After foreign fundamental investors, foreign technical analysts impressed with India

It is notable that eminent foreign fundamental and technical experts are equally expressing confidence that Indian stock markets are headed for stratospheric heights.

Warren Buffett, the World’s greatest investor, was one of the first of the foreign investors to recognize India’s potential.

As far back as in March 2011, he declared that “India is not an emerging market but is a big market”, implying that it deserves the respect and allocation that is accorded to developed markets.

He reiterated this in 2017 when he confidently proclaimed that “India Is An Incredible Investing Opportunity”.

Elite technical analysis experts are right behind Warren Buffett in expressing the same opinion about India.

Peter Brandt, a veteran and highly respected expert on technical analysis, conducts periodic studies of the charts relating to Indian markets.

In December 2015, when the Nifty was languishing at 7,800, Peter Brandt confidently proclaimed that the Nifty is “working lower within boundaries of a channel” and that it is heading to 10,000.

$NIFTY $SNF_F #NIFTY working lower within boundaries of a channel. Long term target of 10,000+ remains pic.twitter.com/isUFH3Cio9

— Peter Brandt (@PeterLBrandt) December 27, 2015

Today, the Nifty stands at 9,595 and is within touching distance of the 10,000 target.

Peter Brandt’s latest target for the Nifty is 11,181.

Attention India followers — #NIFTY $ZIN_F posts all-time highs. Close above 9220 sets new target of 11181 pic.twitter.com/X5FjorQoPR

— Peter Brandt (@PeterLBrandt) March 14, 2017

He claimed that a “close above 9,220” will set the new target. Since that level has been effortlessly crossed, we have to brace for the new high of 11,181, which may be around the corner.

ET Sleuths grill Peter Brandt

Understandably, Peter Brandt’s pronouncements about the Nifty did not go unnoticed by the ever-vigilant sleuths of ET.

They grilled him and extracted valuable information about when the Nifty will attain the coveted target and how smooth the journey will be. He gave the following cogent and convincing replies:

(i) Nifty is likely to achieve the target of 11,180 by the third quarter of 2018. The S&P CNX 500 will probably go to 15,000 while the BSE Sensex will go to 35,200;

(ii) If there is a correction due to volatility in the Western markets, it is an opportunity to buy the index;

(iii) If the Nifty slumps to 9,000, it would be a wonderful buy. However, that is unlikely to happen;

(iv) The ride is likely to be a smooth one, without much volatility;

(v) Indian markets are not overbought. It hasn’t been a “rip roaring bull market” in India. It has been an orderly market which has been self-correcting on the way;

(vi) There will normal corrections on the way like there have been in the near past.

Peter Brandt has earned 42% CAGR returns over 29 years in trading?

According to an interview on youtube, Peter Brandt has earned an eye-popping return of 42% CAGR over 29 years of trading. In his best year, he made 600% gain while in his worst years, he lost a paltry sum of 8%.

he has explained in detail the technique that he adopted to achieve this phenomenal result.

Sensex will surge to 100,000 by 2024: Mark Galasiewski

Mark Galasiewski, an authority on Elliott Wave analysis, has also been watching Indian stock markets like a hawk.

In fact, Galasiewski was even earlier than Warren Buffett in declaring that Indian stock markets are going to surge like rockets.

In April 2009, when the Sensex was languishing at the throwaway level of 10,900, Galasiewski predicted that in just 15 years, the Sensex would surge to 1,00,000.

Obviously, nobody took Galasiewski seriously at that time.

Today, just eight years later, the Sensex has tripled in value and is standing tall at 31,028.

“I see no reason to change or update that forecast because if anything the pattern of the advance from a technical perspective is confirming that forecast from April 2009. The Sensex and Nifty have tripled since that time and they can more than triple again over the next several years,” Galasiewski said with immense confidence in his voice.

Very long-term uptrends

Galasiewski explained that the Sensex and Nifty are both in “very long-term uptrends”. A chart of the Sensex back in 1979 shows that the uptrend since 1979 has been following a single support line and it is above that support line which shows that the uptrend is very strong, he said.

Sensex is in “super cycle advance”

He also pointed out that from the Elliott Wave perspective, the advance from 1979 in the Sensex is a “super cycle advance” and we are now in the “sweet spot of that advance”.

“We are also in the sweet spot of the lot of the smaller degree, cycled degree advance from the 2008 low,” he said, with immense clarity.

