Dolly Khanna’s latest stock pick: Visaka Industries

Dolly Khanna’s modus operandi while buying stocks is to visit Dalal Street in a stealthy manner.

Such is her mastery in stealth and disguise that even I, despite my 24×7 vigil on Dalal Street, could not detect her presence when she came shopping.

Anyway, Dolly can never keep her purchases a secret from her devoted fans for too long.

According to the latest top-secret information accessed by me, Dolly is now the proud owner of 115,968 shares of Visaka Industries as of 31st March 2017.

The holding as of 30th June 2017 is not known.

The investment is worth Rs. 5.89 crore at the CMP of Rs. 508.

The data shows that Dolly visited Dalal Street on ten occasions to make her purchases.

On one occasion (9th December), Dolly had to be content with buying only two shares due to the absence of sellers.

However, she has been relentless in her pursuit of the stock and came back later to persuade the sellers to part with their holding.

| Date | Nos of shares bought | Total holding |

| 20.05.2016 | 46692 | 46692 |

| 27.05.2016 | 47661 | 94353 |

| 03.06.2016 | 2100 | 96453 |

| 17.06.2016 | 8117 | 104570 |

| 21.10.2016 | 2293 | 106863 |

| 11.11.2016 | 1500 | 108363 |

| 02.12.2016 | 2523 | 110886 |

| 09.12.2016 | 2 | 110888 |

| 03.03.2017 | 3020 | 113908 |

| 10.03.2017 | 2060 | 115968 |

Anil Kumar Goel sells stock, realizes folly and takes U-turn

Anil Kumar Goel held 223,000 shares as of 1st April 2016.

In a surprising move, he started dumping his holding as can be seen from the chart.

| Date | Purchase/ (sale) | Total holding |

| Op Bal as of 01.04.2016 |

223000 |

|

| 02.09.2016 | (3000) | 220000 |

| 16.09.2016 | (3000) | 217000 |

| 21.10.2016 | (2000) | 215000 |

| 28.10.2016 | (5000) | 210000 |

| 25.11.2016 | 10000 | 220000 |

In fact, on one occasion (21st October), he crossed Dolly’s path. He sold 2000 shares of Visaka which Dolly scooped up.

On 25th November, Anil Kumar Goel realized that he is making a colossal mistake by selling Visaka (especially when Dolly was buying them).

He immediately staged a U-turn and bought a chunk of 10,000 shares to make good the folly.

Anil Kumar Goel’s holding in Visaka as of 31st March 2017 stands at 2,20,000 shares which is worth Rs. 11.17 crore as of date at the CMP of Rs. 508.

The holding as of 30th June 2017 is not known.

Huge multibagger gains from Visaka Industries

The two stalwarts have raked in a massive fortune from Visaka Industries.

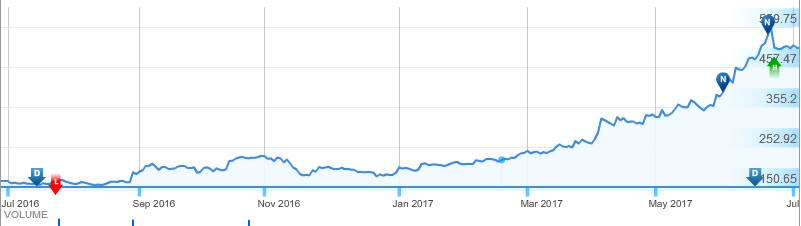

The YoY gain is itself an eye-popping 222%.

If one looks at the gains since Dolly’s first purchase of 20th May 2016, massive gains of 275% are on the table.

This shows that Dolly Khanna is the ultimate master of timing.

Visaka Industries is a beneficiary of Porinju Veliyath’s “Trillion dollar opportunity in housing and infra” theory

Prima facie, it appears that Visaka Industries is a beneficiary of the “Trillion Dollar opportunity in Housing & Infra” referred to by Porinju Veliyath whilst recommending Everest Industries and Ramco Industries to us.

10x in 3 yrs! Many more KNRs in making

Trillion Dollar opportunity in Housing & Infra coming up, Grab it! https://t.co/2h7d3HW1Nv— Porinju Veliyath (@porinju) May 9, 2017

It is worth noting that Visaka and Everest are arch rivals in the market place.

Porinju appears to have recommended Everest Industries because it underperformed Visaka Industries on a YoY basis.

The recommendation has worked out well with Everest Industries having given a gain of 34% since then.

However, Ramco Industries is more or less flat since then.

Is Srikalahasthi Pipes a good stock to play the infra theme?

Dolly Khanna and Anil Kumar Goel are both bullish on Srikalahasthi Pipes.

