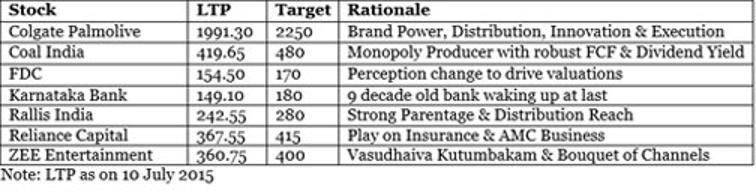

According to ET, LKP has issued a research report stating that as India is well on its way to becoming a $3-trillion dollar economy in the next few years, investors should use this period of turmoil in the euro zone to pick quality stocks in India at attractive levels. In its latest report, LKP has presented a judicious mix of large and mid-cap investment ideas across 7 different sectors:

Colgate Palmolive India Ltd:

Colgate continues to ride on its brand equity and distribution reach in a category which is relatively inelastic and continues to be our preferred play in the FMCG space.

Despite unprecedented competitive intensity its continued focus on driving cost efficiencies and premiumisation would fuel growth. Product Innovation and lower input costs shall ensure high ROE of 90% and Colgate shall sustain its premium valuations.

One of the few gems in a niche sector such as FMCG, this stock has seen a strong uptrend, and is still riding on it. The long-term charts are maintained in their bullish uptrend. The short-term charts indicate that the stock may be very close to a swing ‘smoothened’ Stochastic breakout.

Coal India Ltd:

Coal India (CIL) is a virtual monopoly and produces close to 80% of India’s coal and is 80% owned by the GOI. Institutional investors hold close to 18% equity in CIL.

With annual revenues of Rs.720 bn and net profit of Rs.140 bn, CIL has been increasing coal production annually at 3% over the past five years. We expect CIL to increase coal production at a healthy 8% this fiscal and its robust free cash flows with ROE of 35% gives us confidence.

Large cash reserves of CIL make it a good dividend yield play as well and the stock is our preferred bet to play natural resources.

FDC Ltd:

It is a Rs 900-cr branded mid-cap pharmaceutical company with a MCAP of Rs 2700 cr, earning Rs150 cr of profits annually. Promoters own 69% (no pledge) and institutional investors own 14% of the equity.

It has got market leadership in key therapeutic segments like Oral Rehydration Salts, Opthalmic and Anti-Infective range of products. Debt free entity with robust free cash generation trading at 13x expected earnings for the current fiscal makes FDC a good investment opportunity.

We see a change in market perception with second generation promoters energizing its operations on the ground.

Karnataka Bank:

The 9-decade-old KTK Bank is aiming to do a business of Rs 900 bn this fiscal with a target of closing the year with 725 branches. 25% CASA and targeted NIM of 2.5% with a conscious strategy of bringing down its NPA augurs well.

While the RIDF had pulled back its performance a few years back, its strategy on housing loans and MSME is working well. Rs.450 cr annual profits and EPS of Rs.24 make KTK Bank trading at book with a dividend yield of 3.5%, which is attractive in the banking space.

Rallis India Ltd:

The Rs 1800-cr Rallis is a leading crop protection company of the Tata Group, earning more than Rs150 cr of profits annually. Armed with 4 manufacturing facilities, Rallis has now completed its capital expenditure cycle and is poised to generate free cash flows of close to Rs 200 cr annually.

Stable gross margins of over 15% and robust ROE of over 20% make Rallis trading at 23x forward earnings and a compelling bet to play the agri theme in India.

Rallis has one of the best working capital cycles in the agrochem space coupled with a massive distribution network in India. Its state- of-the-art manufacturing facility in DAHEJ presents vast opportunities for contract manufacturing.

Reliance Capital Ltd:

Reliance Capital (RCAP) is one of the largest financial services companies in India in terms of AUM with a well-diversified product portfolio with a strong position in non-lending businesses like Mutual Funds & Wealth Management, Consumer Finance, Life Insurance and General Insurance.

RCAP runs a best in class AMC business and is among the top-2 players in India on the mutual fund side. We expect RCAP to unlock value from its subsidiaries to shore up capital adequacy.

RCAP trading at 0.7x book at single digit price earnings multiples is a play on insurance and AMC business.

ZEE Entertainment Ltd:

The largest Hindi language television channel with 35 channels globally is poised to grow further on its expanding footprints, with popularity gaining in the Middle East, APAC and Africa.

Its Hindi GEC, Zee TV is ranked third with market share close to 18%, while the success of new launches of Zindagi and &TV along with strong regional presence will further help the cause.

Advertising revenues are expected to grow on the back of higher spends from FMCG, auto and e-commerce companies, removal of 12 minute ad cap and rate hikes. Phase 3 and Phase 4 implementation happening without delay will be the key to subscription revenue growth.

Strong balance sheet, high margins (25%), robust return ratios, expanding cash-flows and transparent corporate governance makes Zee our preferred pick in the media sector.