Shyam Sekhar’s Portfolio sparkles with Prima Plastics

Shyam Sekhar, the noted value investor, is known to be very strict when it comes to buying stocks. He has a clear idea of what stocks to buy and what to avoid.

While Shyam Sekhar is known for his allergy to micro-finance and housing finance stocks, he does have a number of mega multibagger stocks in his portfolio.

Stocks like La Opala, Jayant Agro, Hatsun Agro, HDFC Bank etc readily come to mind as being the bulwark of the value investor’s portfolio.

However, Prima Plastics is one stock that deserves special mention because Shyam Sekhar has shown his mastery by aggressively ramping up his holding in the micro-cap.

From a holding of 71,173 shares as of 31st March 2015 to a holding of 2,35,816 shares as of 30th September 2016, Shyam Sekhar has emerged as one of the largest shareholders of Prima Plastics and is in the position to call the shots.

Prima Plastics has richly rewarded the intrepid value investor by surging a massive 1475% since 1st April 2014 and 280% since 1st April 2015. The YoY return is itself a hefty 58%.

Prima Plastics is another feather in the cap of aceinvestortrader

While Shyam Sekhar may have pocketed big bucks from Prima Plastics, credit for putting the micro-cap in our radar has to go to the mysterious and anonymous blogger called ‘aceinvestortrader’.

Aceinvestortrader has a tendency to be ballistic about his stock recommendations.

He described Prima Plastics as a “Mega Multibagger in Making” and said that he was “awe struck the moment I realized what a great brand I was missing in my core portfolio”. The blogger assured his followers that the stock “will not just double or triple and stop. It will go wayyyy beyond” and advised them to “grab the opportunity while the big guys are busy analyzing messed up big businesses”.

Of course, the praise heaped on Prima Plastics was well deserved, and the advice to buy was invaluable, because Prima Plastics has surged like a rocket from the then throwaway price of Rs. 41 to the CMP of Rs. 208, giving eye-popping gain of 400% in just 25 months.

It is also worth remembering that Prima Plastics is not a flash-in-the-pan recommendation by aceinvestortrader. Instead, the mysterious blogger has several ten-baggers and multi-baggers to his credit such as V2Retail, Cupid, Garware Wall Ropes etc.

Prima Plastics is “riding on the fast track”: IDBI Capital

IDBI Capital has recommended a buy on the basis that Prima Plastics is “riding on the fast track”. The rationale is as follows:

“Prima Plastics (Prima) is the fourth largest moulded plastic furniture player in India, operating in Western & Southern area through strong distribution (425) and dealers network (5000+). It also exports (16% of Consolidated revenues) to US, Africa and Middle East (ME). During FY12-15, it reported revenues and earnings CAGR of 19% and 22%, respectively while debt level brought down to negligible level (from 0.4x in FY12) and ROE improved from 9% (FY12) to 12.4% (FY15). Going forward, the company would be on a fast growth track due to (1) Shut down of its loss making Aluminium Composite Panel (ACP) business in FY15 (2) Capacity expansion in India and African JV (3) Entry in Central America (JV; 4,000MT capacity) (4) Improving working capital cycle. Given its strong future prospect led by robust earnings growth & uptick in return ratios, FCF generation capability and robust balance-sheet, we assign a P/E multiple of 12x on FY18E EPS (v/s 1 year forward industry average P/E of 16x), translating a price target of Rs235 (63% upside). Initiate with a BUY.”

It is worth noting that IDBI Capital issued the buy recommendation in April 2016 when the stock was languishing at Rs. 144. At the CMP of Rs. 208, handsome gains of 45% are already on the table.

Capacity expansion will drive growth and margins: Nirmal Bang

Nirmal Bang has issued a management meet update note in which it has systematically set out all the salient features of Prima Plastics:

“Capacity expansion to drive medium-term growth and margins:

PPL currently has combined capacity of 10,000mt in Daman and Kerala. These two plants have a combined capacity utilisation level of 70%-75%. PPL has invested ~Rs70mn- Rs75mn on greenfield expansion at its plant in Ongole, Andhra Pradesh. This plant will have 1,500mt capacity and will serve eastern region. PPL has formed a 90:10 JV in Central America to serve the markets of Guatemala and Mexico. PPL has set up 4,000mt capacity in Guatemala incurring total capex of Rs180mn. PPL used to export its products to these markets before setting up the plant. It used to take ~90 days all the way from getting the order to shipping products to the clients. As a result of setting up this plant, the company will cut delay and save on logistic costs. PPL expects to clock sales of ~Rs200mn-Rs250mn from this JV in Guatemala by FY19. The partner having 10% stake in this JV has a distribution network in place which PPL plans to utilise. PPL also plans to expand its capacity in Cameroon from 4,00mt to 7,500mt with an investment of Rs120mn. All these capacities (~8,500mt) are expected to start contributing to total sales in the 4QFY17. PPL believes that with increased contribution from African and Central American JVs, operating margin will improve further.

