Zero brokerage business model results in gain of Rs. 6600 crore!

It is astonishing that not charging any brokerage from investors can result in such massive gains for the brokerage.

Robinhood Markets Inc, a brokerage in the USA, was the first to pioneer the concept of zero commission or brokerage for buying and selling stocks.

Not surprisingly, Robinhood is also co-founded by an Indian named Baiju Bhatt. The other co-founder is Vladimir Tenev.

The business model is an enormous success in the USA.

By February 2018, Robinhood had 3 million (30 lakh) user accounts, which is more than what the market leaders like E-Trade etc can boast of.

Robinhood is now valued at an eye-popping $5.6 billion and its founders have been given pride of place in the Forbes Billionaires list.

Nithin and Nikhil Kamath, both visionaries, did the sensible thing of cloning Robinhood’s business model and adapting it to Indian conditions.

Needless to say, the model is also a runaway success in India, with millennials thronging the brokerage.

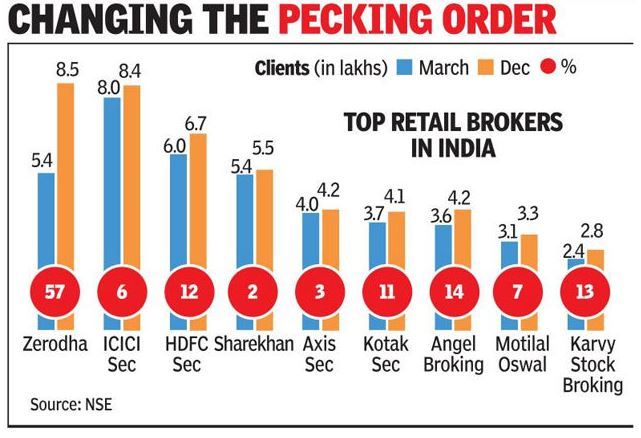

Zerodha is presently India’s largest broker with an eye-popping client base of 1 million+ (10 lakh).

Its arch rivals ICICI Securities, HDFC Securities, Kotak etc are left far behind and are losing ground day-by-day.

In fact, in desperation, these brokers are also seeking to woo investors by promising zero-brokerage service.

However, investors and traders are not taking the bait, given the simplicity and technological superiority of Zerodha’s platform.

We can gauge the level of Zerodha’s popularity from the fact that during the election day Hungama, 1 million unique users placed 15+ million (1.5 crore) orders on its platform.

Well… pic.twitter.com/SOpbXaljQm

— Zerodha (@zerodhaonline) May 23, 2019

Investors are lured in and become active traders

The secret to Zerodha’s success is that investors walk in, initially attracted by the offer of zero-brokerage on delivery trades.

However, it only a question of time before they begin to wonder whether then can also day-trade, given that the brokerage is only a paltry Rs. 20 per order (not per lot) on Futures and Options.

Also, Zerodha offers an automated and convenient system for pledging one’s Demat holdings to raise margin money.

The margin money is interest-free, if there is an equivalent amount of cash maintained in the account.

This combination of throwaway brokerage of Rs. 20 and zero-interest margin money is irresistible and investors soon turn into active traders.

Nithin Kamath confirmed that this is indeed the secret of success of the business model.

“Offering free equity investments helps us grow the capital market ecosystem in India and grow our client base …. the lion’s share of our revenue comes from the active traders, who execute 15+ lakh revenue-generating trades daily. Do the math and one can know why we are a Rs 500+ crore topline business,” he said.

“Our low brokerage and superior platforms have caused a significant increase in our F&O business,” he added.

He also rightly pointed out that all so-called “investors” are in fact “traders in disguise“, looking to make a fast buck whenever the opportunity arises.

“… almost all of us are traders. Buying a stock with an intention to sell in any time frame, or deciding to hold it until price appreciates to the buy price when the price goes against, is not really an “investment”, but a trade. Making an investment is like buying a house with the intent to live – you do it for reasons other than just price appreciation,” he explained.

So, it does not take much to convince a so-called “investor” into becoming a full-time “trader“.

In fact, some traders believe that trading is better than investing because of the inherent emphasis on ‘risk management’ while trading.

“I always prefer trading because risk management is inherently built-in in all forms of technical trading. While putting in money into markets, everyone is simply busy looking upto the profits and people are usually not prepared regarding what should be done when the trade is not going in their favor,” a trader observed.

Not a single Rupee on advertising, no marketing team

The baffling aspect is that Zerodha’s enormous success has come without it having to spend any money on advertising.

“Alexa says that we’re the 76th most popular website in India (and the 1031st most popular website in the world). All this without ever spending a single Rupee on advertising or having a marketing team,” Nithin Kamath said in a blog post, with justified pride in his voice.

