Dolly Khanna lost colossal fortune of Rs. 100 crore by prematurely dumping Relaxo Footwear from portfolio

One of Dolly Khanna‘s attributes is her penchant to tinker with her portfolio.

We have seen numerous examples of this in the past where Dolly has dumped stocks which appeared to be mega baggers.

Sometimes, the strategy is sensible and has saved her from losses.

In Hawkins Cooker and Nandan Denim, for instance, Dolly escaped in the nick of time before the stocks imploded and were reduced to a shadow of their former selves (see Dolly Khanna Escapes Hawkins Cookers’ Carnage Even As Punters Rue Their Luck).

There are also examples of other stocks like Cera, RS Software, Avanti Feeds where Dolly bolted.

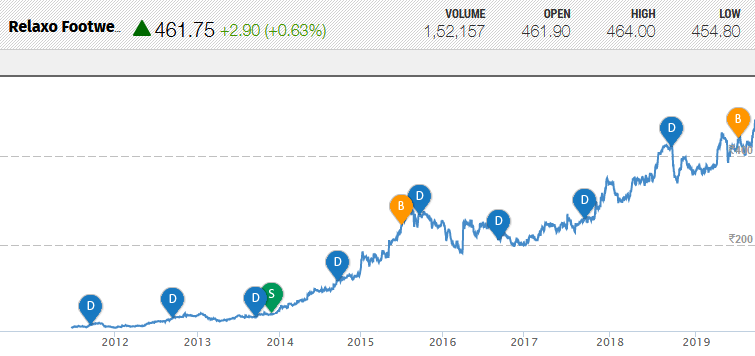

However, the strategy has badly backfired in Relaxo Footwear.

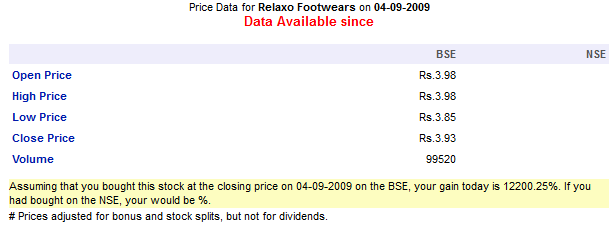

As of 31st December 2012, Dolly held 120,342 shares of Relaxo.

This would have morphed into an hefty holding of 24,06,840 shares as of date because there was a 1:5 split in November 2013 and two 1:1 bonuses in July 2015 and June 2019.

The investment would have grown from a petty amount of Rs. 93.86 lakh into a fortune of Rs. 116.50 crore, an increase of 1100%.

Unfortunately, Dolly systematically reduced her holding in the stock.

As the table below shows, she aggressively dumped the stock.

| Dolly Khanna’s holding in Relaxo Footwears | |

| 01.04.2014 | 522,815 |

| 04/04/2014 11/04/2014 18/04/2014 25/04/2014 02/05/2014 09/05/2014 16/05/2014 23/05/2014 30/05/2014 06/06/2014 13/06/2014 20/06/2014 30/06/2014 04/07/2014 11/07/2014 18/07/2014 25/07/2014 01/08/2014 08/08/2014 15/08/2014 22/08/2014 29/08/2014 12/09/2014 19/09/2014 30/09/2014 10/10/2014 17/10/2014 24/10/2014 31/10/2014 07/11/2014 21/11/2014 28/11/2014 05/12/2014 12/12/2014 19/12/2014 31/12/2014 02/01/2015 09/01/2015 16/01/2015 23/01/2015 30/01/2015 06/02/2015 13/02/2015 20/02/2015 27/02/2015 06/03/2015 13/03/2015 20/03/2015 27/03/2015 |

-3500 -1000 -1000 -5750 -6500 -4000 -4340 -4510 -3455 -1150 -2668 -1250 -5310 -2250 -3250 -1510 -3000 -1291 -520 -2030 -1510 -1000 -2881 -500 -1000 -1175 -1650 -750 -1300 -3368 -1078 -3026 -2197 -2124 -1321 -5640 -369 -2652 -6750 -3033 -2219 -3700 -6594 -1247 -4859 -7298 -5305 -3494 -2850 |

| 31.03.2015 | 383,641 |

She repeated the exercise in the other years as well till her holding was reduced to zero.