Healthy growth with a clean balance sheet:

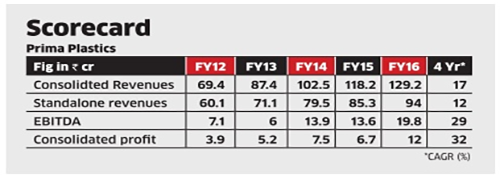

PPL is almost a debt-free company with cash and cash equivalent of Rs105mn despite expanding its capacity from 14,500mt to 22,500mt. PPL has steadily increased its sales at a CAGR of 17% over FY12-FY16 while EBITDA/PAT grew 29%/33% each. Declining crude oil prices helped improve PPL’s EBITDA margin to 15.7% (11.7% in FY15) and RoC and RoE to 16.8% and 20.4% (11.1% and 12.3% in FY15), respectively.”

Nano Nivesh Buy Recommendation By ICICI-Direct

Now, the big news is that the wizards at ICICI-Direct have recommended a buy of Prima Plastics with the solemn assurance that it has a target price of Rs. 267 to Rs. 283, which translates to a hefty upside potential of nearly 35% from the CMP of Rs. 208.

As always, the logic is simple and indisputable:

“Aggressive expansion plans:

PPL envisaged a series of expansions in FY15-16 to increase domestic & overseas capacity by 64% through internal accrual of ~Rs 35 crore. In FY16, It increased domestic capacity by 15% by adding a new plant in Andhra Pradesh (AP) to increase penetration in eastern & southern regions. Further, PPL increased its overseas capacity by ~3x (by doubling capacity in Cameroon and starting a new facility in Central America (Guatemala)).

This would help PPL serve the rising demand for moulded furniture, increase presence in untapped markets and reduce export related freight cost

• Overseas business to drive future growth: Prima Dee-lite (50% JV) posted a strong performance with revenue, earning CAGR of ~40%, 22%, respectively, in FY12-16, supported by strong EBITDA margin (average 29% EBITDA margin). The encouraging performance was backed by lucrative demand, change in product mix and brand acceptance, which also boosted the confidence of the management to expand into new geographies. We believe the strong performance of Prima Dee lite would continue albeit lower than historical trend due to an increase in overhead expenditure and rising competition. To replicate the same performance, PPL formed another JV (90% owned by PPL) in Central America that will start manufacturing moulded furniture by Q4FY17. We believe the overseas business will contribute ~39% by FY19E in topline (from 27% in FY16) due to current expansion

• Strong balance sheet, attractive margin: Debt free status, benign raw material prices, rising contribution of higher margin business and efficient working capital management have helped PPL to produce strong RoCE & RoE of 26% & 19%, respectively. Going forward, we expect consolidated revenue, earnings CAGR of 21%, 19% supported by EBITDA margin expansion of ~83 bps in FY16- 19E. We value PPL at Rs 267- Rs 283 i.e. 17x-18x P/E of FY18E.”

Expansion & cost gains will add shine to Prima Plastics: ET

Ashutosh R Shyam of ETIG has studied the fundamentals of Prima Plastics in a meticulous manner and concluded that it is likely to “reap rich dividends thanks to its capacity expansion, improving cost efficiency and increasing reach in high-growth markets”.

He has also opined that the present valuations, about 10x FY18E, is “reasonable” owing to the company’s potential earnings growth and improving return ratio. Prima’s peers, namely, Wimplast, Nilkamal, and Supreme Industries, are demanding exorbitant average valuations of up to 16x, he says.

(Image Credit: ET)

Conclusion

Prima facie, the bullishness of the experts with regard to the prospects of Prima Plastics appears to be justified. The Company’s debt-free status and high growth trajectory will hopefully soon propel it from the status of a nano cap into that of a small/mid-cap and lead to multibagger gains for its shareholders!

Dear Arjun, I wish to place a link here, my earlier posting on this same messageboard, where I recommended a stock called Emmbi Industries. Here is the link:

http://rakesh-jhunjhunwala.in/prof-sanjay-bakshis-fav-6-bagger-deep-moat-stock-entices-sumir-chadhas-jwalamukhi/

If you go through the link, I had posted the message on April 16th, 2016 when the stock was at 77. Today it is at 135, with an annualised gain of 105% in 8 months, with a very large headroom for further growth in stock price in the times to come. I posted here again on May22nd

http://rakesh-jhunjhunwala.in/top-quality-specialty-chem-stock-junked-by-jwalamukhi-is-a-strong-buy-now-experts/

And on June 15th

http://rakesh-jhunjhunwala.in/shankar-sharmas-latest-stock-picks-thrill-investors-with-59-gain-in-just-10-days/

and as late as 16th December’16

http://rakesh-jhunjhunwala.in/sanjoy-bhattacharyya-puts-a-buy-on-fav-stock-of-vijay-kedia-prashant-jain/

I posted repeatedly because I have done my research on the stock, and am myself a top ten shareholders of the company, my name being listed in the AR of 2016.

You are right Mr Venky, I missed this…

Can u share any other stock which ur positive like EMMBI?

Dear Sir,

On your recommendation , I hv bought Emmbi Industries and I am making good profit . Unfortunately I bought very little quantity.

Please recommend some new ideas also.

I think its too late to buy it now, 2 years ago it was at nice valuations.