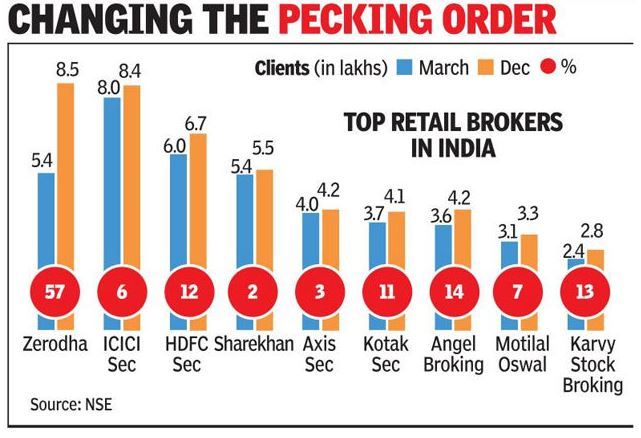

Zerodha: Biggest broking firm with 8.47 lakh clients

First, we have to compliment Zerodha and its dynamic promoters, Nithin and Nikhil Kamath, for being awarded the coveted title of “biggest broking firm in India” with a mammoth active client base of 8.47 lakh.

No doubt, the achievement is enviable and commendable.

Zerodha wrested the title from ICICI Securities which is now trailing with 8.45 lakh clients.

Other heavy-weight brokerages like HDFC Securities, Sharekhan, Axis Securities, Angel Broking, Kotak Securities, Motilal Oswal etc are left far behind with a rapidly dwindling client base.

Upstox alias RKSV, which is Zerodha’s arch rival in the discount brokerage business, is also growing by leaps and bounds though details of its client base are not available.

Outages & glitches galore

Unfortunately, the steep increase in client base and consequent surge in orders has led to several bottlenecks because Zerodha’s infrastructure has not kept pace.

The system conks off often and it is common to find traders expressing their angst against Zerodha, especially on days of high volatility.

Yesterday was a textbook example of this.

The news about hostilities between India and Pakistan led to a sudden surge in volatility.

Traders scrambled to take new positions or cover their existing ones.

However, Kite, Zerodha’s flagship trading system, was down and out.

It stopped taking orders, which is an unthinkable eventuality given the mayhem that was being witnessed in the markets at that time.

You may face a delay in order execution on Kite. We are looking into the issue and it will be resolved shortly. We regret the inconvenience caused.

— Zerodha (@zerodhaonline) February 27, 2019

We faced a connectivity issue at market opening because of which a few lakh orders piled up and started going to the exchanges with a delay. We have stopped taking fresh orders until the pile is cleared. We regret the inconvenience.

— Zerodha (@zerodhaonline) February 27, 2019

Naturally, traders took to the streets and vented their fury.

This is how zerodha works. pic.twitter.com/9QxaZqRf8a

— Gautam (@Gautam39495324) February 27, 2019

How about one month trading free of your issues, I will treat you at a place of your choice?

This is not "inconvenience" that you cause..This is loss of money esp when trying to book covered trades where 1 leg of trades gets executed and 1 remains open#zerodha pic.twitter.com/5LO4oaIBIG

— Ashish Gupta (@AshishGupta325) February 27, 2019

@zerodhaonline already stopped trading ??? @NSEIndia @SEBI_India @BSEIndia @FinMinIndia #zerodha #Zerodhadowntime pic.twitter.com/4FZ7xxi7RU

— Ullas S Bhat (@Bhatsampathila) February 27, 2019

Zerodha is killing us. Orders stuck in validation pending. Anyone else seeing the same thing?

— Love Bear Markets (@MarketBears) February 27, 2019

Closed for the day… missed big profit… now out from zerodha too? pic.twitter.com/f0lCeJkR78

— Ganesh Paudel ?? (@GaneshPaudell) February 27, 2019

ZERODHA doing surgical strike on retailers…

Discount broker

Day by Day getting worst…@CNBC_Awaaz @ZeeBusiness

— RM (@ravi_mehata) February 27, 2019

Dear zerodha, thanks for your contribution for making 5% loss on my trade. #BoycottZerodha .

— Koyel Banerjee (@BanerjeeKoyel) February 27, 2019

@zerodhaonline why do i feel that zerodha is becoming more of a pain day by day and getting into unethical activities like blocking orders in the name of connectivity issues….i have sharekhan as well and i have never faced this problem…@SEBI_India pls look into this pic.twitter.com/6gSM4VMAHE

— priyanko chatterjee (@cpriyanko) February 27, 2019

I quit from #zerodha

Today is my LAST day— Ashish Kesharwani (@ashishkesh) February 27, 2019

Damage control: Take clients into confidence

At this stage, we have to compliment Nithin Kamath for giving a textbook example of how to handle customer grievances and not to alienate them.

Instead of lying low and hoping that the issue would peter down, he provided a detailed explanation of what went wrong and how he intends to resolve it.

We are extremely sorry about the issues that you faced today morning on our trading platforms. Here is an explanation of what happened. – Nithin Kamath

https://t.co/t3weIqbQWs— Zerodha (@zerodhaonline) February 27, 2019

Apparently, Thomson Reuters’ Omnesys system was the culprit. Its’ OMS (Order Management System) conked off and did not forward orders from the broker to the exchange.

