Nigel D’Souza explains merits of Asian Granito but forgets Dolly Khanna

First, we have to compliment Nigel D’Souza of CNBC TV18 for the succinct manner in which he is able to explain the merits of a stock.

In the case of Asian Granito, Nigel provided masterful insight into all of its salient features and explained why it deserves pride of place in our portfolios.

However, the baffling aspect is that while he referred to the fact that Asian Granito has various assorted shareholders with the surname ‘Patel’, he totally lost sight of the fact that Dolly Khanna rules the roost with a shareholding of 3,17,702 shares as of 31st March 2017.

Prima facie, this is sacrilegious because it is the unwritten law of Dalal Street that Dolly Khanna’s name has to be invoked first before we can talk about the other shareholders.

Nevertheless, Nigel’s analysis was spot on. The stock is up a hefty 28% since then (10th April 2017).

Asian Granito #midcapmania

q4fy17 needs to be tracked closely and promoters hiking stake is another big factor at these levels https://t.co/f76Z2RBmQZ— Nigel D'Souza (@Nigel__DSouza) April 10, 2017

Dolly Khanna rakes in 250% gain from Asian Granito

Thankfully, nobody can accuse me of committing sacrilegious acts with respect to Dolly Khanna.

When Dolly first made her grand entry into Asian Granito in January 2015, I diligently reported it (see Missed Cera & Kajaria? Consider Dolly Khanna’s Latest Micro-Cap Stock Pick)

I confidently opined that Asian Granito has the credentials of a strong brand, aggressive management, attractive product range, huge demand potential etc and that it will blossom into a multibagger and sparkle in Dolly Khanna’s portfolio.

I was right because the stock is up a magnificent 250% since then.

Mukul Agrawal & GMO Emerging Domestic Opportunities Fund hold big chunks

Mukul Agrawal of Param Capital appears to have visionary capabilities. His investment modus operandi and portfolio deserve to be analyzed in detail.

For now, we can note that he holds 3,50,000 shares (1.16%) of Asian Granito as of 30th September 2017.

GMO Emerging Domestic Opportunities Fund holds 6,90,686 shares (2.30%).

Sundaram Smile Fund holds 3,32,157 shares (1.10%).

Robust H2FY19 results shows that stock is ready for “Chala De Jadoo”

According to a press release, the following are the highlights of the H2FY18 performance:

• Net Revenue is at Rs. 500 Crores as compared to Rs. 483 Crores in the corresponding period of the previous year.

• EBITDA up 14% to Rs. 67 Crores as compared to Rs. 58 Crores in the corresponding period of the previous year.

• EBITDA Margins are at 13.3%, an increase of 120 bps from H1 FY17

• Profit after Tax up 41% to Rs. 25 Crores as compared to Rs. 18 Crores in the corresponding period of the previous year

• PAT Margins are at 5.1%, an increase of 140 bps from H1 FY17

Chala De Jaadoo campaign

It is pointed out that from 1st November, 2017 the Company has begun its New Brand Campaign – Chala De Jaadoo on all platforms i.e. Electronic Media, Digital Media and Outdoor Marketing PAN India.

Impact of GST on the ceramic tiles and marbles sector

It is also stated that the Government has reduced GST on Tiles and Marble from 28% to 18%. This is extremely positive for the ceramic industry as a whole. This will not only augment sector growth but will also encourage unorganised players to pay taxes which were facing problems post demonetisation and slowdown in real estate. The reform will offer level playing field for all players in the industry, reduce logistic cost, and offer scope for inorganic growth as the industry is likely to gain through consolidation post GST.

| Particulars (Rs. Crs.) | Q2 FY18 | Q2 FY17 | Y-o-Y | H1 FY18 | H1 FY17 | Y-o-Y |

| Revenue from Operations | 274.5 | 271.3 | 1% | 500.2 | 483.1 | 4% |

| EBITDA | 37.1 | 32.6 | 14% | 66.5 | 58.3 | 14% |

| EBITDA Margin (%) | 13.5% | 12.0% | 13.3% | 12.1% | ||

| Profit After Tax | 15.0 | 9.9 | 52% | 25.4 | 18.0 | 41% |

| PAT Margin (%) | 5.5% | 3.6% | 5.1% | 3.7% |

Affordable housing thrust and GST will be “game changers”: Investors’ presentation

According to the latest investors’ presentation, the thrust of the Government on affordable housing will benefit the Company in the following way:

(i) Market potential of affordable housing is expected to touch Rs 6.25 trillion by 2022

(ii) Development of Smart Cities: The Smart Cities Mission is expected to catalyze tiles demand from offices and residential spaces

(iii) Construction Market: India’s construction market is expected to reach USD 1 trillion by 2025, the third largest globally

(iv) Pradhan Mantri Awas Yojana: Aims to construct two crore houses in India, in three phases, till 2022

(v) Swachh Bharat Abhiyan: Aims to build 60 million toilets by 2019

GST is claimed to be a game changer for the following reasons:

(i) Increase in Market Share of the Organised Players especially AGL

(ii) Cost Competitive: Level Playing Field for All Players in the Industry

(iii) Reduction in Logistics Cost

(iv) High Industry Growth: Through consolidation, Industry is expected to grow @ 13% for next 5 years

(v) Scope for Inorganic Growth

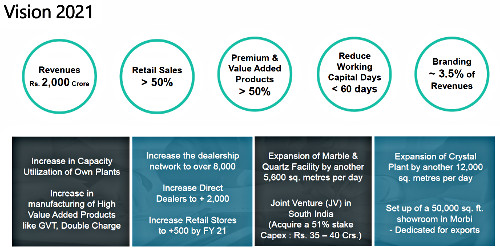

Vision 2021

The Company has also revealed its Vision 2021 plan.

