What are Rakesh Jhunjhunwala’s portfolio holdings? How does he pick his shares? what are his investment techniques? How does he find his multi-baggers?

One noteworthy thing about the Badshah of Dalal Street is that – like other geniuses – he is not shy of sharing his techniques. If you are willing to listen (and understand), he is only too happy to tell you how he achieves his spectacular success.

We have carefully listened to RJ whenever he has spoken on investment seminars and also on TV. We have tried to understand his thinking process.

When analyzed carefully, RJ’s spectacular success has a common-sense technique to it. Much like that of Warren Buffett, Sir John Templeton, Peter Lynch and other legendary investors.

ASSET ALLOCATION & COMPOUNDING

The primary factor that the Oracle of Mumbai emphasis is that one should bear in mind the importance of ASSET ALLOCATION and the power of COMPOUNDING.

What Asset Allocation means that you must be clear in your mind how much money you can spare for your equity investments. The necessity for asset allocations stems from two realities of equities that every investor must be conscious of:

(i) Equity investments are very risky as compared to other asset classes in the short to medium term;

(ii) Equity investments take a long time to deliver results.

RJ says that as an investor, you must ensure that the money that you invest in equities are not coming out of the moneys that you have kept aside for necessities and emergenicies.

He points out that you must ensure that a sufficient amount of money is always kept handy and out of the stock market (in debt investments) for meeting expenses on medical care, education, marriage and other unavoidable necessities.

It only the money remaining after this ASSET ALLOCATION that you must invest in shares.

You must also bear in mind your age, your income-earning capacity and your risk-taking ability – also dependent on the number of dependents that you have and their short / medium-term requirements.

The Master investor point about compounding follows logically from the first point. If you are comfortable with letting the money rest in equities for a medium / short period of time, the magic of compounding works by itself.

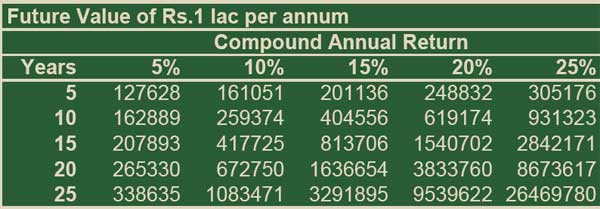

In one of his presentations, RJ showed this table of the magic of compounding.

What this astonishing presentation shows is how if money is allowed to quietly compound, it attains enormous proportions. See how a paltry sum of Rs. 1 lakh per annum over a period of 25 years at a rate of return of 25% becomes an incredible Rs. 2.64 crores.

Imagine if you could save 10 lakhs every year, in 25 years you would have 26 crores!!

That is the simple but incredible clarity of thinking that the Badhshah’s mind has.

CONVICTION

You must have CONVICTION in what you are doing. You must feel it deep in your bones that equities are the way for you. You must be comfortable with the idea that your investments are subject to the vagaries of the market and you must not get sleepless night worrying about your investments.

If you think about it, this mantra is a logical corollary to the Master’s first mantra about Asset Allocation. Your comfort level with equities is directly proportional to the correctness of your asset allocation. If you have correctly kept away from equities the moneys that you need for emergencies and necessities and have only invested long-term funds in the stock market, you will have no tension only!!

DON’T BE RIGID

You must be open to accepting that you have made mistakes. Don’t be rigid or obstinate. Keep an open mind!

Before buying a share, make sure that you have done proper research and identified all the positives and negatives of the shares.

Don’t get carried away by the positives of the share. Don’t get carried away by your own logic. What are the risk factors? What are the drawbacks? You must consciously ask yourself this question.

If you have the CONVICTION that you are right about the share, only then go ahead and buy it.

The Wise One says that if you bought a share that turns out to be a dud, accept that reality and do not compound the mistake by hanging on to the dud.

SAFETY OF CAPITAL & ABSOLUTE RETURNS

RJ’s next mantra also follows in logical progression to his other mantras. Take care of your capital! Don’t risk it foolishly! If you have no capital left, where is the question of returns and where is the question of compounding!

