Investors are so obsessed about risks that they lose sight of the opportunities

In March 2017, Sumeet Nagar cited Avanti Feeds as an example of how investors lose sight of the massive opportunities that a stock offers while worrying about the risk factors.

“Avanti Feeds is a company that a lot of people have had concerns about. There is fear about what can happen because of disease and the volumes can just plummet, the market can go down, the market share can go down — without really digging deeper and understanding it.

If you do a lot of work and try to understand that what happened in Thailand was a set of issues specific to that country and those kind of risks are very difficult to replicate in India.

Here, you have a company which is very strong. There are two players with combined 80% plus market share and that means they do something specialised.

To be able to establish that, we have to go to a number of shrimp farms across the country, meet a lot of people, understand their advice, talk to people from Thailand and what happened there.

You have to do a lot of research to find out why this investment is actually safer vis-à-vis people’s fears.

If you honestly cannot answer the fact that we know something about this company or investment better than other people out there, then basically you are just camping because whenever you are buying somebody else is selling and that is a very good construct to have in mind to make sure that you really understand the business well and you understand it from a long term perspective as opposed to what is happening in the next one or two quarters.”

Tremendous value with potential to generate significant returns

In October 2017, Sumeet Nagar described Avanti Feeds as one of the rare things where there is a great company with a very focussed management team and investors still feel shy of investing in it.

“People were very concerned about the risk in this business and they never looked at the opportunity,” he repeated with a chuckle.

“Those are the places where you have the potential to generate significant returns. For many years they have been growing at 50% year-on-year with ROEs north of 50% and yet people continue to ignore them.

It was trading at 10 times PE even a year ago. There was a tremendous value in there,” he added.

Rapid entry and rapid exit after pocketing 1000% gain

Malabar Investment Fund aggressively bought Avanti Feeds.

The Fund made its debut into Avanti Feeds on 25th July 2014 with a token investment of 1852 shares.

This was rapidly scaled up to 257,000 shares as of 31st March 2015, 14,16,260 shares as of 31st March 2016 and 14,85,759 shares as of 31st March 2017.

At the peak, the investment was worth a mammoth sum of Rs. 234 crore.

In the period from July 2014 to date, the stock is up an eye-popping 1015% (11-bagger).

The scale down began soon thereafter and was also rapid.

By June 2017, the investment was reduced to 11,76,893 shares.

By September 2017, the investment was reduced to 5,43,668 shares.

By December 2017, Malabar Investment Fund was nowhere to be found in the list of shareholders of Avanti Feeds.

We can get a sense of Sumeet Nagar’s investment acumen from the fact that while he was lauding Avanti Feeds for its business acumen, he also had an eye on the valuations.

He began dumping the stock because he rightly sensed that the valuations were getting too hot for comfort.

The interesting aspect is that in October 2017, Sumeet Nagar had disclosed that his fund had “trimmed exposure” to Avanti Feeds on the basis that no position should become very large in the portfolio.

However, as it transpired, it was not a case of “trimming exposure” but one of a complete exit.

Woe begets seafood exports

Today, the wheel has come to a circle.

Avanti Feeds is no longer a hot stock.

This is because seafood experts from India are plunging.

According to the BS, the export prices of shrimps, the key contributor to the country’s seafood basket, have plunged by more than 20 per cent in the last couple of months because of increased supply from competing nations such as Vietnam, Thailand, and Ecuador.

There is also a sharp drop of $2 per kg (30 per cent) in prices of key varieties, compared to last year.

The falling rupee has also contributed to the woes.

It is also stated that shrimp farmers, especially in Andhra Pradesh, are forced to harvest one crop against the usual practice of three crops annually.

They are suffering huge losses.

Suppliers of fish feed are bearing the brunt of the production squeeze. Hatchery owners are also likely to feel the heat.

CRISIL has also painted a grim picture of the economic scenario.

It warned that growth in seafood exports is likely to drop to 17-18 per cent in 2018-19 compared to 21 and 31 per cent in the previous two fiscals.

Cogent reasoning has been given in support of the prophecy.

The problems plaguing the industry with specific reference to Avanti, Waterbase and Apex Frozen Foods are explained in a systematic manner in ZEE Business.

There is also “anti dumping duty” imposed by the USA on export of “frozen warm-water shrimps” from India.

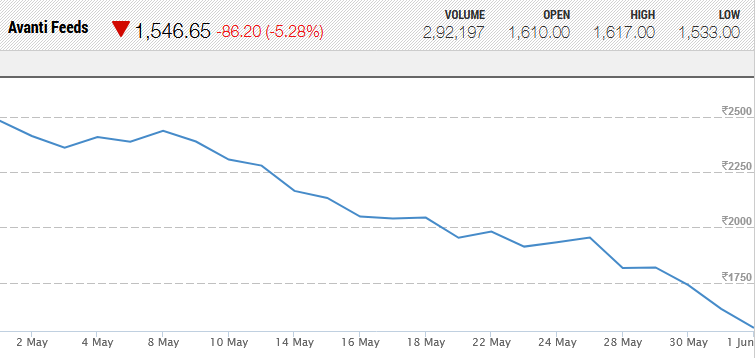

Naturally, Avanti Feeds’ stock price has tanked like a ton of bricks in the wake of the grim economic situation.

