Latest newsletter of Equitymaster

Equitymaster’s latest newsletter has put the spotlight on one of the stock picks of Akash Prakash’s Amansa Capital.

The virtues of the stock are described thus:

(i) The company is the market leader in its industry. It has, over the years, grown its profits faster than its sales.

(ii) Over the last ten years, sales have grown at a compounded annual rate of 25%, while the profits have grown at a whopping 50%.

(iii) The company has latched on to a multi-year mega trend both in the domestic and international markets.

(iv) Apart from riding this trend, the management has made the business stronger by backward integration. They have forayed into exports (now around 60% of the company’s revenues) and they have allocated capital wisely.

(v) The other numbers are good too. Margins, return ratios, debt levels, and cash flows, everything looks to be in top shape.

|

A Company with strong fundamentals |

|

| Growth | 10 Y CAGR |

| Sales | 18% |

| Operating Profits | 29% |

| Net Profits | 50% |

| Return Ratios | 10 Y Avg |

| Return on Equity | 32% |

| Return on Capital Employed | 31% |

| Debt to Equity | 0.6 |

| Operating Cash Flows/ Profits | 1.9 |

(Source: Equitymaster)

(vi) The company’s journey may have just begun. Not only is it building upon its success, it is continuously introducing new products in the Indian market and expand abroad.

(vii) Going by its track record, the company is well poised to execute its plans to perfection and keep the growth momentum going.

(Image credit: Equitymaster – Chart shows that over 10 year there is 50% CAGR growth in bottom line and average return ratios are in excess of 30%

Unfortunately, the name of the stock will be revealed only on Monday, 25th June 2018.

Latest portfolio of Amansa Capital

To decipher the name of the stock being referred to by Equitymaster, we have to first peep into the latest portfolio of Amansa Capital.

For this, we have to take the assistance of Ayesha Faridi and Karunya Rao of ETNow.

The two charming ladies have ripped open the portfolio and explained all the salient features of the stocks therein.

#SmartPortfolio | What are the stocks Akash Prakash of Amansa Capital is holding on till the end of Q4FY18 and what are the ones he is removing from his portfolio. ET NOW's @RaoKarunya takes us through his investment bucket pic.twitter.com/jsYoHwJixc

— ET NOW (@ETNOWlive) May 3, 2018

Based on the valuable information provided by Ayesha Faridi and Karunya Rao, I have laboriously pieced together the latest portfolio of Amansa Capital as of 31st March 2018, which is as follows:

| Stock Name | CMP (Rs) | Nos of shares Held | AUM (Rs Cr) |

| Gateway Distriparks Limited | 182 | 94,33,238 | 172 |

| SRF Limited | 1671 | 44,42,241 | 743 |

| Ramkrishna Forgings Limited | 727 | 23,72,440 | 173 |

| Cyient Limited | 707 | 72,35,341 | 512 |

| Eveready Industries India Limited | 237 | 40,00,000 | 95 |

| Zensar Technologies Limited | 1268 | 21,36,385 | 271 |

| Majesco Limited | 469 | 13,03,252 | 61 |

| MindTree Limited | 983 | 67,31,593 | 662 |

| Sundram Fasteners Limited | 626 | 84,96,550 | 532 |

| CEAT Limited | 1326 | 14,02,310 | 186 |

| Bharat Financial Inclusion Limited(SKS) | 1172 | 44,63,628 | 523 |

| Info Edge (India) Limited | 1199 | 37,10,862 | 445 |

| Federal Bank Limited | 83 | 580,01,055 | 481 |

| Crompton Greaves Consumer Electricals Limited | 225 | 175,52,797 | 395 |

| Trent Limited | 317 | 89,75,416 | 285 |

| Dish TV India Limited | 72 | 441,94,773 | 318 |

| PI Industries Limited | 791 | 25,09,397 | 198 |

| Tata Communications Limited | 602 | 51,64,228 | 311 |

| AU Small Finance Bank | 680 | 45,21,582 | 308 |

| Balkrishna Industries Limited | 1101 | 28,31,796 | 312 |

| Aurobindo Pharma Limited | 611 | 69,08,053 | 422 |

| Bharat Forge Limited | 613 | 50,00,000 | 307 |

| Sun TV Network Limited | 836 | 41,04,620 | 343 |

| Total AUM | 8055 |

Is PI Industries the recommended stock?

I rushed to screener.in and meticulously checked to see which stock meets the parameters referred to by equitymaster.

