“Fast Money” is gushing into Dalal Street ….

Samir Arora usually has a flamboyant and dare-devil personality.

He regales his massive follower base of 4,10,000 with a steady dosage of jokes and anecdotes and keeps them occupied.

However, on this occasion, he was not his usual cheerful self.

Instead, he appeared nervous.

“I am a little nervous,” he admitted with a stutter.

“This looks like fast money which comes into different markets basically to play specific events and it may go from one market to the other quite fast,” he said.

“Right now, it doesn’t look like the money is here for good,” he added.

“If BJP wins we could see a reasonable correction of 5-7 percent,” he warned in a grim tone.

It is obvious that if the Index is to correct by 5-7%, individual stocks will effortlessly lose 20-30% and hit rock bottom.

See 3 long-term themes in the market: Financial, consumer & tech companies. Not very excited about this market, expect moderate returns post election: @Iamsamirarora #OnCNBCTV18 pic.twitter.com/Ddhu4CKagX

— CNBC-TV18 (@CNBCTV18Live) April 8, 2019

#MarketMaster | ‘85-90% growth in #market will be driven by #consumption, #finance & #IT’ says @Iamsamirarora of #HeliosCapital, adding that ‘Not very excited about this market, expect moderate returns post #Election’#OnCNBCTV18 @latha_venkatesh @_anujsinghal @_soniashenoy pic.twitter.com/k63zmKXwZi

— CNBC-TV18 News (@CNBCTV18News) April 8, 2019

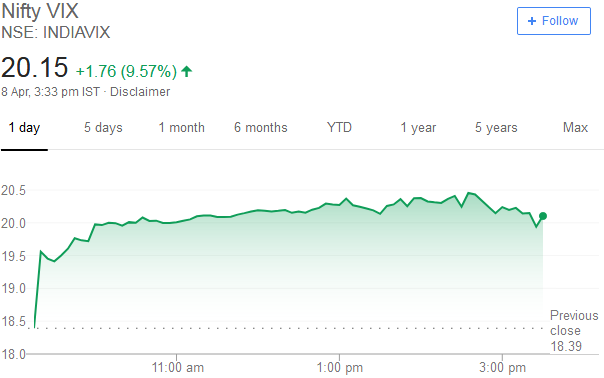

IndiaVIX surges, markets crash

Today, the IndiaVIX (the barometer of volatility) surged a mammoth 10%.

According to seasoned market watchers, such volatility in the IndiaVIX is unprecedented and is a sign of looming uncertainty in the markets.

#INDIAVIX at 20, going bonkers !

— Subhadip Nandy (@SubhadipNandy) April 8, 2019

Big rise in #IndiaVix is an indication of looming uncertainity in markets before elections..#Nifty.. pic.twitter.com/ILiTRvqQDc

— Vikash Shrivastava?? (@VikashS28) April 8, 2019

It is also claimed that the VIX can surge to as high as 40 and that the Indices can witness savage intra-day swings of up to 1-2%.

If history repeats itself, which is the cornerstone of technical analysis, given the same situation mass will behave similarly.

So here are my expectations :

1. VIX from here will continue to go up, maybe till 35-40 range

2. Expect daily 110-150 points daily moves on Nifty— Subhadip Nandy (@SubhadipNandy) April 8, 2019

By the EOD, the Sensex crashed a mammoth 300 points from the top while the Bank Nifty lost 239 points.

Higher #Crude prices drag market lower; #Sensex slips more than 300 points from highs. #Nifty breaches 11,600 to hit an intra-day low of 11,549.

Broader market ends with cuts of 0.8%; Midcap Index slips 1.2% from highs pic.twitter.com/Zxj0XtKRXJ— CNBC-TV18 (@CNBCTV18Live) April 8, 2019

The contagion spread to the US markets as well with the DOW Jones, S&P 500 and Nasdaq sinking like stones.

US market trades lower as Dow Jones slides 155 points, S&P 500 down 0.3% & Nasdaq Composite dips 0.4% on #WallStreet pic.twitter.com/Zc7CE0Bwkt

— CNBC-TV18 (@CNBCTV18Live) April 8, 2019

Traders should sell stocks now & come back later: Ridham Desai

Ridham Desai echoed the warning given by Samir Arora.

His words are eloquent:

“This quarter may not turn out to be a very good quarter in terms of share prices. So, India may underperform EMs. By the time, we get to the end of May the market may have priced in election outcome and then you will get some correction in June“.

“If you are a trader, you want to sell this as it crosses all-time high. Now that it has touched an all-time high, it has made a move ahead. And then you have to lighten up, wait for the elections to get over and then come in. That’s the better risk management for a trader.”

He also warned that if India decides to vote a fragmented government then you will get “perceptible correction” in stocks.

Conclusion

Prima facie, it appears that we will have to heed the advice of Samir Arora and Ridham Desai. It is better if we stay light until the elections are over. We can rush in to scoop up stocks at bargain basement prices if there is indeed the expected correction!