While Goel holds 948,200 shares as of 31st March 2017, Dolly holds 636,313 shares.

| SRIKALAHASTHI PIPES LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 1,385 | |

| EPS – TTM | (Rs) | [*S] | 35.27 |

| P/E RATIO | (X) | [*S] | 9.88 |

| FACE VALUE | (Rs) | 10 | |

| LATEST DIVIDEND | (%) | 50.00 | |

| LATEST DIVIDEND DATE | 18 AUG 2016 | ||

| DIVIDEND YIELD | (%) | 1.71 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 204.61 |

| P/B RATIO | (Rs) | [*S] | 1.70 |

[*C] Consolidated [*S] Standalone

| SRIKALAHASTHI PIPES LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | MAR 2017 | MAR 2016 | % CHG |

| NET SALES | 432.2 | 315.05 | 37.18 |

| OTHER INCOME | 5.07 | 7.52 | -32.58 |

| TOTAL INCOME | 437.27 | 322.58 | 35.55 |

| TOTAL EXPENSES | 376.62 | 245.87 | 53.18 |

| OPERATING PROFIT | 60.65 | 76.71 | -20.94 |

| NET PROFIT | 31.19 | 45.47 | -31.41 |

| EQUITY CAPITAL | 39.76 | 39.76 | – |

Entry barriers + competitive advantages make Srikalahasthi Pipes a good buy: Reliance Securities

Reliance Securities has painted a rosy picture of Srikalahasthi Pipes with the following logic:

“SPL is an Andhra Pradesh based integrated manufacturer of Ductile Iron (DI) pipes. Since it is integrated, it enjoys significant competitive advantage, while several cost-optimization measures – including commissioning of Sinter Plant – has led to sustained margin expansion

– Lack of adequate sanitation has been prompting the government to focus on improving water supply and sewerage infrastructure through multiple schemes like JNNURM & Swachh Bharat Mission and “Smart Cities Mission”. Thus we believe that the demand for DI pipes would witness a healthy growth in medium to long-term

– DI pipes – which are widely recognised as the industry standard for modern water and waste water system – find application in water transportation and sewage management

– With ~75% market share in Southern & Western markets augers well for SPL, as the industry enjoys strong entry barriers for being capital intensive having long gestation period”

Capacity expansion & demand revival augers well for Srikalahasthi Pipes: Religare

Religare has recommended a buy of Srikalahasthi Pipes on the following logic:

A strong play in water infrastructure space…

– The Government’s continued thrust on water supply & sanitation infrastructure is reflected in steady increase in its allocations through related schemes over the years.

The Ministry of Drinking Water & Sanitation has been allocated Rs 200bn for FY18 (up 21% over FY17). The allocation under PMAY increased by 53% to Rs 230bn for FY18.

Further, open defecation free villages have now been given priority for piped water supply. This should boost the demand for DI pipes.

With market leadership & steady capacity additions, SPL is well placed to capitalize on the available opportunities.

– SPL commands ~15% market share in DI pipes market across India and ~75% in South & Western Zone, which it primarily caters to. It has a fully backward integrated manufacturing facility which includes a sinter plant, coke oven plant, power plant and sewage treatment facilities, thus giving it a significant cost & competitive advantage.

– Alliance with Electrosteel Castings (ECL) has clearly provided SPL a strategic advantage. The experience and brand image of ECL in Ductile Iron Pipes arena in the domestic and export market has / would continue to help SPL for its DI Pipes business growth. ECL’s technical expertise has been adopted in SPL’s various backward and

forward integration projects, thus providing it competitive edge.

– SPL has recently expanded its DI pipes capacity by 75,000 TPA at its existing facility, which has become operational in Q4FY17. The company has also undertaken upgradation and modification of Blast Furnace. This should enable it meet its future demand requirements for DI pipes. Further, SPL is installing an additional coke oven battery and is enhancing its power plant capacity by 1.5MW, which is expected to go on stream by Q4FY18. This should result in meaningful cost savings.

– Led by capacity expansion and demand revival, SPL’s revenue and PAT are estimated to grow at a CAGR of 15% & 21.4% over FY17-19E with improved volume offtake. While growth in FY17 was subdued, we expect a meaningful revival over the next two years.

Higher input cost could keep the EBITDA margins under pressure in FY18E. However, we expect the same to improve in FY19E, led by better capacity utilization and backward integration initiatives. At CMP of Rs 320, SPL is trading at 6.2x FY19E EPS. The company deserves to trade at better valuations, given its impressive track record of growth, leadership position in DI pipes, bright growth prospects and declining debt-equity. We recommend a BUY on the stock with a target price of Rs 416.”

Are Kridhan Infra and SPML Infra good buys as well?

We also have to keep an eye on Kridhan Infra and SPML Infra.

Mudar Patherya has assured that SPML Infra is at “inflection point” which means that the stock is expected to rocket into the stratosphere sooner or later.

DD Sharma has come in strongly with a buy recommendation for Kridhan Infra.

