(Image credit: Chennai Angels)

One can see that Dolly is implementing a carefully thought out strategy when picking stocks.

Her favourite sectors at present are the textiles sector and the specialty chemicals sector. Experts have opined that both sectors will do well as a result of the slowdown in China.

A few days ago, we analyzed the three stocks that Dolly has picked in the specialty chemicals space. Each stock is notching up handsome gains.

Even in the textiles space, Dolly has chosen three stocks. These are Nandan Denim, RSWM and Nitin Spinners.

All three stocks are doing well and have heavily out-performed the benchmark indices.

| Stock | Holding as of 31.03.2016 | Value of holding (Cr) | YoY gains (%) |

| Nandan Denim | 558,373 | 8.65 | 109 |

| RSWM | 424,220 | 15.61 | 53 |

| Nitin Spinners | 560,176 | 3.53 | 43 |

| 27.79 |

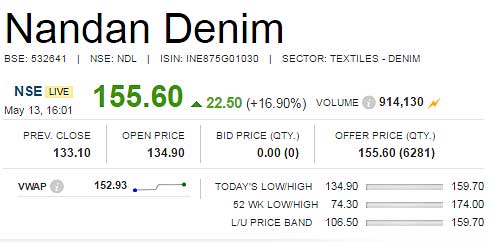

Nandan Denim jumped 17% on Friday to rest at Rs. 155. What caused the surge is not known.

According to a report in the Hindu, Nandan Denim will become “Asia’s largest denim manufacturer” by June 2016 when the expansion plan goes on stream.

It is stated that there will be “exploding global demand” for denim as several international players are sourcing denim from India “due to raw material and other input advantages” apart from stable economic and political environment.

It is also stated that the current per capita consumption of denim in India is at 0.3 pairs per person as compared to 2 pairs in China and 8/9 pairs in UK/US. This implies that there is huge scope for expansion. It is also pointed out that the current domestic consumption of denim is about 700-800 MMPA, while 200-300 million metres are exported. Assuming the domestic market grows at a compounded annual growth rate of 15-18 per cent (the current growth rate), the demand would reach 2 billion metres by 2020.

RSWM also surged 16% on 11th May after it reported robust Q4FY16 results.

Shares of RSWM gain 16% after the company reported a 7% YoY rise in net profit for the March quarter. pic.twitter.com/tKf9fa1Hxv

— ETMarkets (@ETMarkets) May 12, 2016

Riju Jhunjhunwala, MD, RSWM stated that the company will see 10-15% top-line growth in FY17 and will be debt free by FY19. The current debt is around Rs 8800mn and RSWM plans to repay around Rs 2200mn each for the next two years.

Riju Jhunjhunwala, MD, RSWM: Company will see 10-15% topline growth in FY17. https://t.co/J1YN2uOeew

— CNBC-TV18 News (@CNBCTV18News) May 12, 2016

It is significant to note that RSWM appears to be Dolly Khanna’s high conviction stock pick when you consider the amount of funds that she has pumped into the stock relative to the other textile stocks.

RSWM’s MD revealed that the Company has now completed its aggressive expansion plan (which had depressed the financials) and that it would now reap the benefits of the same.

It is obvious that if RSWM does achieve the promise of becoming debt-free, it will be re-rated and more gains will effortlessly from the stock.

Nitin Spinner is also on an aggressive expansion spree. Dinesh Nolkha, its MD, revealed that for FY17, the company has plans to increase capacities which would come on stream by the year-end. It is also stated that the debt, which presently stands at Rs. 290 crore, would be reduced by Rs. 50 crore in FY17.

Daljeet Kohli has studied Nitin Spinners in detail and recommended a buy on the basis that the expansion plans will be a “game changer” for the Company.

Vardhman Textiles is undisputed leader of textile sector .

Ambika cotton , kprmill ,suryalakshmi cotton and Kallam spinning are way cheaper and all of them have excellent management except suryalakshmi.

#Stock #Market #Tips::

Nandan Denim is looking reasonable at current levels as the company is at PE of 5.46x which is decent and undervalued. Looking at past five years performance, revenues are growing at CAGR more than 20% which is remarkable for the company. Company is paying debt significantly. As compared to FY14, FY15 is reasonably down. With the current valuation, Nandan Denim is a true multibagger stock. RSWM is looking good as far as revenue growth is in the picture but company is dealing with high debt. But the positive out of it is the company managed to cut short the debts in last couple of years. This is a positive sign that earnings are growing and the debt is minimizing. Nitin Spinner is again a cheap bet at current levels, trailing at PE of 3.4x which is reasonable. Last years company borrowed huge for their expansion plans and aggressively managed the outcomes as well. It could be a good buy at current levels.