Mutual Funds will dump stocks indiscriminately: Porinju Veliyath

“Yeh Mutual Fund ka banda lag raha hai,” Jigneshbhai said, taking a sip of the Kadak Adrak chai.

He was training his binoculars on a portly chap climbing the stairs of Jeejeebhoy Towers.

“Haan, suit boot mein hain,” Mukeshbhai replied.

The two stalwarts are part of the elite task force set up by the Bulls Army of Dalal Street (BADS) to keep surveillance on the activities of mutual funds.

Usually, the mandarins of mutual funds are easy to spot. They wear starched polyester shirts despite the sultry weather of Mumbai. They also have a look of self-importance around them.

The mandarins also do not hobnob with the local punters at Dalal Street.

The task force was necessitated because Porinju Veliyath has sent the chilling warning that there will be a selling avalanche by Mutual Funds to comply with the SEBI reclassification norms.

Over 300 mid & small-cap stocks are in selling list by MFs as part of their restructuring, partly to comply with SEBI reclassification norms – an opportunity for value-picking but need to be extremely selective!

— Porinju Veliyath (@porinju) April 30, 2018

It is explicit in Porinju’s warning that we should rush in to pick up the scraps after the mutual funds are done selling.

Our timing has to be impeccable. If we rush in before the selling has subsided, we will be swept away into the sea by the tidal waves.

Porinju’s diktats cannot be ignored because he has a follower base of 1 million (10 lakh) rivaling that of the legendary Warren Buffett (1.3 million).

Rain Industries falls victim to dumping by mutual funds

Yesterday, the mandarins of BNP Paribas Arbitrage Mutual Fund came to Dalal Street with a massive consignment of 18,90,000 shares of Rain Industries.

They started selling the shares like confetti, with no questions asked of valuations.

BULK DEAL

Rain Industries

BNP Paribas Arbitrage sold 18.90lk shares (0.6%) at Rs 277.43 each— Avinash Gorakshakar (@AvinashGoraksha) May 11, 2018

Naturally, the stock price plunged like a stone, recording a massive fall of 17%.

The stock has lost about 25% in just the last month.

Mohnish Pabrai had foreseen the crash and warned novices to stay away

Mohnish knows that novices have the bad habit of rushing in where angels fear to tread.

That is why he took time out to look us in the eye and warn us in a stern tone not to clone his stock picks unless he personally gives us the green signal to do so.

Never buy a stock without doing your own thorough research. I'd never buy a stock even if Buffett recommended it to me without doing the wrk https://t.co/Ed6vDTnkh8

— Mohnish Pabrai (@MohnishPabrai) November 5, 2017

With specific reference to Rain Industries, Mohnish made it clear that he would himself not buy the stock at the current valuations because it is not a “screaming buy”.

What made @MohnishPabrai buy Rain Industries? @_nirajshah https://t.co/3lTmaZmA6c pic.twitter.com/vItOJVDY8q

— BloombergQuint (@BloombergQuint) December 30, 2017

No doubt, Mohnish’s warning was timely and would have saved those who cared to listen.

Incidentally, there are three high-quality stocks that Mohnish has handpicked for us to invest in. These stocks are safe as a house and will lead us to prosperity (see Mohnish Pabrai Recommends Three Multibagger Stocks As Diwali Gift).

What is Dolly Khanna’s take on Rain Industries?

Unfortunately, Dolly maintains a stony silence despite the fact that her devoted fans at Dalal Street crave her counsel.

As of 31st March 2018, Rain Industries was the crown jewel of Dolly Khanna’s portfolio with a massive holding of 89,47,515 shares.

Even at the CMP of Rs. 274, the investment is worth an eye-popping Rs. 245 crore.

Dolly is second only to Mohnish Pabrai in Rain Industries’ list of illustrious investors.

Mohnish’s PMS Funds hold 290,12,715 shares as of 31st March 2018.

The investment is worth a colossal Rs. 795 crore at the CMP of Rs. 274.

