Good track record of Dharmesh Kant

Dharmesh Kant, who was earlier with IndiaNivesh and who is now with Motilal Oswal, has a reasonably good track record at finding multibagger stocks.

Some of his earlier stock picks which have yielded multibagger gains include Force Motors, Hestor Biosciences, MPS, Camlin Fine Sciences, Thomas Cook etc.

Dharmesh follows the sensible practice of under-promising and over-delivering. His target prices are always modest though the stocks usually deliver humongous gains.

One recent example is that of Aarti Industries where Dharmesh solemnly assured a target price of Rs. 630 in 12 months. Today, barely four months after his recommendation, Aarti Industries is standing tall at Rs. 730, having crossed Dharmesh’s target price with impunity.

Sterling Tools, the next Sundaram Fasteners?

In August 2016, I diligently reported that several eminent investors such as Dolly Khanna, Anil Kumar Goel, Seema Goel, Jagdish Kumar Agarwal etc have parked themselves firmly in Sterling Tools.

I also conducted a meticulous assessment of the stock and opined that it has all the credentials such as high operating margins, high RoE, high ROCE, low debt-equity ratio, high dividend payout and consistent operating performance to qualify to be in the hallowed portfolios of the wizards.

I emphasized two significant points. The first is that the promoters and the eminent wizards control 83.60% of the equity which means that the quantum available for sundry investors is very low.

According to one school of thought, stocks with low liquidity enjoy “supply scarcity” with the result that well-heeled investors who are desperate to get their hands on the stock are willing to pay exorbitant premiums for the stock.

The second important point is that Sundaram Fasteners, Sterling Tools’ arch rival, is quoting at a P/E which is several times higher than that at which the latter is quoting.

The surprising part is that Sundaram Fasteners has a lower RoE of 13.48 as compared to the RoE of 19.48 churned out by Sterling Tools.

I opined that this means that it is only a question of time before Sterling Tools surges to catch up with its illustrious peer, Sundaram Fasteners.

I was right because soon after my report, Sterling Fasteners has spurted a fantastic 56%. The YoY return is 121%.

More mega gains are expected from Sterling Tools

Dharmesh Kant’s professional analysis of Sterling Tools is worth reading line by line:

“We recommend to BUY Sterling Tools Limited (STL) for a target of INR 1,207 – 20x on FY18E EPS (+32% Upside).

One of the largest fastener manufacturers in India:

Sterling Tools is one of the largest manufacturer of fasteners in India, with a market share of ~28%. The company is supplier of high tensile (HT) fasteners to Honda Motorcycle Scooter India Private Limited (HMSI) and Maruti Suzuki India Limited (MSIL). In top line 2-wheeler accounts for 25% , passenger vehicles (~15%), commercial vehicles (~25%), and farm equipment (~7%-8%) of total sales. STL’s other customers include Tata Motors, Ashok Leyland, Daimler, FIAT, Hero Motocorp, Mahindra & Mahindra, Volvo, Eicher, TAFE and General Motors. Sales to OEM form ~85%, after market ~8% and exports constitutes ~7% of total revenue. STL has a capacity of 45,000 MT spread across three plants currently running at 70-75% utilisation. The company has started work on the phase-I expansion for a new plant in Gujarat. Total capex for the project will be INR 50cr likely to be commissioned by September 2017.

Triggers in place for an uptick in automobiles sales:

Good monsoons and 7th pay commission have accelerated the volume growth for the leading automobile companies across segments. STL’s major principal’s Maruti Suzuki and HMSI reported 13.5% YoY and 23.5% YoY volume growth respectively for 3 month period Aug-Oct 2016. Passenger vehicles, 2 wheelers, commercial vehicles or tractors all are poised to post strong volume growth in FY17. STL’s strong market positioning in automobile fastener segment having sizeable market share in OEMs lends heft to its growth prospects for foreseeable future.

Strong financials:

The company delivered a CAGR of 10% in revenues during FY13-16; during the same period PAT delivered a CAGR of 43% aided by improving margins and cash flows. Strong focus on costs and tight control over working capital has yielded desired operating efficiencies for the company. Sound balance sheet management has led to sharp improvement in return ratios over the years. [ROE 11% in FY13 to 23% in FY16, ROCE:15% in FY13 to 24% in FY16].

Valuations & View:

Conducive macro factors like good monsoons, 7th pay commission roll out, passage of GST, increasing localization by OEMs will propel STL on growth path going forward. We expect earnings growth of 20% over FY16-18E. STL trades at 15.1x FY18E EPS of INR 60.3. We initiate coverage on the stock with a ‘BUY’. We value the company at 20x FY 18E EPS with a target price INR 1,207, giving an upside of 32%.”

Stock split leads to mega gains?

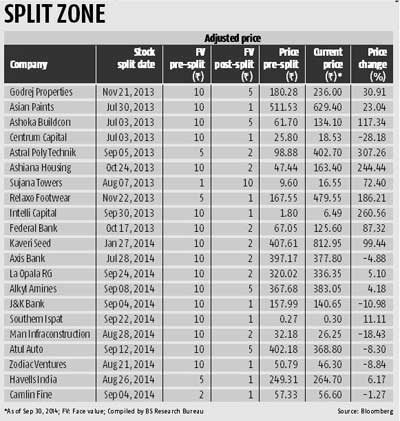

Sterling Tools has announced a sub-division of every equity share of Rs. 10 each into five equity shares of Rs. 2 each.

One question that has baffled stock market experts over the decades is whether there is a cause and effect relationship between a stock split and the upward trajectory of the stock.

Neha Pandey Deoras of Business Standard has conducted an in-depth study of the subject and also interviewed eminent luminaries like Arun Kejriwal, Vikram Dhawan, Piyush Garg etc. The consensus of the experts is that for some reason a stock is perceived to be “cheaper” after the stock division and this attracts investors in droves and pushes the stock price upwards.

A similar opinion is expressed by Preeti Kulkarni of ET.

Examples are quoted of several stocks like La Opala, HDFC Bank, Titan Industries, Rallis India, Cox & Kings, Rain Commodities and Bajaj Corp which split their shares and shot up in a vertical trajectory on the back of improved operating performance.

The experts are at pains to emphasize that the stock split per se does nothing but if it is accompanied by superior operating performance, there is heightened investor interest in the stock and this leads to more gains for investors than what they might have got without the stock split.

PPAP Automotives, also on a growth trajectory

I have also drawn attention to the fact that Dolly Khanna and Anil Kumar Goel have commandeered large quantities of PPAP Automotives, also a top-quality micro-cap stock.

However, PPAP Automotives has not been able to match the performance of Sterling Tools. It is up only 17% on a YoY basis.

Conclusion

I have earlier referred to the opinions of leading experts (see Auto ancillaries in a sweet spot, the best bet for long-term investors, Auto ancillary ramping up and Auto parts: Best Buys) that auto ancillary stocks are on the threshold of a boom and that their reasonable valuations makes them ideal investment opportunities. The expert analysis by Dharmesh Kant with regard to Sterling Tools confirms the veracity of this hypothesis!

which one is better ppap or sterling tools, not liking ppap automotive

#Nivezareview –

Sterling tools operates as a manufactures of fasteners in India and they have more than 25% of market share in India. The customers of the company are big corporate such as Honda Motorcycle, Maruti Suzuki, Tata Motors, Ashok Leyland, General Motors, Volvo etc. Overall Auto sector is in a good condition and hence demand for the company’s products will remain good for next few years. So Looking at it one can look to buy a stock from long term perspective and can accumulate it on good decline in prices.

Who is best PMS manager?