Excitement in Dalal Street after Reliance surges to 9 lakh crore and becomes “most valuable company“

Sonia Shenoy’s voice boomed across the nooks and crannies of Dalal Street today.

“RELIANCE HITS FRESH HIGH, MARKET CAP OF Rs 9 LAKH CRORE RELIANCE NOW THE MOST VALUED INDIAN CO IN TERMS OF MARKET CAP,” she yelled at the top of her voice, while flailing her arms vigorously, delirious with joy.

Mukeshbhai, who was dozing, woke up startled.

“Kya hua? Koi Naya Multibagger stock mila kya,” he asked.

Sonia’s excitement was shared by her massive army of followers and fans.

Everyone rushed to congratulate her on the splendid achievement.

According to experts of technical analysis, the super-surge in Reliance Industries, one of the mega behemoths, is a clear sign that the Bears have been permanently evicted from Dalal Street and it is now the Bulls who will reign over the place.

This means that we can now safely resume our punting activity without fears of being waylaid by the Bears.

RELIANCE HITS FRESH HIGH, MARKET CAP OF `9 LAKH CRORE

RELIANCE NOW THE MOST VALUED INDIAN CO IN TERMS OF MARKET CAP

— Sonia Shenoy (@_soniashenoy) October 18, 2019

#BREAKING | Reliance Industries hits market cap of Rs 9 lakh crore! pic.twitter.com/mR6K8zYA95

— CNBC-TV18 News (@CNBCTV18News) October 18, 2019

Buy stocks which will last a 100 years: Guy Spier

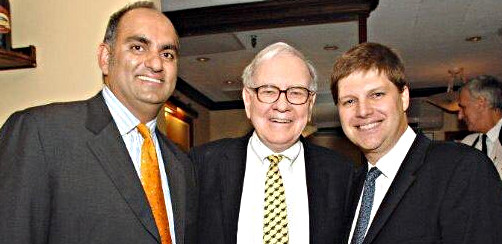

Guy Spier needs no introduction to us.

We have seen him several times before, in the distinguished company of Mohnish Pabrai.

In fact, Tanvir Gill had the privilege of interviewing the duo and treating them to a feast of Vada Pav and Kadak Adrak Chai.

The duo disclosed many secrets about the techniques they adopt to snare multibagger stocks (see I Lost Rs. 800 Cr Says Mohnish Pabrai & Explains Whether His ‘No Brainer’ Stock With ‘Moat’ Can Be Multibagger).

Guy Spier is also an accomplished author.

His treatise titled “The Education of a Value Investor: My Transformative Quest for Wealth, Wisdom, and Enlightenment” is held in great esteem by the intellectuals of Dalal Street and they frequently refer to it to solve complex problems on value investing.

Devina Khanna, the new incumbent at Bloomberg, knows how to research her celebrity guests and ask them pertinent questions in a clear and succinct manner.

Guy Spier was impressed with her hard work and he candidly complimented her.

@khanna_devina am looking forward to talking to soon. You sent me an excellent set of questions think about – I only hope that I can do justice to them when we speak.

— Guy Spier (@GSpier) October 16, 2019

Devina extracted valuable information from Guy about the sectors where he finds value in India for long-term investment.

These are the sector where Guy Spier (@GSpier) finds value in India for the long-term investment. @khanna_devina

Read more: https://t.co/ortOSqY0lR pic.twitter.com/Z9LGgC7pSj

— BloombergQuint (@BloombergQuint) October 17, 2019

Guy also provided cogent commentary on how the political and economic environment affects an investor’s decisions amid uncertainty.

How does the political and economic environment affects an investor's decisions amid uncertainty. @khanna_devina

Read more: https://t.co/ortOSqY0lR pic.twitter.com/NoMkUy5d3R

— BloombergQuint (@BloombergQuint) October 17, 2019

However, what is most important from our perspective is the fact that Devina managed to get Guy to reveal that his latest stock pick is Cera Sanitaryware.

Buying in a fearful market isn't easy… but it's not supposed to be. If it were then everyone would be doing it!! Super conversation with @GSpier https://t.co/WrptJAFzsr

— Devina Khanna (@khanna_devina) October 17, 2019

Cera Sanitaryware, fav stock of Dolly Khanna, Vijay Kedia & Nalanda

Dolly Khanna was one of the first discoverers of the multibagger potential of Cera Sanitaryware.

I reported, as far back as in 2013, that Dolly held 1,44,533 shares of Cera Sanitaryware.

Dolly came second to Vijay Kedia, who held 3,15,000 shares.

Nalanda India Equity Fund, led by the redoubtable Pulak Chandan Prasad, held 2,16,456 shares.

Unfortunately, the stock thereafter fell out of favour owing to alleged pricey valuations.

In April 2015, there was rumor that Dolly has bolted from the stock (see Dolly Khanna Does It Again. Escapes Carnage In Cera Sanitaryware).

However, this was hotly contested by some of Dolly’s die-hard fans.

Vijay Kedia stayed defiant despite the nose-bleed valuations of Cera.

As usual, his logic was flawless.

“I am holding Cera Sanitaryware for the last 10 or 12 years. It is quoting at a PE ratio of 55. So it is a mouth-watering valuation, you can say. I have sold some shares, but I am not a seller at this price,” he said.

Vijay Kedia explained that despite the hefty PE multiple of 55, the stock was worth keeping because other powerhouse stocks like Bosch, Eicher Motors, Page Industries etc were quoting at even higher valuations.

“So if companies are going to grow by 30%, suppose even 25%, then a PE ratio of 25 or 30 or even 25 is reasonable,” he added.

However, he also cautioned that we should not be dare-devils with high P/E stocks.

“I am not a buyer of Cera Sanitaryware at this price. Why do you want to follow those stocks which are quoting at a 50 PE ratio or 40 PE ratio? The market is full of stocks, good stocks, which are available at comparatively cheap valuations. You should buy those shares,” he said with his typical earthy wisdom.

The situation as of 30th September 2019 is that Dolly Khanna’s name does not appear as a shareholder Cera Sanitaryware.

However, this is not surprising because one of Dolly’s modus is to fly under the radar by keeping her holding below reporting limits.

Vijay Kedia held 1,40,000 shares as of that date.

The investment is worth Rs. 37 crore at the CMP of Rs. 2612.

Nalanda India Equity Fund holds 3,71,558, which is worth Rs. 97 crore at the CMP.

The holding of Guy Spier in Cera is not known.

Buy Cera: BoB Capital Markets

Cera Sanitaryware has been in the doldrums over the past few years owing to the slowdown in the realty sector.

However, this is the ideal time to tuck into the stock, according to BoB Capital Markets.

BoB has pointed out that Cera has a wide distribution network, strong brand, comprehensive product portfolio, sound balance sheet and prudent working capital management and that it must be given pride of place in every investor’s portfolio!

I want to invest in stoks

I am interested to invest in Rakesh favorable stock along with Cera sanitary

In my view Paints stocks are far better than Cera sanitary. Paints are not only used in nes houses, but houses need paints at regular intervals. More over paints are required in non housing sector like auto and machinery etc.