Did Dolly Khanna escape the Corona Virus meltdown?

Dolly Khanna is well known in Dalal Street for being an escape artist.

There are a number of well-documented episodes where she escaped in the nick of time before a meltdown.

Some examples that come readily to mind include Hawkins Cookers, Nandan Denim, Avanti Feeds, RS Software, Cera etc (see Dolly Khanna Escapes Hawkins Cookers’ Carnage Even As Punters Rue Their Luck).

Dolly quietly escaped from the back-door, minutes before the stocks imploded and were reduced to a fraction of their former glorious selves.

Rajiv Khanna, Dolly’s illustrious alter ego, appears to have foreseen the present melt-down as well.

When he was grilled by the sleuths of ET as to why he and Dolly were AWOL from Dalal Street for so long, Rajiv pointed out that the “irrational exuberance” in the markets was keeping the Golden couple away.

“The current rally is irrational exuberance. I am a bit skeptical about it,” he said, giving a tiny glimpse of his visionary outlook.

Dolly also aggressively dumped several stocks from her portfolio during the peak of the exuberance.

Only a handful of trusted warhorses like Rain Industries, NOCIL etc have been allowed to stay in the portfolio.

The portfolio is now stands at a paltry Rs. 75 crore, with the bulk of the funds being invested (presumably) in RBI Gilt Bonds and other safe assets.

This brilliant maneuver has ensured that the wealth has remained unscathed despite the meltdown.

Chennai-based Rajiv Khanna, who invests in the name of his wife Dolly Khanna, pared his holding in at least 10 companies. @iYashUpadhyaya

Read more: https://t.co/sWMX9njymN pic.twitter.com/pUQLisBFXt

— BloombergQuint (@BloombergQuint) July 24, 2019

| Latest Portfolio Of Dolly Khanna | |||

| Stock | Nos of shares | CMP (Rs) | Value (Rs Cr) |

| Rain Industries | 6072042 | 54.75 | 33.2 |

| NOCIL | 3028025 | 67.75 | 20.5 |

| Nilkamal | 156029 | 959.70 | 15.0 |

| Muthoot Capital | 185765 | 245.20 | 4.6 |

| Butterfly Gandhi | 191315 | 91.90 | 1.8 |

| 75.1 | |||

NOCIL has a “towering entry barrier” and a “durable competitive edge”

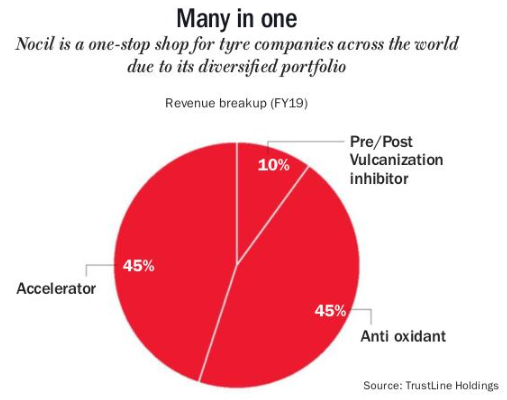

Arunagiri N, the founder of Trustline Holdings, has conducted an in-depth analysis of the prospects of NOCIL in the latest issue of Outlook Business.

He has pointed out that Nocil has established itself as a niche specialty player in the rubber chemicals business with a high entry barrier.

He has explained that NOCIL enjoys a “towering entry barrier” and a “durable competitive edge” owing to the following reasons:

• Highly critical ingredient that contributes to the quality of end product, but at the same time, constitutes a very low percent of the end product in terms of unit value.

• Long lead time for customer approval and stringent approval process.

• Exceptional need for technical knowhow and long gestation period for setting up capacity.

• Favourable replacement cycle in the end user markets.

• Few limited specialised players (niche oligopolistic market).

He has further stated that besides the industry level economics, Nocil also has another significant source of moat, namely, a high level of operational and process efficiency that come s from a long period of specialisation.

(Image Credit: Outlook Business)

Stranglehold over market place

Globally, there are just a handful of rubber chemical players and NOCIL is a dominant player in the market place.

It is the largest manufacturer of rubber chemicals in India with a domestic market share of 40%.

It is also the fourth largest in the world, in terms of capacity, with a market share of 5%.

It boasts of a marquee list of clientele such as Apollo Tyres, Pirelli, CEAT, Michelin, JK Tyres etc.

Its products are consumed by tyre manufacturers and non-tyre sectors such as latex, cycle tyres, surgical gloves, footwear etc.