“The craziest metric of all is that we now have 1.6 million customers and over 15% of the retail trading turnover on the Indian exchanges without spending any money on advertising!,” he added.

He also pointed out that the competitors are bleeding themselves dry by splurging big bucks on advertising.

“We’ve never advertised, which cannot be said of our competition who have large budgets for online, print, and TV advertising. The quality of our products and the goodwill we’ve earned from our clients is why we’re the largest broker in India today“.

Employees also share in the riches – get ESOP of Rs. 200 crore

The best part is that Nithin and Nikhil Kamath have not hoarded the riches with themselves.

Instead, they have generously distributed the wealth amongst the employees in the form of ESOPs worth Rs. 200 crore.

“Almost everyone on our team holds a stake in the business,” Nithin Kamath pointed out.

The employees are also not under any pressure to generate revenue.

“We do not have a single person on our 1000+ team that has a brokerage revenue or commission target,” he said.

Naturally, the attrition levels are low.

“We have historically had very less churn in our employee base, and our core operations and technology teams have remained almost the same since inception. Out of the 1,100 employees, we have allocated shares to 850,” he added.

Sharekhan, victim of Zerodha’s success

Sharekhan is buckling under pressure from the discount brokerages.

It has unceremoniously sacked 400 employees.

“Nearly 400 employees have been asked to go and more will be asked to go over the next few weeks,” an official said tersely.

“Most of the executives who have been asked to leave are part of sales and support functions“, he added.

Sharekhan is going through a restructuring process that could impact 350 employees, reports @jashkriplani https://t.co/iLhEIikDDC

— Business Standard (@bsindia) September 27, 2019

And as you thought that the equity markets were reviving

A leading stock broking co (Lion King) retrenches 1200 employees in a single day!

Whoa! That is a larger issue than auto cos also!

— Nagpal Manoj (@NagpalManoj) September 25, 2019

Only PayTM can unsettle us

PayTM, which is founded by Vijay Shekhar Sharma, an equally aggressive and visionary entrepreneur, is a looming risk to Zerodha’s dominance in the broking sector.

It will almost certainly spell the death knell of the so-called full-service brokers.

Nithin Kamath acknowledged the threat and revealed that he is girding his loins for combat.

“If anyone out there can compete with us in terms of product, it will be Paytm …. we will be forced to constantly watch our back, because you never know where they will catch up,” he observed.

“Competition is always good, keep everyone on their toes, everyone is constantly pushed to update products, better pricing for the end user, etc. If Paytm offers a better product, of course eventually all clients will move away from us, but that is what will push to make sure we are improving on ours,” he added.

He also opined that PayTM’s entry may prove beneficial because their high-decibel advertisements will put the focus on the discount brokerage industry.

“If someone can grow the market participation in India quickly, it is probably Paytm. So, it is good that they are jumping in,” he said tongue-in-cheek.

Zerodha provide best service for their clients.

MyWife and my Son are trading with Zerodha. But for over 10 years I am trading with Ventura. I want to try Zerodha.

Thank God Rohit did not end up as a plumber or driver. Engineers these days are recommended to take up jobs like plumbing or driver.

Zerodha will be Zero in future. Earlier we had Reliance Money in 2006,

Flat Fee 501/- per annum. No Brokerage on Volume : Intraday , Delivery, Equity, F&O.

Purely Tech based Broking…. Got 1 Million Clients in 3 years.

Could not sustain, charged Web Usage fee at end of FY, Client ledger was debited.Created big issues, CEO Sacked…

Then switched to %tage broking.

It will become hard to service a large client base without proper revenue stream.

Hey Vivek,

I beg to differ here, so talking about the revenue system the entire business model of depends on the active traders like F&O and in India more than 60% trading volume cames from F&O

Another point is zerodha do not think survival as a problem there major problem is to how to increase the financial market ecosystem beyond what it is today in India less than 5% people invest their money in the secondary and primary market in India they are trying to increase this number. and if zerodha will succeed in doing so it will be benifical to the entire economy

Also, zerodha is one of the best fin-tech startups in the world. they are saving into millions by using FOSS there entire tech is built around FOSS ( Free and open sourse software )

If you see just one metric of customer base and comparing Zerodha vs RC followed by a similar prediction for Z is far fetched conclusion. Other metrics such as number of F&O customers, Avg Daily Trading Volume and Avg Revenue for each customer of Z is much better compared to any brokerage. Zerodha model is very simple, increase the footfalls by luring the customers with zero brokerage for delivery and turn them as traders with tempting analysis pops. Trading is addictive and a week of exposure is enough make it compulsive.