“Today at the market open, the OMS developed connectivity issues, which resulted in orders piling up. We witnessed several lakh orders piled up waiting to be pushed to the exchanges. This would’ve been indicated by the “validation pending” status you would have seen. This caused a snowball effect of customers placing more orders to make up for the hanging orders, increasing the pile up exponentially,” Nithin Kamath explained in a somewhat laborious manner.

He also pointed out that Zerodha was helpless in the matter because they have no access to Thomson’s OMS.

“The Thomson Reuters team tried to bring the pending order queue down, but it wouldn’t happen. Since the OMS is their proprietary system that is licensed out to stock brokers, our technology team does not have any control over the internals of the system. We were in constant touch with several of their teams trying to get a resolution,” he stated.

He also pointed out that while 90% of the order flow is handled efficiently by Zerodha’s internal systems, only 10% is farmed out to Thomson’s OMS.

However, the 10% is the “weakest link”. Thomson Reuters has struggled to cope with our growth, he said.

He also hinted that the time is ripe for Zerodha to boot out Thomson Reuters and take control of 100% of the order flow.

Anyway, Nithin Kamath’s proactive stance of explaining the nitty-gritty of the problem pacified some clients.

“Its ok.. rulaoge kya,” one said.

“It’s OK bro, don’t worry about small issues but try to give good service in future thanks bro…,” another observed.

“We have faith in you. Technology is bound to fail at any Time and place when most needed and is part of the game,” yet another said.

Zerodha is liable to compensate client: Arbitrator

Some traders pointed out that Zerodha had earlier found itself in hot waters after a client dragged it to arbitration and claimed compensation.

Arbitrage case filed against zerodha won by a client who had sued them.

If any friend faced loss today due to zerodha please contact your lawyers @Amit_Gulecha

— Ashutosh Shah (@onlyequities) February 27, 2019

In that case, a trader named Leslie Prabakar Ruphas wanted to sell 3000 shares of State Bank of India first thing in the morning.

However, when he punched in a sell order at the price of Rs. 347, the system was down and the order did not go through.

In desperation, Leslie called the call center but did not meet with any success.

To add insult to injury, Zerodha forcefully squared off the holding at 2.57 pm on the ground that there was a “margin shortfall”.

By then, the share price of SBIIN had plunged to Rs. 330.

Naturally, Leslie was boiling with rage.

He marched to the arbitrator and demanded that Zerodha compensate him for the loss of Rs. 17 (Rs. 347 less Rs. 330) that he suffered on each of the 3,000 shares of SBIIN.

Before the arbitrator, Zerodha fairly admitted that there was a “network failure” at its end.

However, it sought to avoid liability with the specious argument that it was immune from loss under the “Risk Disclosure Document”.

V. Paul Das, the learned arbitrator, was not impressed by Zerodha’s submissions.

“The respondent was not able to prove that the system failure was not due to their control. Lt is verified with the NSE that no system failure was caused in their trading platform on 26.10.2017. Hence, the system failure was due to the negligence on the part of the respondent only for which they have to take the responsibility of compensating the loss sustained by their client due to the system failure of the respondent,” he held.

Zerodha also argued, in desperation, that Leslie could have traded in the BSE.

Leslie countered this by saying that he was “not aware” of this facility and that Zerodha had never advised him in this matter previously.

Naturally, the arbitrator rejected the submission of Zerodha. “This type of argument of the respondent’s side is not acceptable to me,” he held.

Ultimately, the arbitrator held that Zerodha “has totally acted against the interest of the applicant by not maintaining then system properly between 9.30 AM and 10 AM on 26.10.2017 and by squaring off his position till the loss is reached by 100%”.

Other client(s) compensated

The final nail came when Leslie produced email correspondence which showed that Zerodha had compensated some other client for a similar loss due to system failure.

After this, the learned arbitrator had no choice but to hold that Leslie’s claim for compensation is “very reasonable” and that Zerodha is liable to compensate him for the loss.

Change in contractual terms absolves Zerodha now?

Some astute traders pointed out that the judgement secured by Leslie may no longer be valid because Zerodha has inserted a “no-damages” clause in the agreement.

You cannot file a case on them as per the agreement signed by us pic.twitter.com/pmHqo5Xeqv

— Ganesh Paudel ?? (@GaneshPaudell) February 27, 2019

The said clauses read as follows:

“9. The client is aware that trading over the internet involves many uncertain factors and complex hardware, software, systems, communication lines, peripherals, etc. are susceptible to interruptions and dislocations. The Stock broker and the Exchange do not make any representation or warranty that the Stock broker’s IBT Service will be available to the Client at all times without any interruption.

10. The Client shall not have any claim against the Exchange or the Stock broker on account of any suspension, interruption, non-availability or malfunctioning of the Stock broker’s IBT System or Service or the Exchange’s service or systems or non-execution of his orders due to any link/system failure at the Client/Stock brokers/Exchange end for any reason beyond the control of the stock broker/ Exchanges.”

In fact, all brokers insert such a clause in their agreements with their clients so as not to be saddled with the sort of liability that Leslie managed to wrest from Zerodha.

However, some traders pointed out that such clauses are intended to protect against occasional failures in internet connectivity which are beyond the control of the broker and not for “systemic failures” which happen repeatedly. In the case of the latter, it is a clear case of “deficiency of service” it was opined.

Anyway, we will have to see how the law develops and whether such an immunity clause will be upheld by Courts!

I am sure 8.47 lac clients of Zerodha are indulging in Intra day, Futures and Options trading due to very low cost. No wonder trading volumes and turnover has increased dramatically ever since discount brokers started the platform.