The unfortunate result is that Dolly lost an opportunity to effortlessly pocket a fortune in excess of Rs. 100 crore.

Relaxo Footwear is immune to slowdown & recessions because of low ticket size and heavy branding

According to a report in the ET by Amit Mudgill, Relaxo is unaffected by the woes of economic slowdown and is continuing to churn out hefty returns year after year.

This is probably because Relaxo produces footwear such as ‘Hawaii Chappals’ which are sold under the brand names Sparx, Flite, Bahamas and Schoolmate.

These are low-ticket and essential items that people purchase without a second’s thought.

Also, the footwear is promoted by A-list Bollywood celebrities like Salman Khan, Akshay Kumar and Ranveer Singh.

This makes the products irresistible to the masses.

Relaxo is India’s second-largest footwear maker (Bata is the largest) and has clocked a compounded annual growth of 14 per cent in five years to FY19.

Further, its drive towards product premiumisation may help it log double-digit sales growth in value terms, if not in volume terms.

The ET report also points out that Relaxo’s prospects are favoured by the fact that it is strengthening the distribution network and making strong investment in branding.

Relaxo is a category dominator and a compounding stock: Saurabh Mukherjea

Relaxo is recommended by none other than Saurabh Mukherjea, the authority on Coffee Can Investing.

Saurabh gave strong logic to support his buy recommendation.

“A category dominator like Relaxo has a bright future and there is very little dependence between Relaxo’s fortunes and the latest GDP print or the NBFC crisis and so on. These sort of stocks provide opportunities which does not really depend on the outcome of RBI policy or elections and so on. You buy companies which are category dominators and you compound with them over several years,” Saurabh advised.

Brokerages are also gung-ho about Relaxo’s prospects

Dolat Capital pointed out that Relaxo has strong presence mainly in North and eastern parts of India and will continue to prosper.

“Relaxo will continue its journey of double-digit sales growth with new in-season launches and a strong product portfolio“.

It was also pointed out that solid fundamentals of operating model, in-house manufacturing capabilities, premiumization and rising aspirational levels within the target segment augur well for the company.

Sharekhan is also optimistic.

It pointed out that the consumer shift from non-branded to branded products, the company’s distribution enhancement and capacity expansion would continue to drive growth for Relaxo.

Karvy has also given the stock a clean chit:

“Despite the overall consumption decline, particularly in the rural market, Relaxo seems to have managed to maintain good volume growth. We value the stock at a five-year average one-year forward P/E of 40 times on FY21E EPS of Rs 11.8,” Karvy said.

Not able to understand the whole logic and the heading given to this post.

Do you mean that you are celebrating and eulogizing Dolly Khanna because she exited Relaxo counter long back before it would give stellar returns. Looking at the performance of Dolly Khanna stocks and investment, I think we should be careful in following such personalities – we come to know about their entry as well as exit quite late, by that time the counter has moved tremendously leaving ordinary folks in lurch.

Why are you suddenly discussing only good stocks and good investors?

Usually this time-pass blog features a stock when it is at a life time high … like the police in Desi movies, that comes after all the action is over ?

Looks like this blog finally spotted one small cap winner among thousands of duds and hence the excitement. There isn’t any critical analysis of the stock except brokerage recos, dolly Khanna’s misadventure and branding and advt of its products by big celebs. With sales growth of around 11%, this stock is commanding a PE of 67 indicating complete bubble zone. I am sure every investor has a story to tell that once sold stock has become a multibagger. DK is no exception and don’t know why this post chose to run the salt on wound.

I like to read this blog for it’s style of writing and it makes me to feel excited. I should appreciate the content writers for this skill. Regarding the stock advise, I don’t take it seriously bcz it will be discussing once upon a time events and here comes the beauty of the blog that, they can attach few line from renowned celebrities or stock market punters in the past to add colours to the content….

I just read other comments to this post, it all given befitting reply…. LoL