Kaha gaye woh log jo roj humme naye naye chakri aur kachra stocks dete the?

Today was a dreadful day for Dalal Street. The market crashed in such a savage manner that investors were walking around with a dazed look on their faces.

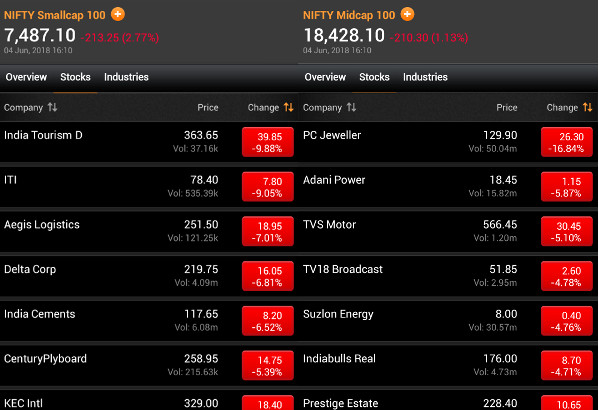

The Nifty Small-cap 100 Index plunged 2.77%. Several stocks in the Index hit the lower circuit.

The Nifty Mid-cap 100 Index fared slightly better by plunging only 1.13%. However, here also several stocks plunged to hit their lower circuits.

Basant Maheshwari had no sympathy for the investors who suffered the dreadful losses.

Instead, he blamed them for investing in alleged ‘chakri’ and ‘kachra’ stocks.

“Kaha gaye woh log jo roj humme naye naye chakri aur kachra stocks dete the?” he asked in stern tone, implying that we have been misled into buying all sorts of junkyard stocks for our portfolios.

Investing isn’t gymnastics where you can score a 10/10 but a faulty technique can break a lot of bones and put you out of action – completely. Kaha gaye woh log jo roj humme naye naye chakri aur kachra stocks dete the? ?

— Basant Maheshwari (@BMTheEquityDesk) June 3, 2018

Basant had issued the warning of “clear and present danger” against these stocks earlier also.

However, everyone ignored him.

Kachra, crap and chakri stocks are are like terminally ill cancer patients having multiple organ failure. Just because you are emotionally connected to your purchase price does not mean that you will get it back. And stocks are NOT family members. Yaha dawa kaam ayegi na Dua !

— Basant Maheshwari (@BMTheEquityDesk) March 6, 2018

Someone throws a name; the stock starts to dance; the public joins the party; once everyone’s bought, the music stops; there are no new buyers; the stock, devoid of fundamentals starts to fall; the protagonist disappears temporarily – then appears to throw another Chakri. REPEAT https://t.co/09l07iQfxE

— Basant Maheshwari (@BMTheEquityDesk) March 11, 2018

High Valuations + low earnings + dubious corporate governance = recipe for disaster

Shyam Sekhar conducted a systematic analysis of the reasons for the savage crash in small and mid-cap stocks.

He pointed out that investors have valued small and micro cap stocks at a higher P/E than that given to established stable businesses.

Such valuations are not sustainable unless if the company shows performance and very clear reliable corporate governance.

He warned that small and mid-cap stocks are seeing headwinds in terms of higher commodity prices, higher oil prices and also witnessing margin pressures due to higher cost of capital.

Further, the corporate governance standards of such companies have been overestimated.

This is shown by the fact that the auditors in three fancied small-cap companies abruptly resigned.

3rd listed co in a row where Auditors have resigned-Vakrangee, Manpasand & now Atlanta Ltd.

Underlines very little tolerance for even the slightest whiff of doubt. Take no risk-no chances approach! @BTVI @Geetu_Moza @stockgurupiyush @ShailDamania @SEBI_India @theicai @PwC_IN pic.twitter.com/00pnIBlf6W— Siddharth Zarabi (@szarabi) May 30, 2018

How would it be if we created a list of #MBD s(Multibagger Dud)? Just put out a name of a stock that was publicly touted and then simply went sunk. Name just one #MBD please.

— Shyam Sekhar (@shyamsek) May 28, 2018

Some large investors are still defiant about kachra stocks

Shyam Sekhar warned that some large investors are still defiant about the weaknesses in small and mid-cap companies.

“You have another set of large investors who still believe that based on their personal reputation, they would be able to sustain the valuation of these companies and find new followers to buy into them,” he said.

“The greater risk is in following other investors whatever be their reputation into companies,” he added in a grim tone.

He advised investors to make their own assessment of what the earnings headwinds are, what the governance related issues are and what should be a realistic valuation.

“That is the biggest need of the hour and we need to go through this phase. I do not see any escape from this space,” he said emphatically.

#MarketView | May have overestimated the corporate governance standards in midcaps; Must make own assessment on co's earnings, quality & not follow others, says Shyam Sekhar (@shyamsek) of iThought @nikunjdalmia @AyeshaFaridi1 pic.twitter.com/aJzXQ7DS8a

— ET NOW (@ETNOWlive) June 4, 2018

Two must-buy stocks

However, behind every crisis there is an opportunity.

Stock market crashes lead to even high-quality and fail-proof stocks being quoted at bargain-basement prices.

Shyam Sekhar recommended two companies which he said he has liked for a long time.

These are ITC and Bata India.

“These are two stocks which on any correction one should buy,” he said.

“One should buy these stocks at every fall and hold them for a very long period of time,” he repeated.