All cylinders firing – Wonderful time to invest in India

“This is a wonderful time to be invested in India because you are seeing all cylinders firing,” Mark Galasiewski said with a big smile on his face.

He explained that the increasing participation of investors from smaller towns broadens the market and augers well for its strength.

He called this participation the “third wave of a third advance” and emphasized that “it is a wonderful thing to observe”.

“It is a great time to be in India, to be invested in India and it should continue for several more years,” he added.

Midcap stocks will show higher strength than the Index

Galasiewski confirmed what we have always believed in, namely, that the mid-cap stocks will show greater strength than the Index and are investment worthy.

“Midcaps are showing the same strong uptrend that the Nifty and the Sensex are showing and in fact it is those smaller indexes that have taken off. Their rate of change is greater than the general market and that is a very strong sign that we are heading into this third of a third wave advance,” he said.

Just buy and hold without any worry

“It is a buy and hold story, It is a buy the dips and buy for the long term,” Galasiewski said in a soothing tone.

“Unfortunately for me as a forecaster and publisher the truth is that our viewers perhaps do not need my services at this particular time for the next two or three years,” he chuckled, implying that we should have no hesitation in following his advice.

(Investors celebrating Sensex 30,000 on Dalal Street)

Eminent Indian technical analysis experts corroborate theory

It is important to note that leading Indian technical analysis experts have come to the same conclusion as that of Peter Brandt and Mark Galasiewski.

Gaurav Dua of Sharekhan explained that while Mark Galasiewski’s target of 1,00,000 for the Sensex sounds mind-boggling, it can be easily achieved if the Sensex grows at a CAGR of 18% over the next seven years.

“It does not sound unachievable given the fact that the Sensex has given compounded annual returns of close to 16.5 percent in the last 39 years – move from 100 in 1978 to 30,500 now (2017),” he added.

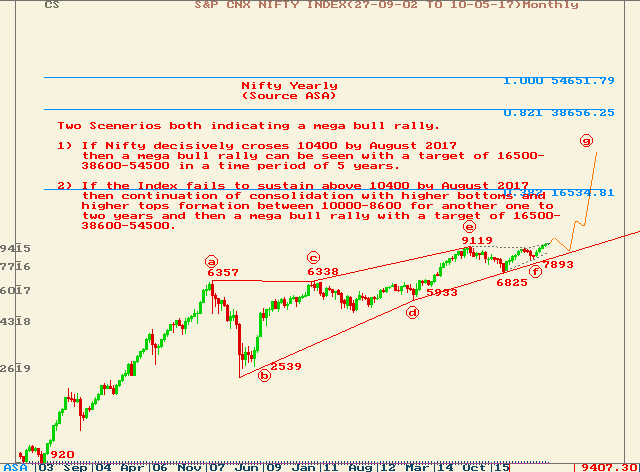

The experts at Systematix Shares conducted a complicated “Neo Wave Analysis” to determine the trend of the Nifty.

They opined that if the Nifty decisively crosses 10,400 by August 2017, a strong bull rally will come into place which will send the Nifty surging to levels of 16,500-38,600-54,500 in a time period of 5 years.

However, if the Nifty fails to sustain above 10,400 by August 2017, the consequence is that there will be a consolidation with “higher bottoms and higher tops formation” between 10,000-8600 for the next couple of years. Thereafter, there will be a “mega bull rally” which will lead to targets of 16,500-38,600-54,500 levels.

(Image credit: moneycontrol.com – click for larger image)

The entire scenario has been cogently explained by a chart.

Conclusion

The bottom line is that we are on velvet from a fundamental as well as a technical perspective. There is no reason for us to be fidgety and nervous. Instead, we have to buy aggressively whenever there are corrections and sit tight!

Although sense touching 100000 is no new prediction.But to predict it in 2024 looks to be tool early . Technicals may be indicating it in 2024 but in my view it will happen only any time between 2026 or 2027.I don’t expect any further rerating in most of the stocks,so it will be as per earning growth which may be around 15%.There is already a thread started by me in which I predicted it one and half year back that it will happen in 12 years plus minus2.Stay invested in Domestic Quality stocks which will cater 1.3,Billion customers.

Sensex

Ambit also predicted something similar but on fundamental basis.

yes but what individual stocks will go up….which stock will help me buy nokia 3310 and tata nano car in 2 years now…sadly that is the goal now but it may go up in the future

Fine I Will tell you. TCI express. You are welcome.

Thanks.