TIPS ON HOW TO CHOOSE AN INVESTMENT

Okay, now we come to the most important segment – How to choose an investment?

RJ is a genius because it is only a genius who is able to present a successful investment strategy in an easy-to-understand format and most willing to share the formula with his less-fortunate brethren!

Like Warren Buffet and Benjamin Graham, RJ emphasizes that we are not buying just a little thing that bounces about 2% every day on the stock market – but we are buying a part of a real business. He urges us to think like an owner of a business would. If you were really buying a business, what is the extent of research you would have done and care taken. RJ’s tips on what we should look for whilst buying a share is a clear indicator that he wants us to think that we are buying a part of a business.

RJ emphasizes that we must look for the following in any business we are looking to own.

(i) Attractive, addressable external opportunity;

(ii) Sustainable competitive advantage – the "moat" that Warren Buffet always refers to as his investment technique;

(iii) Scalability + operating leverage. How far can the business go – in volume terms and in geographical terms;

(iv) Management quality + integrity. You don’t want to be partners with unscrupulous fellows, do you;

(v) EVA positive over investment horizon. Yes, a short-term aberration in the profitability is acceptable but the idea must turn positive over your investment horizon;

(vi) Valuation: Price –Value divergence. Ultimately, everything boils down to this. What is the value of the Company? And what are you paying for it? Obviously, the more the value and the less the price is the best case scenario.

10 commandments for investors (tips on how YOU can be a great investor):

RJ is not a legend for nothing. Not content with telling us what techniques we should adopt whilst picking our portfolio, he also tells us what mental attitude we should cultivate to be a successful investor.

(i) Be an optimist! The necessary quality for investing success;

(ii) Expect a realistic return. Balance fear and greed.

(iii) Invest on broad parameters and the larger picture. Make it an act of wisdom, not intelligence.

(iv) Caveat emptor. Never forget this four-letter word -R-I-S-K.

(v) Be disciplined. Have a game plan.

(vi) Be flexible. For Investing is always in the realms of possibilities.

(vii) Contrarian investing. Not a rule, not ruled out.

(viii) Its important what you buy. It’s more important at what price you buy.

(ix) Have conviction. Be patient. Your patience may be tested, but your conviction will be rewarded.

(x) Make exit an independent decision, not driven by profit or loss.

Each of the said 10 commandments deserves to be etched in stone and read and re-read everyday by anyone who aspires to reach the heights of Rakesh Jhunjhunwala!!

Tips on when to sell an investment

RJ enhasizes that not only should you know when to buy but you should also know when to sell. As he says in one of his commandment, learn to balance greed with fear and have reasonable expectations.

(i) Asset Allocation: It is interesting that this Master Investor never tires of emphasizing the need for proper asset allocation. If your asset allocation has gone haywire, don’t hesitate to sell to bring it back on track;

(ii) Review of Critical Factors: when you make an investment, you have hopefully paid attenbtion to the factors that Rakesh Jhunjhunwala emphasized that you should bear in mind. Keep reviewing these factors. If any of them changes adversely, sell;

(iii) Relative Opportunity: Again, trust RJ to state the obvious but which all of us overlook. Keep your eyes peeled for better investment opportunities. Is Gold a better investment opportunity? If you have that conviction, re-balance your asset allocations;

(iv) EPS or EPS Expectation Peaks: If the EPS has reached levels that can’t be matched in the near future, that’s a sign that you should exit;

(v) PE Absurdity: Keep an eye on irrational behavior from other market participants. If you see a bubble building, get out before it bursts;

(vi) Not Driven by Profit/Loss -Independent. This is a profound statement by the Badshah of Dalal Street. Don’t behave like an emotional creature and be averse to loss or get excited by profits. Keep a cool head and evaluate all decisons on an independent platform. Don’t refuse to sell because you don’t want to book losses and don’t rush to sell only because you have made profits. Decide independently, on the merits of the investment and whether it has any more steam left or not.

really a genius person. young investor should follow his trust worthy idea

really a genius young investor should follow his trust worthy idea

trust worthy ideas

equtiy