In just the last month, the stock has lost 38%.

The US hikes anti-dumping duty three-fold on Indian shrimps from 0.84 to 2.34%. Watch Ramakanth V Akula, CEO of Waterbase & Depesh Kashyap, Midcap analyst at Equirus discuss its impact with @Nigel__Dsouza @blitzkreigm pic.twitter.com/Cw7Uq6c4xC

— CNBC-TV18 News (@CNBCTV18News) March 13, 2018

Avanti Feeds soothes sentiments of investors reg steep fall in share price

In an unusual move, Avanti Foods issued a clarification as to the state of affairs so as to prevent investors from panicking and dumping the stock.

The clarification is as follows:

“INFORMATION TO INVESTORS ON RECENT STEEP FALL IN COMPANY’S SHARE PRICE

It has been noticed that the Company’s share price has been declining steeply in the recent past, particularly, during last few days. The investors are aware that the audited financial results for 04 FY18 and also for the FY18 have been published recently on 261h May’18, declaring exceptional performance for FY18 and a good performance in 04 FY18 compared to corresponding periods of the FY17, even after considering increase in feed raw material prices and other circumstances, not warranting a steep declining trend in the share price, which is taking place now.

However, on an analysis of reasons, it appears that the news, purported to be given by some agencies, stating that the shrimp prices are likely to fall further in this year and the production of shrimps in India is likely to drop drastically, has caused serious apprehensions of sustainable performance of the aquaculture industry in India, among investors.

As a result, the share prices are falling at a steep and fast pace.

In the light of this development, the Management would like to dispel the apprehensions of the investors about sustainable performance of the Company as well as the industry by bringing the following facts to the notice of the investors:

1. The steep fall in export prices of shrimps witnessed during the past 3 to 4 months was due to certain global developments such as temporary decline in consumption of shrimps in US due to extended winter coupled with stable shrimp production in countries like Indonesia, Vietnam.

The shrimp imports by China from Vietnam were also curtailed due to Chinese Regulatory reasons.

The decline in price is only a temporary reaction and the consumption of shrimps in US has come back to normalcy and the demand started picking up and would be restored to normal level soon and even expected to go up, which is expected to trigger increase in prices. The Chinese imports are also expected to go up in the months to come.

Therefore, there is no need to be panic about export demand for shrimps from India and its price, in future.

2. The second apprehension appears to be sustainability of aquaculture activity for the farmer to continue shrimp culture.

It is true that the farm gate price of shrimps has fallen steeply in the past few months, reducing the margin (ROI) of the farmer drastically.

This, initially, gave a knee-jerk reaction among the farmers to consider to slow down shrimp culture activity.

However, now the farmers are in the process of realising that the fall was a temporary phenomenon, as the farm gate price of the shrimps is gradually increasing now, which will make the shrimp culture much more profitable than other agricultural crops.

Moreover, the farmer would have invested in developing the infrastructure for shrimp culture and would prefer to continue this activity.

Hence, there is no need for any apprehension about continuation of shrimp culture and maintaining the production levels in this year also.

3. Realising the importance of sustenance of shrimp culture as a potential foreign exchange earner and also providing employment to rural youth, the Governments have focussed their attention to this sector and considering to render support to the farmers and the industry.

4. Coming to the performance of the Company, the Management would like to assure the investor, with confidence that the capacity utilisation in feed should be able to achieve a growth rate of not less than 10% in FY19 over FY18 and in processing and export of shrimps 60 to 65% capacity utilisation should be possible to achieve.

As the Company has always been maintaining that the sustainable margins (PBT} in feed at 10 to 15% and in shrimp processing and export 8 to 10%, which the Management is confident of achieving at minimum levels.

The Management trusts that the above information would put to rest the apprehension of the investors about sustainability of the industry and also growth and profitability of the Company.”

Whether the clarification by the management has the desired effect of preventing investors from dumping the stock requires to be seen.

Conclusion

Obviously, being able to determine the business prospects of Avanti Feeds is beyond the scope of our intellectual abilities.

The limited takeaway that we can glean from Sumeet Nagar’s brilliant strategy is that it is always prudent to cash in on multibagger gains from time to time. Being too greedy can cause the gains to evaporate into thin air!

Export oriented business should not be investment candidate for very long term as its prospects are subject to govts regulations,which may change from time to time in view of various political considerations.Avanti feeds is one example,technology stocks are other

I would say nice analysis by Sumeet Nagar. Though I have not bought Avanti Feeds, if I would have, I would have sold it in early 2015 out of fear. Those magnificent gains are well deserved.

By the way I would still say that those who sold early weren’t wrong either. Fear of competition from other nations was a valid threat. Same threat lead to decline of prices in Avanti Feeds and Waterbase like businesses now.