His recommendation is supported by BoB Capital which claims that gains of upto 99% are waiting to be harvested from the micro-cap.

Conclusion

It is quite obvious that all five stalwarts, Dolly Khanna, Porinju Veliyath, Anil Kumar Goel, Mudar Patherya and DD Sharma, are bullish about the infra boom that is going to be unleashed soon.

If we remain mute spectators, we will cut a sorry face. Instead, we need to urgently grab our respective favourite infra stocks and prepare for the gains to gush into our portfolios!

Shift to large caps as any down turn will result into huge losses in small caps ,most of small caps are flying with only reason of speculation .

you are right. shift to stocks like dhfl, ril, yes bank, hdfc bank, nbcc

Even after recent rally in stock price of Visaka Industries, I do not think this stock will see any major correction. I agree that many small caps have rallied a lot and may correct but Visaka is getting rerated my friends. Its still trading at trailing PE below 20, and if we look at business prospects of Visaka, its great. Company is transforming to a proxy play offering value added products in construction sector. Its VNext range of products have exponential business potential. As per mgmt, these products are substitute of plyboard which is a 20,000 crore segment. Company is doing all the right things and growing this segment contribution every year. V Next range contribute 15% revenue in its building material business, rest comes from asbestos sheets, see the improvement in margins over last 4 to 6 quarters to dig deeper. Already going through expansion in fibre cement board and textile sector, dividend of Rs. 6 paid in June, dividend yield still above 1% and stock trading at trailing PE below 20, market cap to sales still below 1, did sales of around 950 crores last year and market cap is only 800 crores, debt to equity ratio improved to 0.63 from 1.3. So its a buy and add on all dips. Thanks, Mani

Yes stock goes up in every boom with lot of justification, but come on ground after every market correctlon,see the graph of last 25 years. I dont say it is bad company but is just average organstions like many hundreds other available.Use of asbestos is banned in most developed countries due to health hazards but I dont know when it will be baned in India.

I am not counting on asbestos, it was surely a mediocre company till it was operating in asbestos sheets. But company has shifted its focus to VNext range of products, all high reputed builder are their clients for Vboard, Vpanel, Vplank range. All developed countries are using fibre cement board instead of plywood considering its numerous advantages like fire, termite resistant over plyboard. Moreover, its cheaper and last for long (15 to 20 years) compared to plyboard life of 5 to 10 years.Its also economical but in India still more carpenter uses ply to build interiors. Its just matter of time as the awareness increases, these products are gaining acceptance over plyboard. Now its but obvious that investors like Dolly Khanna and Anil Goel with such high profile with not invest in company which is in asbestos sheet business and is banned in other countries, they can foresee which layman investor cant. Its because of transformation, the company is going through. Mr. Vamshi Krishna, who has elevated as joint director recently is the force behind this division.

Company’s fibre board division which is doing well, mgmt is targeting revenue contribution of 50% from fibre cement and textile business together in next 2 to 3 years which is currently around 30 to 35%. VNext range contributes only 15% of total revenue from building material with lot of growth potential. Promoters increased their stake to 41% in March quarter, have a dividend payout history of 28 years without break tells companys integrity.

If all small caps have rallied, it does not mean that all will fall during market correction, some will survive falling hardly by 10 to 15% or say 20% from their highs and bounce back sharply making new highs later, and many will erode your capital.

Investors looking for 5x or 10x gains with long term view will surely not get worried to keep churning portfolio by getting into large caps by worrying about correction of 20%, isnt it?

No doubt that big investers has made money by putting few right bets ,but in many compnies they had also made money due to hype created in very ordinary compnies and investers cloning those will surely lose money heavily ,once market give correction.

Dear Kharb, please don’t make a general statement here. I agree that following these stalwart of dalal street is not a right strategy always, they surely started accumulating at lower prices. What I mean to say is if company is transforming and is operating in a sector which is bound to grow in coming years and if mgmt is ethical and prudent and do reward minority share holders, we should not ignore such companies. No bear market has lasted for more than 15 months in India, and any correction in bull market will surely short lived, if you have picked the right company and really ready to hold on your investment with 2 to 3 years at least, you can invest without any second thought about it. We have multiple examples, Wim Past also rallied from 200 to 400 and than to 800 in just a month’s time. Now its price is 3000 (pre bonus). We have seen Cera, Kajaria, we have seen Mayur Uniquoter, we have seen La Opala… Avanti Feeds is a recent one, all were micro caps and turned to be multibagger ones. Visaka till 2010 was a company making conventional products but with VNext range of products, you cant count it as a ordinary company anymore.

Bro, your “latest top-secret information accessed by me” is nothing but AR of visaka Industries, why making it so sensational ? LOL

They should have informed about the Dolly Khanna position earlier. Now it returns more than double. I don’t think this is right time to buy.

Very impressive returns.