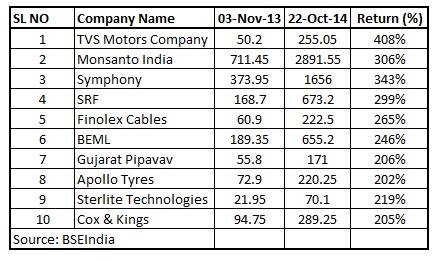

“There are some midcaps which have run up rapidly, but if you leave them aside, there are a few more which look very well positioned in the midcap space” Lalit Nambiar of UTI Mutual Fund was quoted as saying.

It is all about picking the right stocks with professional management, which has shown consistent growth rate, stable margins and comfortable debt levels over the years.

Monsanto India:

Microsec Capital rates Monsanto India Ltd. a BUY based on factors like company’s research based biotechnology, strong parent and healthy business model with selective products. MIL mainly divided into two divisions one agro chemicals & another is hybrid seeds.

It ranks number 10 on Forbes’s list of the world most innovative company. The stock is currently trading at PE of 22 on FY16E expected EPS of Rs 125.10.

Symphony Ltd:

Even though Motilal Oswal Securities has a ‘neutral’ rating on the stock but the brokerage firm is of the view that the company will continue to dominate the cooler market with new product launches and strong growth prospects in the international market.

They expect the company to record 27 per cent revenue CAGR and 29% PAT CAGR over FY15E-17E. The stock trades at 37.2x and 27.6x FY16E earnings.

SRF Ltd:

As per Vivek Gupta of CapitalVia Global Research, technically the stock is in a strong uptrend. The stock has immediate support level placed at Rs 630 and then a major support is placed at 534. However, the stock may face resistance is at levels around 776.

Finolex Cables Ltd:

Finolex Cables Ltd is one of India’s largest manufacturers of electrical and telecommunication cables with 9 per cent market share across India. FCL holds a strong brand image and value and it has manufacturing facilities at Pimpri and Urse in Pune as well as at Goa & Uttarakhand and operates under three main divisions namely: ECS, CCS, CCR and Others.

Microsec Capital prefers FCL over the longer term due to (a) a scalable and de-risked business model, (b) a strong balance sheet, (c) cash flow CAGR of 41% over FY14-17E, (d) sizeable hidden value in its 32% stake in Finolex industries.

Sterlite Technologies Ltd:

Sterlite Technologies is a leading player in Telecom (Optic Fibre and Cables) and Power Conductors with domestic market share of 35% and 25% respectively. It also has a portfolio of 6 Power Transmission projects on build, own, operate and maintain (BOOM) basis.

BEML:

BEML Limited was established in May 1964 as a Public Sector Undertaking for manufacture of rail coaches and spare parts and mining equipment at its Bangalore Complex. The Company has partially disinvested and presently Government of India owns 54 percent of total equity and rest 46 percent is held by Public, Financial Institutions, Foreign Institutional Investors, Banks and Employees.

Gujarat Pipavav Ltd:

GPPL has successfully scaled up its business despite its small size. 1HCY14 revenue / EBITDA / PAT grew 22% / 48% / 80% YoY and, as a result, concerns have faded about competition from larger ports and customer churn, Citigroup said in a report.

Going forward, the investment bank expects GPPL’s total cargo/container cargo to grow at 12%/14% CAGRs over 2013-16. Revenue / EBITDA / PAT should grow at 18%/28%/40% CAGRs over the same period.

Apollo Tyres Ltd:

Angel Broking has an Accumulate rating on Apollo Tyres. Tyre industry witnessed sluggish growth in FY2014 reporting growth of about 3%. Subdued volumes in the automotive OEM segment (which constitute about 30% of the overall demand) and lower replacement sales due to sluggish economic growth impacted the demand.

Rubber prices (which constitute about 45% of the raw material costs for the tyre companies) have been on the downward spiral in the last six months due to sluggish global demand (weak demand from China) and surge in the production (led by Thailand and Vietnam).

The brokerage firm expects gross margin improvement of about 120 bps for the tyre companies given the lower rubber prices.

Cox & Kings Ltd:

Edelweiss which has a buy rating on the stock says that the management is confident of clocking over 20 per cent CAGR from FY16 onwards riding increased business enquiries in retail outbound and corporate.

International leisure: C&K estimates 10-12% revenue CAGR due to recovery in Europe. Management also expects long-term growth of 15%. They see EBTIDA CAGR of 20% over the next 3 years due to increase in capacity, which is expected to double in five years.