Vijay Kedia is obviously, like the rest of us, a devoted fan of Rajnikanth, the legendary superstar. Kedia is so inspired by Rajnikanth that he equated India to “Kabali”, the superstar’s latest blockbuster movie.

India is like 'kabali' in the world' s economy. https://t.co/xheIlRuuuk

— Vijay Kedia (@VijayKedia1) July 22, 2016

In response, one of Vijay Kedia’s ardent and quick-witted fans, equated Karnataka Bank, one of Kedia’s favourite stocks, to “Kabali”, implying that the Bank would prove to be as much of a blockbuster as its namesake.

@VijayKedia1 sir u will love this pic.twitter.com/oUL7U5OTae

— Mehul (@mehul23mrk) July 23, 2016

Vijay Kedia’s logic for investing in Karnataka Bank proves Warren Buffett’s advice that “investing is simple but not easy”. Sometimes the simplest ideas make for the best investments.

Kedia explained that the “simple reason” he bought Karnataka Bank is because “it is a mid-cap bank with a good management, a 100 years old, a good dividend yield”. He also pointed out that the Bank is quoting at a rock-bottom valuation of 0.5x book. He emphasized that “the company is doing well, growing 16-18 per cent year-on-year, has a Rs 80000 crore business now projecting to touch Rs 200,000 crore by 2020”.

Now, in a sensational turn of events, investors in Karnataka Bank have the opportunity to rake in a fabulous 66% gain in just three months thanks to an “arbitrage opportunity” arising from its rights issue.

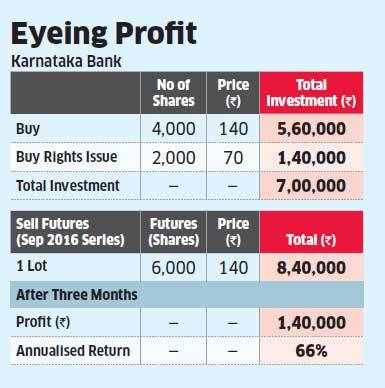

Jignesh Shah of Capital Advisors, a leading stock market expert, has formulated the theory that if investors buy 4,000 shares in the cash market at the current price, apply for the rights issue to get another 2,000 shares and go short on one lot of 6,000 shares in the September future series, they stand to make a whopping gain of 66%.

(Image Credit: ET)

Jignesh Shah also explained that the cost of buying shares from the cash market and applying for the rights issue would be Rs 7 lakhs. The investor would have to pay a margin for going short on Karnataka Bank stock futures, which would cost him another Rs 1-1.5 lakhs.

So, while the total cost of the transaction could be around Rs 8-8.5 lakhs. “This is a clear arbitrage strategy where investors can immediately lock in their profits,” Jignesh Shah said with immense confidence in his voice.

However, some astute investors are not convinced by Jignesh Shah’s theory.

https://t.co/38CWim8k3q This article is really funny ……. #economictimes needs to work on the quality of their articles..

— Nooresh Merani (@nooreshtech) August 11, 2016

The author of this article should be fired and ET sued! There is no such arbitrage! https://t.co/UazxI90AQF

— Vijay Pahwa (@Wealth_Park) August 11, 2016

Woke up to this article https://t.co/a1RNCu0Xdv Hilarious, No rights issue price/lot adjustment?? Muft ke 66%?

— Prem (@StocksResearch) August 11, 2016

Looks like someone is going to loose his job today due to the fiasco published in a leading newspaper for Karnataka Bank. Proofread boss!

— Amit Kumar Gupta (@amitgupta0310) August 11, 2016

Even the punters at MMB are not impressed. No one is scrambling to buy the stock nor is there any other excitement at the counter. “TOTALLY A HOPELESS SCRIPT” raj481 proclaimed, frustrated at the lack of movement in the stock.

So, in the light of the difference in opinion amongst the astute investors, novice investors like you and me would do well to hold our horses and look before we leap because if Jignesh Shah’s opinion suffers from a fallacy, neither Vijay Kedia nor Rajnikanth will be able to save us from disaster!

Instead of Karnataka bank, one should buy Laxmi Vilas Bank

ET has removed the article it seems, the link is not working.

http://economictimes.indiatimes.com/markets/stocks/news/you-can-make-upto-66-by-participating-in-karnataka-bank-rights-issue/articleshow/53643042.cms

Below should clear the air of confusion. There is no arbitrage.

http://capitalmind.in/2016/08/no-66-arbitrage-karnataka-banks-rights-issue/

DCB bank, Federal bank, IDFC bank and city union bank are better low ticket bank stocks for long term in comparison , let Vijay Kedia remain stuck in Karnataka bank as he has already earned enough in other stocks.Even the name attached to bank suggest, it may remain a regional bank . Any way after some hits, he now needs a miss, may be due to law of averages.

Kharb, Vijay Kedia has already reaped good returns on the stock. You should know that very recently he entered at around 95. So, he has not missed it, he has hit it again.

Not sure how Vijay Kedia manages to make fund houses buy his shares like Atul Auto, Sudarshan Chemicals . Even though fund houses invested in Atul it has not done anything over the year.I Bet same would be the case with Sudarshan at 300. Mr Kedia should be smiling when they buy 🙂

#Nivezareview on #Karnataka #Bank :: is at low levels but comparing with peers, Federal Bank, DCB Bank are looking much stable as far as long run is

concerned. Banks are having asset quality issues as of now, but during

this challenging phase, Federal Bank managed to post positive results.

One can think of Federal bank and DCB bank along with Karnataka bank.

Visit@ Stock market Tips

Arjun, please do your homework before writing such articles. Your readers are not duffers.