The ET has reproduced Sharekhan’s Top Picks basket for October 2014. There is also fine commentary by Sharekhan on the state of the economy.

Sharekhan has churned the portfolio by replacing Apollo Tyres (up 13%) and Persistent Systems (up 28% in the last three months) with Gabriel India and Tata Consultancy Services, respectively.

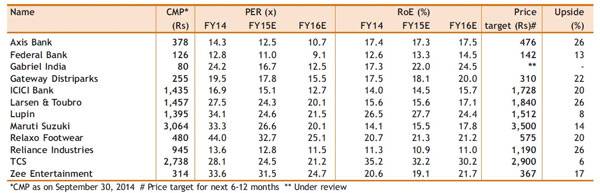

The 12 stocks that have made it to Sharekhan’s Top Picks basket are Axis Bank Ltd, Federal Bank, Gabriel India Ltd, Gateway Distriparks, ICICI Bank Ltd, Larsen & Toubro Ltd, Lupin Ltd, Maruti Suzuki Ltd, Relaxo Footwear Ltd, Reliance Industries Ltd, TCS and ZEE Entertainment Ltd.

A detailed explanation on the merits of each stock is also given.

Few months back they included Gabriel at 36 and next month exited around 45 and now again including at 80. They did Same with Apollo Tyre and TVS motor . What kind of expert they are? invesor would have been in more than 100% profit if holds Gabriel.They want to people to trade same stock many times so that they make money by brokerage not investor. don’t churn your portfolio as they say.

sharekhan are not value investors.They are traders..these stocks are not value buys IN MY OPINION

they r brokers and only if u sell and buy again and and repeat the process will they gain. so watch them on buy reports and use self brain in sell. brokers r interested in making money for themselves rather than advising u making money.

I am using Sharekhan, daily basis they have been providing techncially strong stocks recomendation and investing stocks recomendation, from my experience and track record of Sharekhan expertise is good for nothing… .Even bloggers predict the better stocks by providing detailed information. anybody can check last two months sharekhan technical stocks performances…. almost negative….

There is a lot of difference between Fundamental and Technical Recommendations.

In technical analysis the parameters and time used to predict stock movement is quite different to that of the fundamental analysis.

I never understand technical recommendation analysis myself so I always go for good fundamental stocks.

🙂

I too lean towards fundamentals instead of overbought and oversold and double top and double bottom mumbo-jumbo of stocks that have bad fundamentals.

Bottom line is – “Kachrey mein haath nahi dalna chahiye” 🙂