In the past, we have seen that Dolly is able to predict crashes in stock prices and is able to escape through the back door when no one is looking.

The classic example is that of Hawkins Cookers where Dolly held a massive chunk. She sold a small quantity on virtually every day so that nobody would be alerted.

When the day of reckoning arrived and the stock crashed like a ton of bricks, Dolly had already flown the coop (see Dolly Khanna Escaped Carnage In Hawkins Cookers By Easing Herself Out Of Stock In Skilful Manner).

Yet another example is that of Cera Sanitaryware where Dolly walked out while the going was still good after pocketing multibagger gains (see Dolly Khanna Does It Again. Escapes Carnage In Cera Sanitaryware).

It is anybody’s guess whether Dolly has lightened any of her load in Rain Industries or is still going strong.

Quarterly results are good or bad?

According to some punters at MMB, the Q1CY18 results are so-so and this has contributed to the selling pressure.

However, other punters have a different opinion on the issue.

Unfortunately, it is beyond my competence to analyze financial results and that too of commodity companies.

The latest investors’ presentation paints a rosy picture of the financial affairs and so we can assume that all is well, at least for the present.

Geopolitical issues are grim?

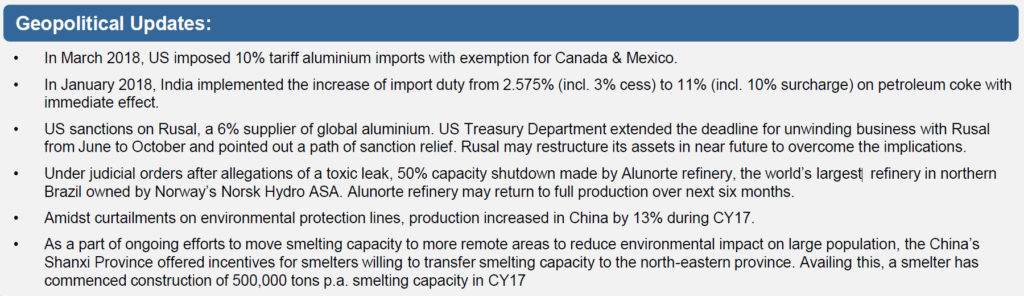

However, one aspect that the MMB punters missed out on is the disclosure with regard to geopolitical issues affecting the Company.

One of the chilling disclosures is the fact that a company in China has commenced construction of a smelter with 500,000 tons p.a. capacity.

It may not be long before the smelter goes into production given the efficiency of the Chinese in these matters.

Also, a refinery in Norway named Norsk Hydro ASA, which was forced into 50% shutdown by the authorities, is expected to resume full production over the next six months.

Further, a Russian competitor named Rusal which was subject to sanctions by the US Govt, has got some sort of reprieve and may be able to wriggle out of the production curbs.

It is elementary that if there is an increase in production, the prices for which the products can be sold will have to be reduced and this will compress the margins.

There are also sinister implications arising from the 10% tariff on aluminum imports imposed by the US Govt and the increase in import duties by the Indian Govt on petroleum coke (presumably a raw material for Rain Industries).

Will BNP Paribas Arbitrage dump its balance holding as well?

A Damocles sword hanging over Rain Industries is the fact that BNP Paribas Arbitrage Mutual Fund held 36,20,164 shares as of 31st March 2018.

Yesterday, they unceremoniously dumped 18,90,000 shares on the unsuspecting public which led to the collapse in the stock price.

Will they dump the balance of the holding also, and if so when?

Conclusion

Prima facie, the disclosures by Rain Industries of the geopolitical risks may have spooked BNP Paribas and the other investors. We should lie low and monitor the situation carefully and thereafter take appropriate decision!

I see it as proposed pet coke ban pan India got leaked yesterday and hence the fall. Today the news is officially in Media.

I assume the thesis behind buying the rain was that it would have a earning of around 30 rupees, in coming future and this was without and before the Chinese new regulations and by looking at the result I think they’re moving towards the road which is expected.