Shankar Sharma advised us a few days ago to forget about investing in large-cap stocks and instead to focus on finding top-quality stocks from the micro, small and mid-cap stocks universe.

Shankar’s logic is that while behemoth large-cap stocks require a great deal of improvement in the economy to move forward, small-cap stocks thrive in niche areas and can prosper even if the economy is growing at a low rate.

Shankar assured that if we are careful about our stock selection, we can get enormously rich.

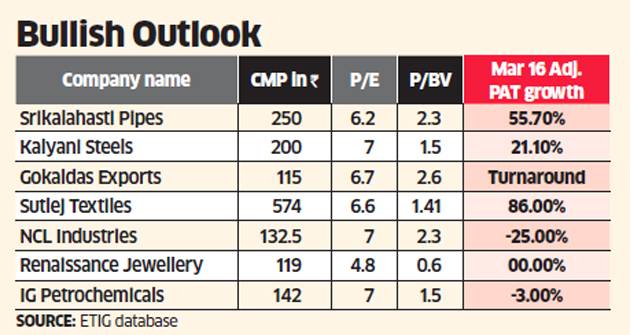

Now, the all-important question as to which small-cap stocks we should focus on is answered by Jwalit Vyas of ET. He has identified seven top-quality small-cap stocks which are quoting at a P/E of less than 7.

(Image Credit: ET)

Srikalahasthi Pipes

The company is into manufacturing of steel and iron pipes, demand for which has been strong due to rapid urbanisation. The government’s thrust on infrastructure provides great potential. It has reported over 50% earnings growth in each of the last four quarters. Also, its long-term debt fell by 40% in FY16.

Kalyani Steel

The Kalyani Group Company manufactures specialised steel which is used by auto ancillary, defence, tube manufacturing and smelting sectors. Despite weakness in steel prices, the company reported 36% growth in the earnings in FY16 over the previous year, driven mainly by margin expansion due to lower costs and lower interest from debt reduction. Its longterm debt dropped by 30%.

Gokaldas Exports

Bangalore-based clothing company which owns innerwear brand Enamor and exports garments to foreign brands was struggling with high debt and losses. However, in the last two quarters, the company surprised the street with strong numbers. It reported adjusted profit of Rs. 54 crore in the second-half of FY16 against losses in the corresponding period of the previous year. The company is expected to sustain its financial performance.

Sutlej Textiles

The Birla group company derives most of its sales from selling yarn. Its sales growth in each of the last four quarters was in high double digits. Most of its capacity expansion is over, the benefit of which will be seen in the coming quarters. Cotton prices, raw material for yarn manufacturing, have started to go up, which will benefit Sutlej in the near term as it may push up yarn prices. Its profitability will depend upon how well the company can pass on the additional raw material cost to end users.

NCL Industries

The South India based cement manufacturer recently announced that it is out of corporate debt restructuring (CDR) scheme. The company reported stellar numbers in the first half of FY16, while the second-half numbers were not encouraging enough. But cement prices in south are rising once again. Given that its debt concerns are over, it is worthwhile to keep an eye on the stock.

Renaissance Jewellery

The Mumbai-based company must be the only jeweller after Titan to have no long-term debt on its balance sheet. Its business mainly involves designing and making low-priced products for brands like Amazon, Hallmark, JCPenney, Walmart in the overseas markets. Although, March quarter earnings growth were flattish, earnings growth for the entire fiscal was 16.3%. Capital allocation efficiency and earnings multiple of below 5 make is attractive.

IG Petrochem

The largest manufacturer of Phthalic anhydride, a chemical used to make paints, could benefit from the declining supply of the chemical over the past few months. Due to this, despite flattish earnings growth for the March quarter, the stock is up 35% in the last three months. Adjusted net profit in FY16 almost doubled.

Of the seven stocks identified by Jwalit, four stocks, namely, Srikalahasthi Pipes, Kalyani Steel, Gokaldas Exports and Sutlej Textiles are familiar to us.

Srikalahasthi Pipes shot into prominence when news emerged that Dolly Khanna, Anil Kumar Goel, Nirmal Bang & Morgan Stanley had cornered large stakes in the Company. Unfortunately, the Company was then embroiled in a corporate governance issue with Electrosteel, its loss-making parent, and this sent the stock price plunging. It is not known whether the wizards continue to hold the stock or not.

There is a recent initiating coverage report on Srikalahasthi Pipes by AUM Capital which recommends a buy on the basis that the Company is one of the largest manufacturers of DI pipes and that its marquee client list includes L&T, NCC, Indian Hume Pipes, VA Tech Wabag Ltd, Sriram EPC Ltd etc.

