ET has reported that HSBC has issued a report stating that the Sensex is likely to touch 30,100 by the end of December 2015.

HSBC has stated that it is overweight on India within Asia based primarily on a recovery in the capex cycle in India, as well as a pick-up in macro-economic indicators, and higher government spending in areas such as roads and railroads.

HSBC is reported to have stated that the private sector capex in industries such as telecoms and mining should start to boost spending in the economy. Reforms on land and labour, and the move towards a goods and services tax regime should be the key catalysts over the medium term.

(Image Credit: ET)

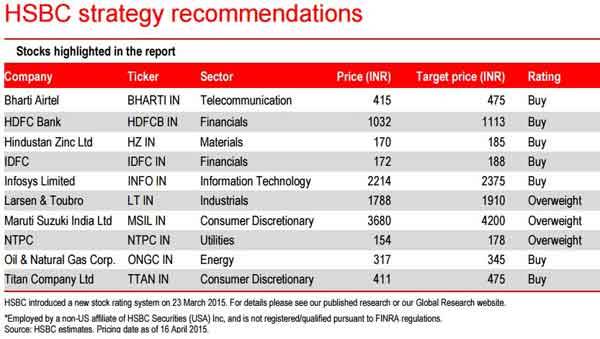

HSBC has recommended that domestic cyclicals such as banks, autos, capital goods, and utilities remain the best way to play the market. It prefers stocks like Bharti Airtel, HDFC Bank (an Asia Super Ten portfolio stock), Hindustan Zinc, IDFC, Infosys, Larsen & Toubro, Maruti Suzuki India, NTPC, Oil & Natural Gas Corp, and Titan.