A new Bull Market has begun. The shortest Bear Market ever has ended

Mukeshbhai is known to be a visionary amongst the punters of Dalal Street.

He had foreseen the lockdown and stockpiled a massive consignment of Kamala Pasand Gutka.

“Muh mein Kamala Pasand, kadmo mein duniya,” he said in contentment as the three of us (Mukeshbhai, Jigneshbhai and me) lay sprawled outside the gates of Jeejeebhoy Towers in Dalal Street, basking in the gentle summer sun, sipping Adrak Chai and munching Gutka.

The reason for our contentment is because the venerable Wall Street Journal has formally announced the end of the Bear market and the advent of a new Bull market.

Breaking: A new bull market has begun. The Dow has rallied more than 20% since hitting a low three days ago, ending the shortest bear market ever. https://t.co/06YS0XqWGP

— The Wall Street Journal (@WSJ) March 26, 2020

This proposition is confirmed by Bloomberg which stated that there are healthy signs that a new Bull market is emerging from the shadows of the Bear market.

The S&P 500 just posted its biggest weekly gain since 1974. All in the face of an health and economic crisis. Morgan Stanley's Andrew Slimmon details the 'healthy signs' in the new "bull market".https://t.co/OFrCr6w1SM pic.twitter.com/4EZQX45Fcw

— Bloomberg TV (@BloombergTV) April 11, 2020

Buy, Buy, Buy stocks

In March 2020, when the Nifty and Sensex had sent shockwaves across the Planet by plunging to the lower circuit, Saurabh Mukherjea was the lone voice advising us to be brave and buy stocks.

“I have been waiting for this day for a long, long time …. we will be buying heavily through the day,” he stated, implying that it was a once-in-a-lifetime opportunity to grab stocks.

“Buy The ‘Corona Virus’ Fear If You Want Mega Gains In Portfolio,” he had added with immense confidence.

No doubt, the advice was very sound.

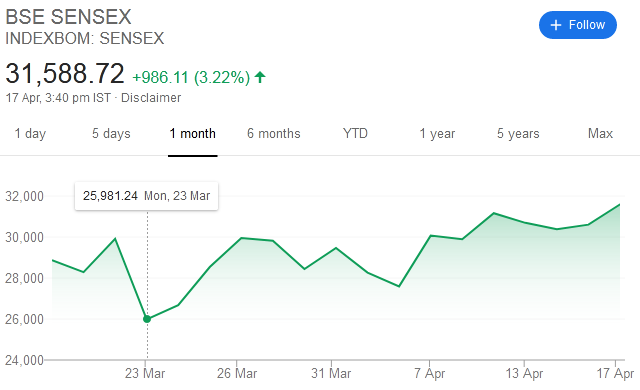

The Sensex has surged like a supersonic rocket since that fateful day, notching up mammoth gains of 5607 points (21%).

Individual stocks have obviously given incalculable gains since then.

Even the Dow Jones has kept pace, surging from a low of 18591 on 23rd March to the present level of 24,242.

The World will boot out China, usher in India as a replacement

Nobody can dispute the proposition that China has emerged as Villain No. 1 in the CoronaVirus episode.

It has allegedly lied about the impact of the Virus and misled everyone and caused the present catastrophe.

China has just announced a doubling in the number of their deaths from the Invisible Enemy. It is far higher than that and far higher than the U.S., not even close!

— Donald J. Trump (@realDonaldTrump) April 17, 2020

China not only lied, destroyed evidence and allowed the virus to spread but it arrested doctors who in December tried to warn the world about what was happening in Wuhan.

My column in today’s @theheraldsun on why China must be held accountable. https://t.co/ZjvF6BGIh6

— Rita Panahi (@RitaPanahi) March 19, 2020

China lied. People died. They can't get away with it.

— DeAnna Lorraine ?? (@DeAnna4Congress) April 17, 2020

Unfortunately we will probably never really know how many perished in China.

They will continue to lie about this, and blame the United States.

We must hold them accountable.

— Ryan Fournier (@RyanAFournier) April 17, 2020

#Corona virus escaped from a Chinese bio lab and has brought death, suffering and havoc throughout the world. China actively hid it. #China MUST be made to pay fair and full compensation for all the lives and trillions of dollars lost. We must insist on it. RT if you agree.

— Jeffrey Zimmerman (@Zimmlaw175) April 16, 2020

This ostracization of China by World leaders is the ideal opportunity for India to break the stranglehold of China and fill the void.

“For a country like us whose main competitive advantage is knowledge and human capital, whether it is via pharma or IT sector, this is a once-in-a-generation reset which could lead to the trigger for India’s fifth economic boom in 40 years,” Saurabh rightly advised.

Saurabh Mukherjea expects the global pandemic to push India into a ‘boom’ period.

Read: https://t.co/wR7CSFZm3p pic.twitter.com/nBlaEqEYTs

— BloombergQuint (@BloombergQuint) April 17, 2020

Stocks are still at ‘mouth-watering levels‘. Grab them ASAP

Many punters (including me) are sporting glum faces because we were too panic-stricken on the fateful day to buy stocks.

Saurabh advised that stocks are still at “mouth-watering levels” and that we can still dive in and grab them.

“We are in a space where buying high quality companies which we love to do, looks even more tasty today than it did earlier,” he said.

“FII money will rush in the moment virus cases drop,” he added.

Indian equity market is ‘mouth-wateringly interesting’, says Saurabh Mukherjea.

Read: https://t.co/wR7CSFHKEP pic.twitter.com/1FO6wDiOs0

— BloombergQuint (@BloombergQuint) April 16, 2020

Avoid adventurism, stick to well-known and high-quality stocks

At this stage, we have to be careful to steer clear of junkyard stocks which are also surging and stick to high-quality stocks with bullet-proof balance sheets and impeccable track records.

Saurabh made it clear that this is not a time for adventurism on our part.

“We have a responsibility to our clients to be sensible about how we invest through a crisis and therefore investing in companies which make the basic essentials of life, makes a lot of sense,” he advised.

“Basic essentials of life was say Dr Lal Pathlabs. They do pathological testing. Presumably given the situation we find ourselves, path testing will become even more relevant in our country in the coming weeks and months,” he added, implying that Dr Lal Pathlabs is a no-brainer buy.

Saurabh also recommended Nestle, Relaxo and Divi’s Lab as fool-proof stocks that we can entrust our hard-earned money to.

It may be recalled that Saurabh had also recommended a few weeks ago that we buy GMM Pfaudler, a small-cap MNC stock.

Needless to say, GMM Pfaudler is also surging like a rocket and notching up hefty gains.

Abbott India, yet another MNC stock recommended by Saurabh, has also been an unstoppable juggernaut, delivering risk-free gains of 28% in just the last month.

“We are focusing on these stocks through the downturn. We own a fair bit of these companies anyway. We will try to buy more of them as others panic“.

The RBI has flooded the system with liquidity, the top banks have buckets of money. This is going to be an incredible opportunity for strong companies to squeeze their competitors out, says Saurabh Mukherjea, @MarcellusInvest pic.twitter.com/DK0asjqugF

— ET NOW (@ETNOWlive) April 15, 2020