Srikalahasthi is also highly recommended by SP Tulsian and DD Sharma, both of whom are veteran stock pickers.

Kalyani Steel was recently recommended by Porinju Veliyath as a top-quality “defense play”.

This is @porinju’s defense play. https://t.co/r6epuDc3eW

— CNBC-TV18 News (@CNBCTV18News) May 27, 2016

Kalyani Steels also happens to be a favourite of DD Sharma, the veteran stock picker. Sharma is exuberant about Kalyani’s prospects and promised that the stock would have a “minimum” target of Rs. 280 in 12 months.

However, the downside with Kalyani Steel is that it is vulnerable to volatile raw material costs like iron ore, coking coal etc which can severely impact profitability. This was revealed by RK Goyal, its MD.

RK Goyal, MD, Kalyani Steel: Steel prices and RM prices have been volatile in the past one month. https://t.co/24dZ3BzAsU

— CNBC-TV18 News (@CNBCTV18News) June 16, 2016

Gokaldas Exports is also one of Porinju’s favourite stocks. We congratulated him a few days ago for pocketing hefty gains owing to the turnaround in the stock.

Sutlej Textiles is a top-quality Birla company which has been recommended by Nirmal Bang with a target price of Rs. 796. Nirmal Bang’s logic for recommending Sutlej is very sound.

Sutlej Textiles is also recommended by Karvy on the basis that the Company is going to expand its spindles capacity from 293,736 (FY15) to 412,392 by the end of FY17E.

Dilip Ghorawat, the CFO of Sutlej Textiles, also came on record a few days ago to state that the expansion will start contributing to revenues from the Q4 of the current fiscal and will add to its growth.

It also appears that Dolly Khanna is a stealth investor in Sutlej Textiles.

NCL Industries is not familiar to us because none of our favourite stock wizards have a stake in it. However, the stock has been an incredible multi-bagger with nearly 300% gains over 24 months and 122% gains over the past 12 months.

K Ravi, the boss man of NCL Industries, revealed that the Company has ambitious expansion plans to take advantage of the burgeoning demand for cement in Telengana and Andhra Pradesh.

Renaissance Jewellery and IG Petrochem are mystery stocks that are flying under the radar of most analysts. We will need to dig in more to uncover the potential of these two stocks!

Sutlej Textiles is a pick by Chokkalingam; NCL a recommendation by Paul Asset.

#Niveza #Review on Top Quality Small-cap Stocks ::

Srikalahasti Pipes is a undervalued stock trailing at PE of 6.2x. Revenue growth is looking good and earnings are improving. Company is managing its earnings well as the dent is reducing as well. This could be a better multibagger stock as well. Gokaldas Exports is recovering losses significantly since last 3 years. Cash flow is on positive side and PE is undervalued as well. The stock can find some space in the portfolio with long term vision. Sutlej Textiles is trailing at PE of 6.6x which is reasonable for the industry. Revenue growth is looking better as well. One can give a thought for this company as well.

Source : Stock Market Tips

Srikalahasthi Pipes has the problem of large debt of it’s holding company Electrosteel Casting and that is not getting sorted out anytime ! They are also under investigation for a Coal mine scam ! Don’t know how it gets picked as top slot no. 1 in this list !

yes sometimes to consider relying on these stocks actually become a big question, these stocks may actually turn to nowhere from being so called best stocks.

the real question still remains is it really worth investing or its just to showcase the world at large.

hence investors do your research instead of relying on these scripts.

Given the penchant of Srikalahasthi Pipes owners to take out money from the net profits from books of Srikalahasthi Pipes, and pay their other company Electrosteel, in several hundred crores, (for buying junk assets). Dolly Khanna exited the stock post such dubious transaction.

I refer to your comments about Mr.Madhukar Sheth about his holding in

Panama Petro. He retired from active investments in 2010. He was among top 20 brokers between 1995 to 2000 when SEBI suspended him for aiding Bajaj (But sebi has not punished Bajaj !). He is a B.E., MIE, MBA and was appearing as expert commentator on various TV channels like Zee Biz, CNBC, NDTV etc.

He was “Chasing scarcity” in Harshad Mehta’s time as per HM’s

GOLD & WATER theory. Though water is useful & precious commodity, its price does not rise due to abundance. Gold, a useless commodity, is good for investment only because of its Scarcity. So chase Scarcity.

Mr.Sheth bought Panama well before 2010 because of its honest & hardworking management.

G.Patel – ex employee of Sheth