But after the big event is over (elections), then, either market will move up sharply – means you won’t get a chance to enter, or market will go down – means you won’t get a chance to exit.

Both ways it is a trap.

Stock market works on “Buy on rumours, Sell on news”. If the news is over, what is there in stock market.

Samir has not said this…he has clarified on Twitter…don’t spread fake news…fake headlines…not correct to go political into finance…bad boy!

Forget all these event based technicals. Major worry is ,who ever win,Modi or oppostion, tax payers and working class will be squeezed to feed Mufatkhors of India, Indian politics has been turned to worst by both principal parties,as both are promising lot of free ,as both has failed to perform, so can not ask vote on performance. India is going to be ruined by these NPA Polticians of both parties. Honest tax payers and working class should oppose these Third rate polticians of both parties, who are promising moon and will suck and loot tax payers and upper middle class to feed Mufatkhor ,non working useless parasites of India.

It’s just not India, the entire Globe is heading for a major economy reset.

The world economy is slowing down yet real estate and stocks continue to rise.

The Indian and Chinese automobile sector has fallen for the first time in 8 and 15 years respectively.

WHY

Russia, China all stocking up on Gold. RBI for the first time in 10 years purchased gold.

WHY?

Stock in Gold and Silver.

When the market crashes Gold and Silver will be 2x and 5x respectively.

Check metal prices pre 2008 and post-2010.

As for Politics, it has nothing to do with the Markets in the long term.

Again this is my individual research. I prefer not to look at India only but at the entire globe as a one market entity.

I don’t why people are writing 5-7% correction in Index as disaster. Looks like we have forgotten about ‘bears’ and taking perpetual bull market guaranteed. I can’t imagine this article is posted for 5-7% possible correction.

5%-7% correction is not even close to a crash.

Brace yourselves for 50% correction.

What is meant by 50% correction.

It is numb chilling.

Correction for someone who has kept cash in hand, waiting for the market to dip 30-50%

Crash for someone who has a majority of his/her money in equities at current rates.

As of 11th April 2019 nifty PE ratio is around 29.06. Market is very expensive.

It is around the same pre-crash of 2008.

Analysts saying earnings will kick in. I just don’t understand how.

Unsold real estate inventory hits 2-year low in the fourth quarter of 2018.

IIP at 20-month low in February 2019. Even the industrial sector is falling.

Car sales grew 2.7% in 2018-19, the worst performance since FY14 when passenger vehicle sales declined by 6%.

Scooter sales grew at the slowest pace in 14 years in FY19, underscoring a slowdown in demand in urban markets.

People’s income is not increasing but credit cards bills and loans are.

Check this link out.

Compare 2008 and 2019 chart. Check how much nifty fell.

https://www.equityfriend.com/investment-charts/nifty-pe-chart-nifty-pb-chart-nifty-dividend-yield-chart.html

People are getting greedy in this market. Smart money getting out, dumb money getting in.

When our office boy or maid or even our parents and friends who have no idea about the market but wants to put in their money. Then my money is out of that place.

People who are in SIPs can continue to do so as they will get more units at lower levels.

My Current Allocation.

25-30% Equities

35% Gold and Silver

35% Debt

Don’t even think about real estate.

The minute US Fed increases interest rates, FIIs will shift to the dollar.

This advice is coming from someone who has studied the 2008 market crash. Learn and educate yourselves about world economics, as for everyone else there is Mutual fund SIP’s.

Believe nothing, no matter where you read it, or who said it, no matter if I have said it, unless it agrees with your own reason and your own common sense.- Buddha.

You are living in past,in earlier time in market upmove all stocks used to go up ,that type of rally is already over as majorty of stocks are trading at fraction of their all time high ,mostly small and mid cap.In India there are hardly 100 compnies which in my view are worth investment ,and so much chasing same stocks,and slowly these stocks has become major constituents of indexes .Any major correction of more than 15% can be possible only in case of war,not due to any economic or global reason.

History doesn’t repeat itself but often rhymes.

1. Nifty traded at this P/E (above 28) last in February 2000 and then tumbled 50 percent between February 2000 and September 2001

2. Earlier, in January 2008, the index P/E had surged above the 28 mark, after which the 50-pack cracked 44 percent in the next nine months.

If anyone has studied the crashes closely (post PE 28 levels). Small caps and mid caps were the first to fall, followed by Large caps.

I hope your right, but again I don’t believe in hope since it is a future disappointment.

Many third rate stocks of 2001 and 2008 are already are already at crash values,and many do called investing gurus of third grade stocks are saddled with huge losses post 10 long term capital gain tax introduction, as many of these stocks were used to convert black money to white money tax free .Now Indian market is heavily concentrated to Quality 100 stocks and even running mutual fund SIPs are sufficient to run those 100 compnies market cap along with increasing growth in those 100 compnies..Any minor correction in market wi be bought,which will not allow any major fall.