Kotak Securities is India's largest broker and has an excellent team of research analysts....

analysts

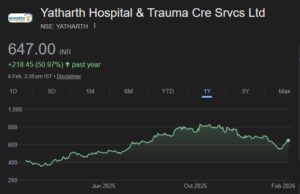

Multibagger stocks are for the brave investor willing to take high risk for high...

Sanjoy Bhattacharyya says that sensible investors should act like contrarians and buy stocks sold...

Bank of America Merrill Lynch have released their Model Portfolio & Top Stock Buys

Shankar Sharma shows his contempt for rating agencies and advises that we should buy...

ET takes a cue from Warren Buffett and puts the spotlight on top-quality MNC...

When Shankar Sharma, who usually has a pessimistic view of the markets, identifies stocks...

Sanjoy Bhattacharya's latest pick for your stock portfolio consists of stocks that are fundamentally...

Rakesh Jhunjhunwala's stock investment portfolio holdings have gained an astonishing Rs. 1,000 crores since...

Ramdeo Agarwal must be laughing his way to the bank as his top stock...