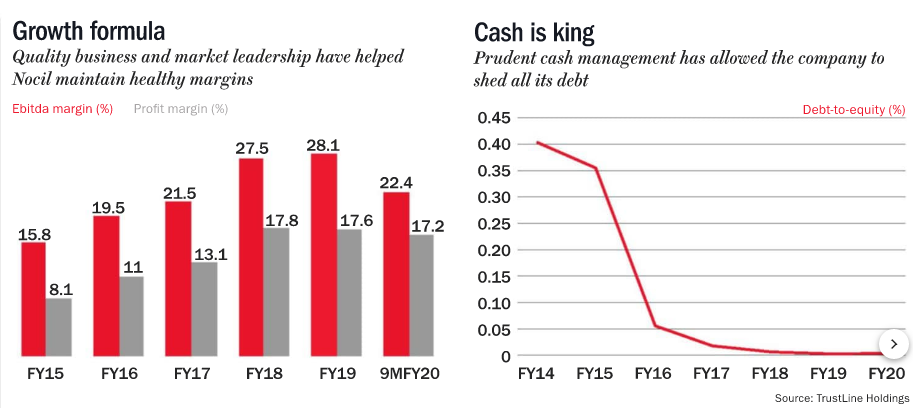

High profits, debt-free status

Arunagiri has also emphasized that NOCIL has robust fundamentals and healthy financial ratios.

It converts a whopping 60% of operating profit into operating cash flow and over 48% of net profit to free cash flow.

NOCIL enjoys a strong net cash position of Rs. 1.47 billion (Rs. 8.9/share) as on FY19 and its expansion capex of Rs. 4.25 billion is completely funded through internal accruals.

Its revenue, operating profit and net profit grew at a CAGR of 10%, 27% and 34% over FYI5-19, respectively.

Its operating profit and profit margins have grown from 15.8% and 7.9% to 28.1% and 15.2%, respectively.

“On the back of its robust earnings growth and cash flows, Nocil was able to clear its entire debt in FY18 and is currently debt free,” Arunagiri has added.

(Image Credit: Outlook Business)

Coronavirus crisis could be the biggest opportunity for NOCIL

It is a fact that China has emerged as a villain in the CoronaVirus crisis.

COVID-19 was made in China.

— Michael Coudrey (@MichaelCoudrey) April 1, 2020

It’s time to boycott China, boycott all goods made in China, and force companies to bring back manufacturing here.

China caused trillions of dollars of losses & will have effectively killed tens of thousands of people by trying to cover up the Coronavirus rather than stop it.

— Michael Coudrey (@MichaelCoudrey) April 1, 2020

According the US intelligence, China lied and concealed the extent of the Corona virus outbreak. That bad data led to a less extreme public policy response all over the world which ultimately led to massive misery and death everywhere https://t.co/18bdcsqvCD

— Bill Browder (@Billbrowder) April 1, 2020

Never forget the Chinese doctor who first warned about coronavirus and was threatened, attacked, smeared, made to sign a confession, silenced, isolated and then died after being infected while trying to help others.

China did all of this. https://t.co/BoySfa67JF

— Imam of Peace (@Imamofpeace) March 18, 2020

China gave the world poisoned dog food, toxic candy & toothpaste, radioactive drywall, counterfeit electronic components, fentanyl, carcinogenic fish, poisoned medication, SARS, now Coronavirus and we still do business w/them and buy their CRAP why?

— Drunk Justin Trudeau (@TrudeauDrunk) March 30, 2020

It is obvious that no sensible manufacturer can rely on a junkyard Country like China any longer.

They have to necessarily diversify and come to dependable Countries like India.

According to Arunagiri, NOCIL is well placed to take advantage of the transition from China to India.

“Right now, Chinese players dominate the global market with over 68% share, but that is likely to change and Nocil is well placed to capitalise on this transition,” he has stated.

“In fact, it has already done that once. In January 2019, the US imposed additional 15% duty on rubber chemicals from China. We believe this has acted as a trigger for Nocil to capture the incremental wallet share from Chinese rubber chemical players. In addition, the export market remains highly untapped for Nocil. With increased capacity, it can leverage and increase its global market share,” he has added.

NOCIL is a “steal” at current prices

Arunagiri has explained that NOCIL’s experienced and competent management, a long and complex period of specialisation, attractive industry dynamics with high entry barriers and robust financials make it a high quality one from the smallcap space.

He has pointed out that the stock is presently languishing owing to the overall global uncertainty and the removal of anti-dumping duty.

However, at the present level, the stock is at a significant discount to what it is worth.

He has estimated that NOCIL’s intrinsic value, even with a conservative growth and margin assumption, works out to be around Rs 220 – Rs 230.

At the present price of about Rs. 64, it trades at a sharp discount and offers substantial margin-of-safety of over 70%, he has opined.

“Over a four-year period, it can provide significant upside to long-term investors as we expect the intrinsic value to grow at a reasonably high rate,” he has added.

Pledging of Promoters is very high and it’s increasing. How do you see that as as a threat ??