Yesterday, the eve of Diwali, was a glorious day for the ace stock pickers. Several of their stocks surged and tripped the upper circuits. The ace investors had a big smile on their faces. Novice investors who had followed the ace investors and cloned their stock picks also had much to rejoice about.

Astec Lifesciences – minnow under the benign guidance of a blue-chip behemoth

| ASTEC LIFESCIENCES LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | SEP 2016 | SEP 2015 | % CHG |

| NET SALES | 90.33 | 68.72 | 31.45 |

| OTHER INCOME | 0.3 | 1.03 | -70.87 |

| TOTAL INCOME | 90.63 | 69.75 | 29.94 |

| TOTAL EXPENSES | 68.56 | 61.66 | 11.19 |

| OPERATING PROFIT | 22.07 | 8.09 | 172.81 |

| NET PROFIT | 11.25 | 2 | 462.5 |

| EQUITY CAPITAL | 19.5 | 19.46 | – |

Astec Lifesciences’ blockbuster Q2FY17 results and the resultant surge of the stock to trip the upper circuit of 20% did not surprise Vijay Kedia.

It also did not surprise me because it is an elementary proposition that when a minnow like Astec gets taken over by a blue-chip behemoth like Godrej Agrovet, good things are bound to happen for the minnow sooner or later.

In addition to Vijay Kedia, we have to pay tribute to Gaurav Parikh for his masterful analysis of the prospects of Astec Lifesciences. Gaurav Parikh rightly rationalized that not only would Godrej transform the business prospects of Astec but may also use the latter as a backdoor entry for listing Godrej Agrovet. Of course, if the eventuality of listing Godrej Agrovet through Astec ever happens, Astec will be locked in upper circuits for weeks together.

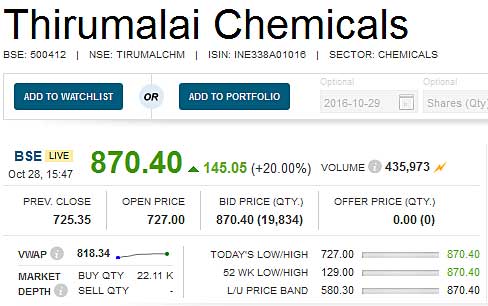

Thirumalai Chemicals – expansion likely to boost prospects

| THIRUMALAI CHEMICALS LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | SEP 2016 | SEP 2015 | % CHG |

| NET SALES | 254.58 | 230.32 | 10.53 |

| OTHER INCOME | -0.03 | 2.94 | -101.02 |

| TOTAL INCOME | 254.55 | 233.26 | 9.13 |

| TOTAL EXPENSES | 221.45 | 234.97 | -5.75 |

| OPERATING PROFIT | 33.1 | -1.71 | 2035.67 |

| NET PROFIT | 16.39 | -14.94 | 209.71 |

| EQUITY CAPITAL | 10.24 | 10.24 | – |

Missing out on a stock backed by Dolly Khanna and Rajiv Khanna, her illustrious alter ego, is sheer buffoonery. Who would like to say no to multibaggers handed over on a platter?

Thirumalai Chemicals reported blockbuster Q2FY17 results which sent its stock price spiraling 20% and tripping the upper circuit. In just the past 12 months, the stock is up a mind-boggling 240%.

The good things may be starting for Thirumalai Chemicals because the Company has announced that is expanding its operations in India and Malaysia and increasing capacity of phthalic anhydride, maleic anhydride, food ingredients, fine chemicals, etc.

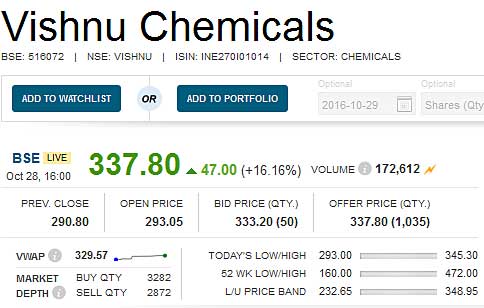

Vishnu Chemicals – on a comeback trail

When the stock price of Vishnu Chemicals slumped in the wake of poor Q1FY17 results, Ashish Kacholia did what any sensible investor should do – he increased his stake. He holds a massive chunk of 408,523 shares as of 30th September 2016.

The stock appears to be in a hurry to make up for lost time. It spurted a magnificent 16% to close at Rs. 338, giving its investors much to cheer about.

The management had indicated that the Q1FY17 results were bad on account of some aberrations. Hopefully, the Q2FY17 results will make up for it and thrill investors.

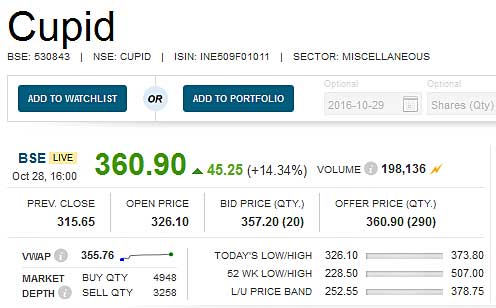

Cupid – monopoly product with insatiable demand

| CUPID LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | SEP 2016 | SEP 2015 | % CHG |

| NET SALES | 22.1 | 15.73 | 40.5 |

| OTHER INCOME | – | ||

| TOTAL INCOME | 22.1 | 15.73 | 40.5 |

| TOTAL EXPENSES | 13.05 | 9.04 | 44.36 |

| OPERATING PROFIT | 9.06 | 6.69 | 35.43 |

| NET PROFIT | 5.36 | 4.11 | 30.41 |

| EQUITY CAPITAL | 11.12 | 11.12 | – |

Cupid qualifies as a no-brainer given that Basant Maheshwari, who is known to be a stickler in picking quality stocks, has given it his vote of confidence.

I have already conducted a meticulous assessment of the prospects of Cupid and explained that it scores well on all parameters such as high RoE, quality management, monopoly product (female condoms), debt-free status and other virtues.

Cupid reported blockbuster Q2FY17 results with a 40% surge in top line and 30% surge in the net profit.

The stock has a stellar history of being a mega multibagger. It is still a micro-cap with a market capitalisation of only Rs. 400 crore. Whether, there are more gains that can be harvested from the stock requires to be seen.

Conclusion

The practice of cloning the stock picks of eminent wizards has proved to be an extremely profitable exercise so far. Whether our good luck holds in the coming future as well requires to be seen!

Waiting for result of sudarshan chemical nd nocil…

Nice articles, Arjun ! I am big fan of the site and your articles in particular. Have made some decent gains from some of the stock recommendations as well. Hope your Deepavali is going great 🙂

What a spectacular rise in all the 4 stocks yesterday!!!

Happy Diwali to Arjun, his team and all members of this form, nice article as always.Examplary stock picking skills from ace investers.

Happy Diwali Arjun,

Your blog is excellent I follow daily my day start with your blog keep update good stock.

Ramana.

Excellent work , arjun and team

Happy Diwali

God bless you

i m a new reader of your blog, arjun, i have got a lot of new ideas about stock picking from this blog. i have already invested in some stocks like cosmo films, adf foods and so on. you are doing a wonderful work, keep it on, god bless you. happy diwali.

HAPPY DIWALI.ARJUN & TEAMS

Best Diwali gift for Ace Investors