Only one stock ticks all the boxes referred to by equitymaster and that stock is PI Industries.

According to screener, PI Industries has the following virtues:

(i) It is virtually debt free.

(ii) It has good consistent profit growth of 41.85% over 5 years

(iii) It has a good return on equity (ROE) track record: 3 Years ROE 31.94%

The statistics relating to the 10-year, 5-year and 3-year data is also impressive:

| Period | Compounded Sales Growth | Compounded Profit Growth | Return on Equity |

| 10 Years | 20.74% | 72.89% | 30.6% |

| 5 Years | 21.08% | 41.85% | 30.85% |

| 3 Years | 12.59% | 34.74% | 31.94% |

| TTM | 0.03% | -19.86% | 33.08% |

(Source: screener.in)

PI Industries is a worthy long-term pick: Experts

Ruchi Agrawal of moneycontrol.com has conducted a detailed analysis of PI Industries’ fundamentals.

She has explained that the Company is presently in the doldrums because it has posted weak FY18 results.

However, she has assured that this is a passing phase and that the Company will soon go back to its days of glory owing to several positive operating factors like substantial growth in the custom synthesis manufacturing (CSM) segment, healthy order book line-up, limited and reduced exposure to rising global raw material prices and new product launches for the domestic business.

She has opined that PI Industries is a quality stock in the agro chemical space and that it is worth looking at from a long-term perspective.

Rohan Gupta of Edelweiss has issued a similar crisp opinion about the prospects of PI Industries:

“Outlook and valuations: Dual segment growth; maintain ‘BUY’

Given the deferment in revenue from Q4FY18 to FY19, the growth expectation for CSM has still been kept the same. On the lower FY18 revenue, we have also maintained our 18% revenue expectation. However, management is confident of strong growth in the domestic agrochemical segment riding new product launches and is guiding for industry‐leading 18% growth in FY19. Given the traction, we have also adjusted our revenue growth expectation for FY19 higher from 8% to 12%. However, factoring in the lower margin guidance, we cut FY19/20E EPS 8%/5%. We value PI at FY20E target P/E of 25.0x, leading to TP of INR954. We maintain ‘BUY’.”

Investe maintains BUY on PI Industries on expectation of a normal monsoon & new product launches pic.twitter.com/5Pp4QycKBC

— CNBC-TV18 (@CNBCTV18Live) May 18, 2018

#OnCNBCTV18 | PI Industries says expect recovery in FY19 due to increase in demand globally, expect 18% revenue growth in FY19 pic.twitter.com/2CSmQL4b5z

— CNBC-TV18 (@CNBCTV18Live) May 17, 2018

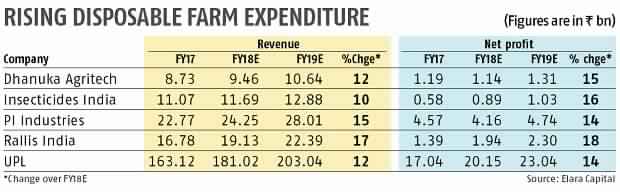

Agri input firms expect double-digit growth in sales, net profit in FY19

Dilip Kumar Jha of Business Standard has spoken to leading experts about the prospects for agriculture input companies in FY19.

The experts have opined that companies manufacturing farm input such as seeds, fertilisers and agrochemicals are likely to post double-digit growth in sales and net profit in 2018-19 on the back of an anticipated normal monsoon and possibility of increases in minimum support prices (MSPs) for kharif crops in 2018.

It is also pointed out that being a pre-election year, the government may seek to lure farmers with an increase in MSP.

The Government procures commodities such as wheat, rice and a limited quantity of pulses under the MSP.

(Image credit: Business Standard)

Conclusion

It is not known whether Equitymaster has PI Industries in mind or some other stock. In any event, as PI Industries is a core stock in Akash Prakash’s portfolio and that as it has all the virtues of a multibagger, we should also consider tucking into in a slow and steady manner!

PI Industries has been a great performer and with its products including in the pipeline and CSM business, we think it should be a good performer in the market in the coming times. However UPL is also a very large global player and has shown reasonable growth in sales and profitability over the years.

if you are not share about the name of the stock, then why you writes volumes and volumes on the subject.

I think following stocks from list are safe and are also available for good low risk price.

Gateway Distriparks Limited

Zensar Technologies Limited

MindTree Limited

Aurobindo Pharma Limited