Staunch believer in merits of diversified portfolio

A careful study of Amit Shah’s affidavit as filed with the Election Commission reveals several interesting aspects.

The first is that the wily politician is a staunch believer in the merits of a diversified portfolio.

According to data meticulously collated by the sleuths of Bloomberg, Amit Shah’s portfolio is worth about Rs. 18 crore as at the end of March 2019.

BJP president Amit Shah’s total investments in capital markets stood at Rs 17.59 crore as on March 30, reports @YatinMota.https://t.co/IJmnXqoujO

— BloombergQuint (@BloombergQuint) April 6, 2019

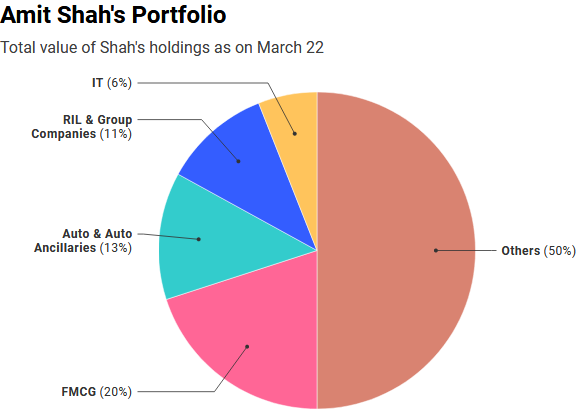

The portfolio is widely diversified and with proper allocation towards various sectors.

FMCG stocks

The FMCG sector commands the lion’s share of the portfolio with an allocation of 20%.

The stocks which have pride of place include blue-chip MNC names like HUL, P&G, Colgate, ITC and Kansai Nerolac.

| Top 5 FMCG stock holdings | No. of shares | Holding value (Rs) |

|---|---|---|

| HUL | 5,000 | 8,390,250 |

| P&G | 600 | 6,279,030 |

| P&G | 598 | 6,258,100 |

| Colgate | 4,000 | 5,055,000 |

| ITC | 15,000 | 4,473,000 |

| Kansai Nerolac | 10,000 | 4,450,000 |

Auto Stocks

Amit Shah is also a believer in the prospects for auto stocks.

He has allocated 13% of the portfolio to the auto sector.

The stocks are fail-safe such as Maruti, Bajaj Auto, M&M, MRF, Bharat Forge, Rane Engine, Castrol etc.

| Top 5 auto & auto ancilliary holdings | No. of shares | Holding value (Rs) |

|---|---|---|

| Rane Engine | 20,000 | 9,050,000 |

| Maruti | 1,000 | 6,552,700 |

| MRF | 100 | 5,654,775 |

| Bajaj Auto | 980 | 2,890,755 |

| M&M | 4,000 | 2,715,200 |

IT Stocks

Nobody can afford not to have blue-chip Infotech stocks in his or her portfolio given their dominance across the Globe.

Accordingly, Amit Shah has allocated 6% of his portfolio to the IT sector and cherry-picked blue-chip names like Infosys, TCS, Tech Mahindra etc.

| Other key Nifty 50, large-cap holdings | No. of shares | Holding value (Rs) |

|---|---|---|

| TCS | 5,290 | 10,609,889 |

| UltraTech Cement | 2,471 | 9,710,412 |

| Tata Steel | 5,933 | 3,075,667 |

| Grasim | 2,735 | 2,242,974 |

| Infosys | 2,970 | 2,207,007 |

| UltraTech Cement | 500 | 1,964,875 |

| Tata Steel | 88 | 518,918 |

| Total | – | 30,329,742 |

NBFC and Bank stocks

NBFC and Bank stocks have to form the bulwark of any sensible portfolio and so it is with Amit Shah.

He has reposed his faith in trusted names like L&T Finance Holdings, SBI, Canara Bank, Max Financial etc.

Mukesh Ambani & Gujarat stocks

No stock picker worth his salt can stay away from investing in Billionaire Mukesh Ambani’s Reliance Industries owing to its highly diversified businesses.

The behemoth is a powerhouse which has richly rewarded investors over generations.

Amit Shah holds a big chunk of Reliance Industries and TV18 Broadcast.

He has also reposed confidence in several high-quality companies based in Gujarat, his native place.

| Mukesh Ambani Group Firms | No. of shares | Holding value (Rs) |

|---|---|---|

| Reliance Industries | 15,572 | 20,893,731 |

| TV18 Broadcast | 70,000 | 2,422,000 |

| Total | – | 23,315,731 |

| Gujarat-based companies | No. of shares | Holding value |

|---|---|---|

| Gujarat Fluoro | 5,000 | 5,329,500 |

| SPARC | 17,500 | 3,350,375 |

| Torrent Power | 10,792 | 2,752,500 |

| Cadila Health | 5,000 | 1,664,250 |

Compulsive buyer of random & “chor” stocks?

However, despite his savviness in the field of stock picking, Amit Shah appears to be inflicted by the same syndrome which afflicts novice stock pickers, namely, that of compulsively buying random stocks.

There are several unknown stocks in his portfolio such as Anil Bioplus, Agro Dutch Industries, Jhagadia copper, Bihar Sponge, Rishabh Digha, Dhanus Technold, Balaji Galwe etc.

Some of these may even be “chor” stocks.

Amit Shah may have piled onto them in the last Bull run in anticipation that they will deliver multibagger gains.

Hopefully, he will have a chance in the next Bull run to dump these junkyard stocks and recover some of his capital.

Why no investments in Gautam Adani’s stocks?

One aspect which is baffling is that Amit Shah does not hold any stocks in Billionaire Gautam Adani’s companies such as Adani Enterprises, Adani Transmission etc.

This is surprising because NAMO, Amit Shah and Gautam Adani are supposed to be childhood buddies.

Presumably, Amit Shah has avoided these companies so as not to mix business with pleasure and to stay away from needless controversy which may be stoked by his political rivals.

Rahul Gandhi trusts only mutual funds

In sharp contrast to the stock picking prowess of Amit Shah, Rahul Gandhi has played it safe and entrusted his money to mutual funds.

He has investments in the following ten mutual funds:

| Scheme | Value (Rs) |

| Aditya Birla Sunlife | 74.90 |

| DSP Small Cap | 23.42 |

| Franklin India Equity | 73.74 |

| IDFC Multicap | 34.63 |

| L&T Equity | 46.82 |

| Motilal Oswal Multicap | 32.05 |

| Aditya Birla Sunlife | 62.38 |

| Franklin Debt Hybrid | 50.97 |

| ICICI Pru Regular | 67.75 |

| 519.44 |

We can see that Rahul Gandhi has also preferred to adopt a diversified portfolio with investments in several random mutual funds.

He appears to have a preference for ‘Multicap’ funds, which is a sensible choice.

He has also invested in a “Debt Hybrid” fund, whatever that means.

Unlike his opponent though, Rahul Gandhi, president of the Congress Party, has equity exposure mainly through mutual funds. #ETMarkets @AmitShah @BJPLive @RahulGandhi @PMOIndia #Elections2019 #ETMarkets @INCIndiahttps://t.co/HmMMEC6lvj

— ETMarkets (@ETMarkets) April 6, 2019

Very Good, So many MNC stocks