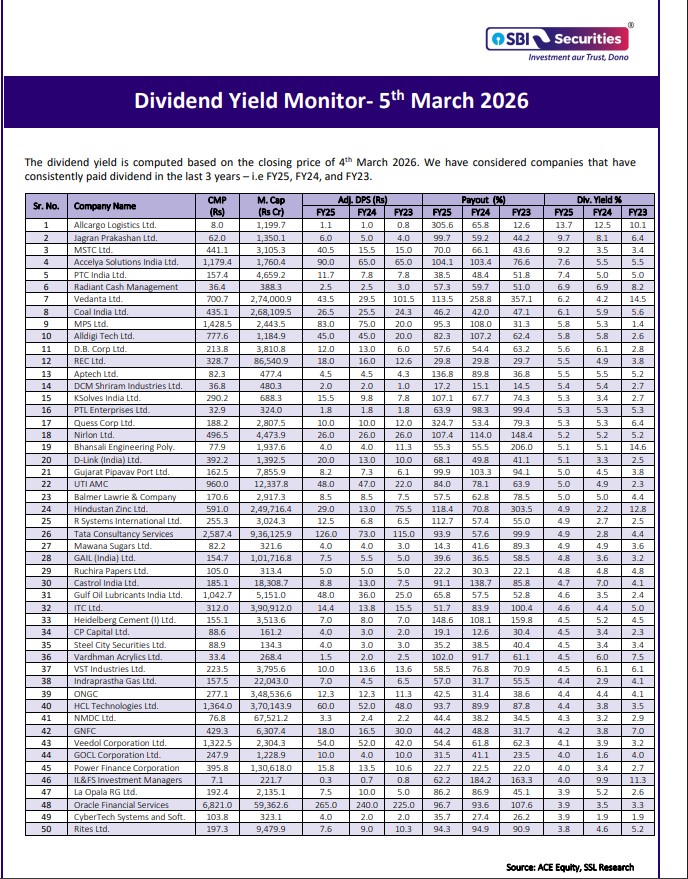

The dividend yield is computed based on the closing price of 4th March 2026

high dividend yield

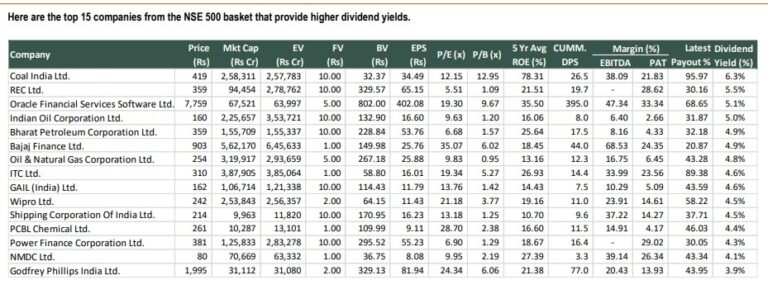

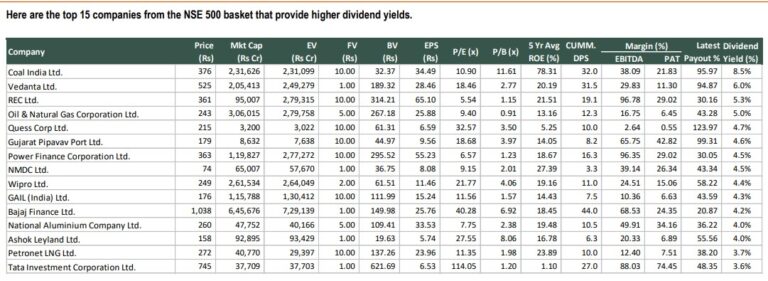

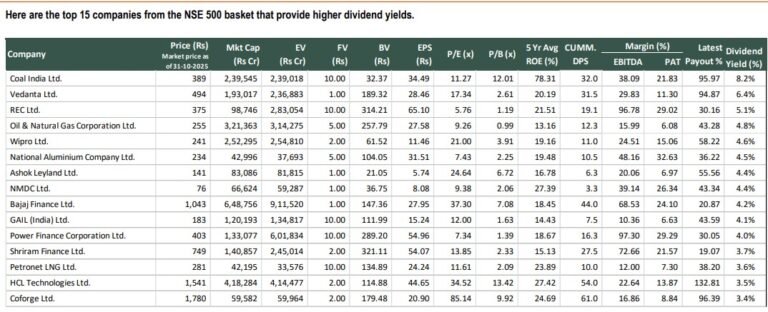

top 15 companies from the NSE 500 basket that provide higher dividend yields

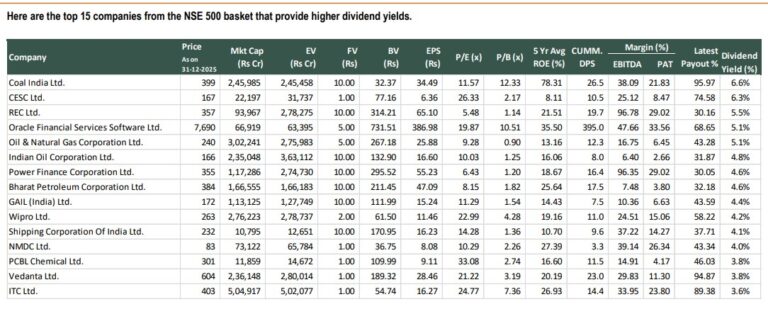

