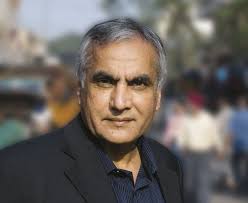

Ajay Relan was part of a team of 15 stock wizards who were roped in by Outlook Business in January 2014. Each stock wizard was asked to pick his favourite stock. Ajay Relan recommended MPS. At that time MPS was quoting at Rs. 186. He said the stock was at a “tipping point”. He gave convincing reasons in support of his logic.

Then, in May 2014, Ruchi Burde & Pritesh Chheda of Emkay carried out a brilliant analysis of MPS in which they confidently asserted that MPS has the “perfect recipe” of high ROE (41%), free cash flows and high dividend payout (50% of profits) and that its MPS’ valuations are “completely out of sync” with future fundamentals.

After that, in June 2014, when the stock price had surged to Rs. 360, Dharmesh Kant of IndiaNivesh picked up the gauntlet and recommended a buy of MPS. He gave ten reasons why MPS is a great buy. He was very conservative with his target price of Rs. 448.

MPS has been living upto expectations by delivering excellent quarterly results. Today was no exception. It delivered block-buster Q2FY15 results.

The consolidated net profit surged 80.2% to Rs 14.11 crore while the total income from operations surged 13.33% to Rs 55.57 crore on a YOY basis. Delirious investors thronged the counter sending the stock rocketing to its upper circuit limit of 20% at Rs. 724. On BSE itself, nearly 89,730 shares were traded as against the average daily volume of 9,163 shares.

On the question whether the stock is still a good buy, we must remember that MPS is still a micro-cap with a market capitalisation of only 1200 crore. Also, we must remember the prophetic words of Ruchi Burde & Pritesh Chheda of Emkay when they said “MPS has the potential for multi-bagger return for investors if the growth story unfolds on expected lines”. So, as I said in my earlier piece “MPS Is A 6-Bagger Stock But It Is Still Not Too Late To Buy It”.

Though there is no doubt the MPS hold great long term value, there is a word of caution, this one is small cap (1200Cr) with free float of 400Cr only.

Yesterday’s 20% move has only 17% deliverable, so it was mostly fueled by traders/speculator. Any bad quarterly results and the correction would also be equally hard. One should only enter it for long term and if he can digest the short term capital loss.

Hello Arjun bhai,

Hem Securities has recommended Sunil Hi Tech just recently. Plus Ashish Dhawan holds it. Today it spiked 5% but has lot of juice still in it i think – valuations are very attractive. Very good buy. Cover it here if you may, in your enjoyable writing style – readers will enjoy it!

good for new investor i think new small appreation of money will bring confidence more fund could be deployed nobel work by profession stock analyst krishnendu das kolkata 31.10.14