#MarketView | Must buy ITC, Bata on any correction; strong organised players in growing mkt, says Shyam Sekhar (@shyamsek) of iThought in conversation with @nikunjdalmia @AyeshaFaridi1 pic.twitter.com/IUr4uEJwKx

— ET NOW (@ETNOWlive) June 4, 2018

The investment rationale for recommending the two stocks was that they are strong organised players in a growing market.

“The market is growing slowly but surely. These two stocks have played out very well over the last 25 years and I do not see why they should not play out for long extended periods of time,” he emphasized.

Conclusion

It is obvious that we have paid a steep price owing to our obsession for multibagger gains. We have loaded onto several junkyard stocks in the misconception that they will make us rich overnight.

These junkyard stocks have turned out to be “multi-beggars” and have dragged us further into poverty.

Thankfully, we can still make amends by choosing the path of buying only “high-quality” stocks as advocated by Basant Maheshwari and Shyam Sekhar!

Bhangaar Cap (D Grade) stock champions has done excesses in stock market, first they will pick any Bhangaar Cap stock and than their social media followers (another sort of Andh Bhakt) will jump like their is no tomorrow . I had warned against Bhangaar Cap stocks, when last union budget (worst in Indian history in terms of taxes) was presented. With Blood Bath in Bhangaar Cap, Equilibrium will be restored in favour of Quality.Always remain invested in Fundamentally Strong Quality Stocks, where there is always a Tomorrow in majority of cases.

Was he not recommending the public sector banks few days back.Is he not heavily invested in small caps. Why is he saying this after the fall why not when he recommended public sector banks.What happened to his recommendation of his ugly duckling sintex and Sugar stocks.

Nobody keeps track of the past, is what they think. Even his recommended stocks Bata and ITC are over valued and most analysts are asking to “HOLD”.

These people are now recommending large cap when small and midcap will soon be available at attractive valuation .When small and mudcap were in fancy he and his pms friends were recommending mudcap stocks.Just wait for good midcap and small caps to fall another 30 percent and then buy them.

Your were equally Tom tomming the so called kachra and chakr stocks by so called experts….I do not blame for anybody’s mistake in judgement…but if they are misleading the retail.investors….i have very very strong opinions about it…and unfortunately you are on of them

Let us not forget that the same Shyam Sekhar recommended Sintex industries soon after the demerger. It sank like a stone-trsdes at rs 15 down from 38 or so!

Great recommendations by Shyam always helping retail investor .Great gentlemen .

Be Careful of some these guys who pretends they are helping retail investors. They slowly increases their holding over 1% and then dumps it on the retail investor. Remember there are no free lunches in this market. Wait for a bear market to invest in high quality stocks. The high quality stocks are still trading at premium valuations.

correct

Recommendation of ITC is of course no brainer for long term investment. It was no brainer 15 years ago and still holds that status. Bata is also on the cusp of serious re-branding retail therapy in the footwear segment and therefore has been on the list of must have recommendations for the last more than 3/4 years.

But still good to catch up with these established performers in these bad times.

ITC looks Good as it has not participated in this Bull run, more over it is in Brand Building mode in FMCG. This exercise may complete in next two three years and may give returns for Decades . No recommendation, just personal view. Bata I don’t track as it is in leather business.

Dilemma before small investors is all stocks which are being condemned as kachra stocks by some, were recommended as value stocks, by other experts ,with investment rationales.The Big question is whome to trust.

Whom to trust?, Very Simple, One has to trust himself, as only he will face consequences, GOOD or Bad, nobody else.

Now that Modi Government has put the fear in the mind of auditors, there will be many more manpasand bones that will come out. It is better to wait and watch.

Actually the problem is that we all have extremely short term memory. And that is an extremely critical advantage point for everyone, be it politicians or equity analysts. They take advantage of extreme public short term memory.

I fact greed plays the critical in this context.We all knows the poor quality stocks should be ignored yet when we see them shooting up ,we get tempted by the greed,forgetting the past experiences.

Do not buy in this market. Huge correction ahead due to upcoming state and general elections. Only traders will make money this year. Others stay in liquid funds or cash.

Highly overvalued is Bata. Great compan, but the intrinsic value and potential value are far below current valuation. Therefor unfortunately you cannot heed Shyam shekars advice. It seems motivated and biased.

Happy Birthday to “southern superstar” investor Porinju …this has been a quiet year for him but I hope it ends with a bang

Shyam seems to be having a bad year with his calls to retail investor first Sintex, Sugar sector. Then the PSU bank blunder.However his personal holdings have some real good stories in the making which he has not recommended to the public from my understanding. He is a slow accumulator of a stock and his theme usually plays out over 3-5 years. However he also take some bets on turnaround which are very risky which i think he should avoid suggesting it to the retail investor to avoid backlash if it does not work. So one needs to have the appetite to hang in there. Its not for investors who cannot stomach volatility.

A stock is great or not is decided by few punters now a days and they all work in circle. One of them recommends a stock, the other punters start echoing it and then the scarcity is created and the stock price goes up. They have shown the audacity of recommending Ricoh, Kitex and Manpasand be and then quarterly offload it. They also habitually market individual stocks (which they acquire in truck loads) pretending how they will be benefitted by Govt. policies. Practically speaking, the policies should benefit entire sector and not a single company. Hence the best method to select stocks is to study fundamentals and then decide.