top 15 companies from the NSE 500 basket that provide higher dividend yields

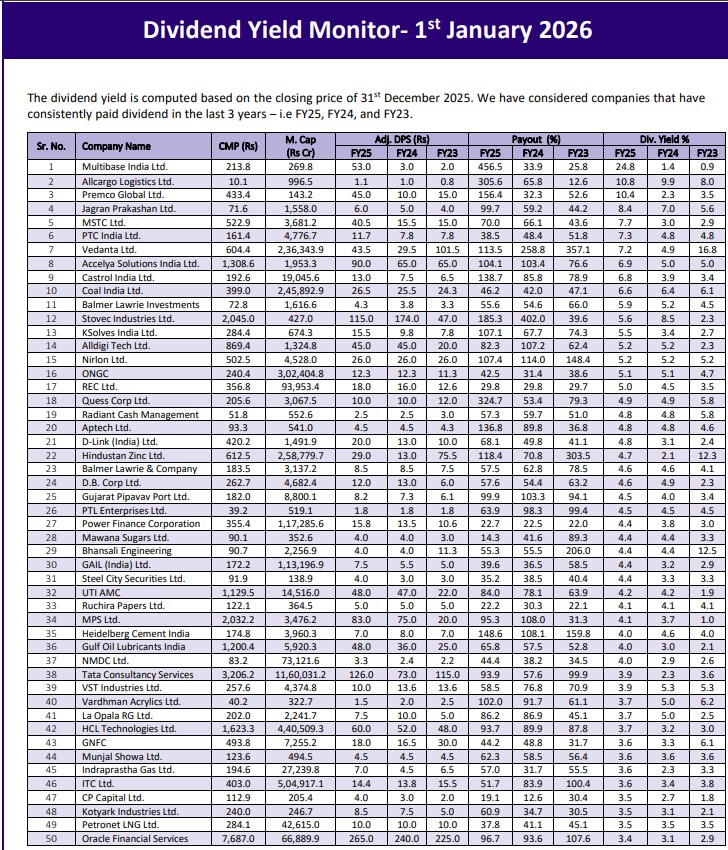

Multibase India Ltd has paid Rs 53 per share as interim dividend in Nov’24

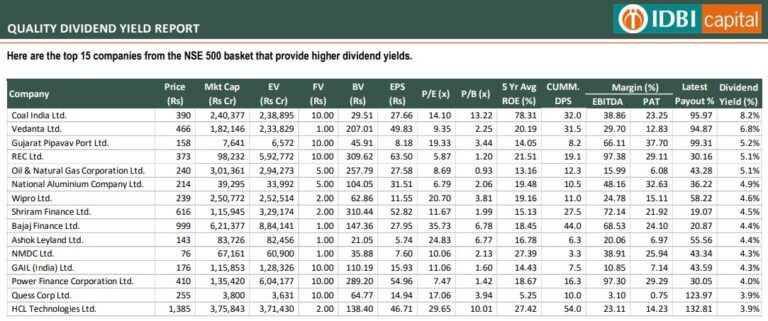

List of top 15 companies from the NSE 500 basket that provide higher dividend yields by IDBI Capital

Here are the top 15 companies from the NSE 500 basket that provide higher...

