he had declared.

However, he now explained that the bane of ITC is its over-diversification.

“I haven’t yet found a company in India, which manages to do more than two things well,” he said.

“They have one or two businesses which shrug out lots of cash, and there are 4 or 5 businesses which guzzle up the cash … It’s difficult for them to generate free cash flow in the modern India paradigm, they are finding it hard to generate cash flows,” he added.

Investors are left none the wiser and so it is better to stay away from conglomerates and focus on companies which do one or two things well, he advised.

Saurabh praised ITC for the stranglehold that it has over the cigarettes business and also the FMCG sector.

However, he opined that the Company would not be able to compound earnings in an attractive way.

“We were not able to convince ourselves that even with the twin-cylinder engine, ITC could gun out 20% earnings compounding. That’s the basic test a stock needs to meet for us. We need to see free cash flow generation, which gets further invested in giving us a 20% earnings compounding,” he explained with a tinge of sadness in his tone.

Is it FMCG company, tobacco company, hotels company ? pic.twitter.com/CkIzQjvlXM

— Finance Memes (@Qid_Memez) August 28, 2020

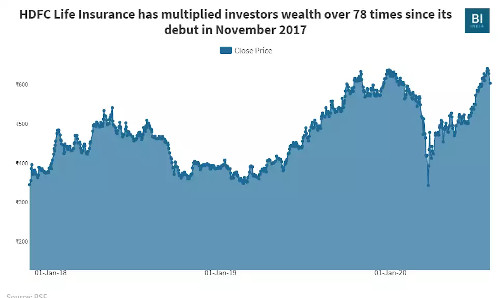

HDFC Life Insurance is a ‘consistent compounder’

Saurabh announced that he has awarded the prestigious title of “consistent compounder” upon HDFC Life and added it to the portfolio.

HDFC Life has a distinguished pedigree. The venerable HDFC Ltd (the mother of all Blue-Chips) is its parent while HDFC Bank and HDFC AMC are siblings.

He pointed out that to qualify as a ‘consistent compounder”, a company should be able to build barriers to entry and its return on capital should be consistently above its cost of capital.

The barrier to entry in HDFC LIfe is around technology and data analytics, he explained.

He also opined that HDFC Life is a great company as is borne out by the financial statements, primary data analysis from distributors, ex-employees and competitors.

“HDFC Life passed that assessment, and it entered our portfolio,” he said.