top 15 companies with high dividend yield

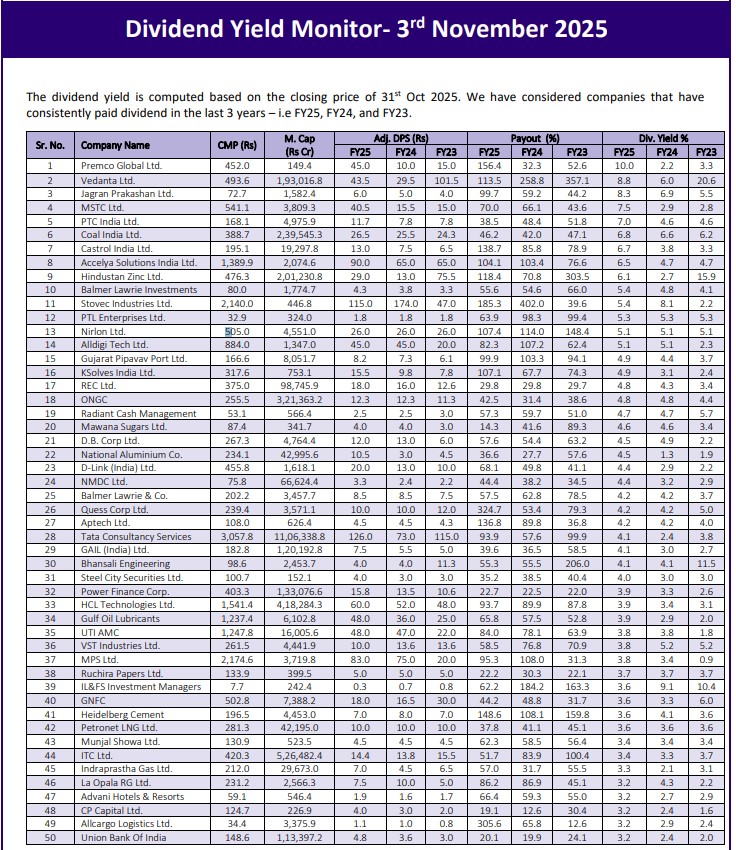

Dividend Yield Monitor- 3rd November 2025

top 15 companies from the NSE 500 basket that provide higher dividend yields

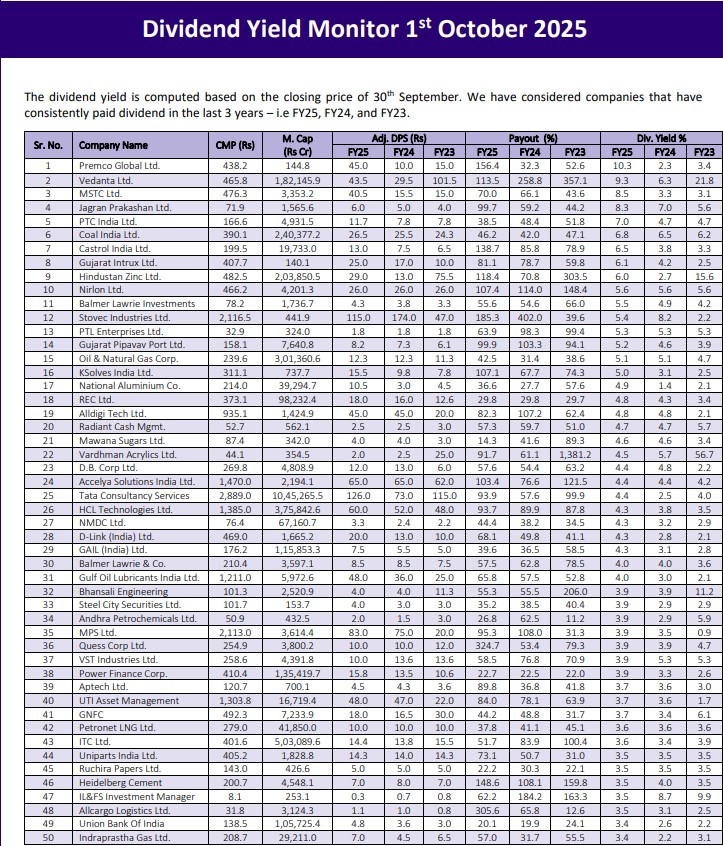

The dividend yield is computed based on the closing price of 30th September. We...

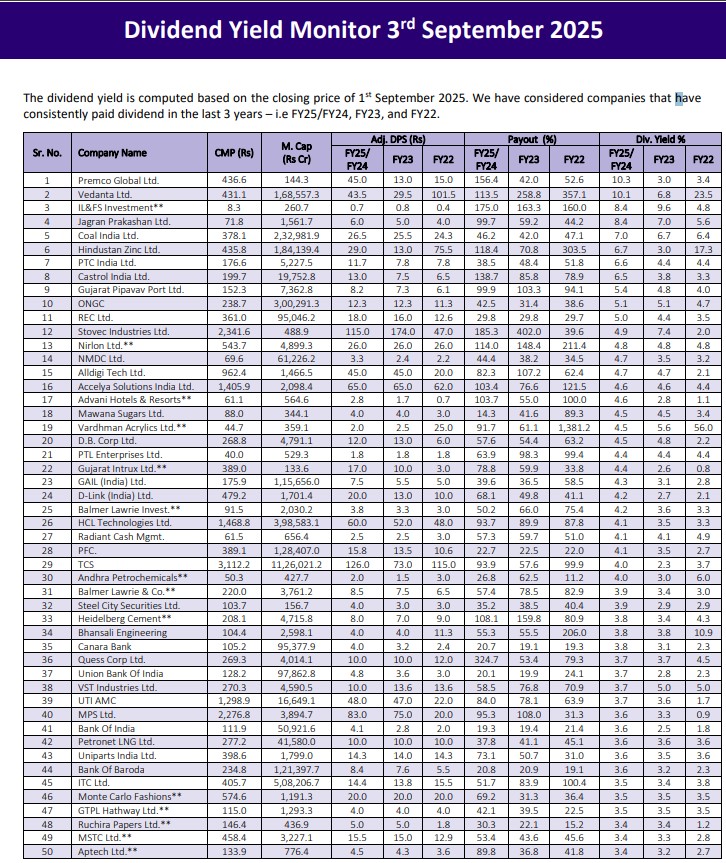

The dividend yield is computed based on the closing price of 1st September 2025....