Asian Granito has “ample levers & catalysts” to spur operating margins and outperformance: Edelweiss

Edelweiss has recommended a buy of Asian Granito.

As expected, the rationale is flawless:

“Beneficiary of GST + Product mix driving profitability

Asian Granito India (AGL) is the fourth largest tiles manufacturer in India, with ~33MSM capacity and accounts for ~8% of the organised tiles market. AGL produces ceramic wall & floor tiles and digital, polished/glazed vitrified tiles. It is also engaged in marble and quartz manufacturing with an annual installed capacity of 1.3MSM. The company has a wide range of tiles portfolio offering 1,200 plus designs across the INR 30 to INR 165 per sq ft price range. A vibrant product range, aggressively expanding distribution network, sustained capacity expansion and potential benefits of shift of market share to organised players are expected to aid AGL outperform peers. We estimate AGL to clock revenue/PAT CAGR of ~19%/45.7% over FY17‐19E, respectively, with healthy RoCE of ~20%. Initiate coverage with ‘BUY’ and target price of INR 640.

Ample catalysts to spur outperformance

AGL’s is expected to clock revenue CAGR of ~19% over FY17-19E primarily driven by increase in tiles sales volume CAGR by 16.7%, improvement in utilization, introduction of new products and increase in distribution reach to 5,500 sales points. AGL is targeting INR 2,000 cr sales over FY17- 21E. GST implementation is expected to lead to market share gains for organised players as Morbi players: a) may convert into organised players as it will be difficult to bypass GST; b) may shift focus to export markets to replace anti-dumping duty hit China, thus helping organised players like AGL gain domestic market share; or c) could outsource their facilities to organised players.

Ample levers to spur operating margin

We estimate AGL’s operating margin to catapult 180bps over FY17-19E on account of: (a) increased contribution of VAPs; (b) higher B2C sales (from 35% to 50%); c) lower gas prices; d) sharpening focus on branding; and e) expansion of dealers’ network— planning to add another 90; targeting 1,200 dealers by FY19. Ergo, we estimate the company’s EBITDA margin to jump to 13.4% by FY19E.

Outlook and valuations: On strong turf; initiate with ‘BUY’

The key drivers that will spur AGL’s surge are: 1) rising capacity; 2) focused vertical for value-added products; 3) aggressive launch of new products; 4) expanding network; and 5) demand recovery. These, we believe, will boost the company’s profitability in coming years, which is likely to lead to re-rating of valuation multiple. We initiate coverage on the stock with ‘BUY’ recommendation and target price of INR 640 based on 25x FY19E earnings (12% discount to Kajaria’s target multiple). The stock is currently trading at 24x/16x FY18E and FY19E earnings, respectively.”

Asian Granito has “Multiple growth levers” and is well placed to reap the benefits of the favorable outlook for the tile and quartz industry: Religare

Religare has also recommended a buy of Asian Granito on similar logic:

“Multiple growth levers

Established in 2000, Asian Granito India Ltd. (AGIL) is the fourth largest ceramic company in India with a global footprint across 53 countries. AGIL manufactures and markets interior & infrastructure products like vitrified wall & floor tiles, porcelain, natural marble composite and quartz. It has 8 state of the art manufacturing units spread across Gujarat and has 196 exclusive showrooms across lndia.

• Investment rationale

• Given India’s consumption potential, demand from retail is expected to remain robust in the next few years. Thus, the management is focused on increasing the number of its exclusive outlets from 196 currently to 500 by FY21E. It is targeting revenue mix of 50:50 (retail:institutional) in the next 3-4 years from (35:65) currently.

• GST implementation will help the organized players, including AGIL, to gain market share in the coming years. To encourage domestic manufacturers, the government has imposed an anti-dumping duty between USD 0.79 per sq mt and USD 1.87 per sq mt on all vitrified tiles imported from China in April 2017 for a period of five years (valid till 2022), which is expected to provide some relief to domestic tile players.

• The management is planning to increase its capacity utilization to 85% in the next 3-4 years from 65% in FY17, while selectively outsourcing the production of non-value added tiles. It is focusing on going through JVs and outsourcing model to expand its tiles capacity, which will help it to create an asset light business structure.

• The market for quartz stone in India is estimated at around Rs. 450 cr, which is growing at ~30% every year. Further, the export market for quartz stone is huge and it is targeting exports to US, Canada, EU and other Middle East Asian countries. The management is targeting to triple its quartz revenue in the next 2-3 years.

• The proportion of revenues from value added products is expected to increase from ~35% to ~60-65% over the next 3-4 years. AGIL also benefitted from falling natural gas prices in the last 3 years and favorable long term gas supply contracts with some of the major gas suppliers, which we expect to continue in the coming years as well.

Outlook & Valuation

AGIL is well placed to reap the benefits of the favorable outlook for the tile and quartz industry. The management has an ambitious target of reaching Rs. 2,000 cr revenue by FY21E from Rs. 1,066 cr in FY17. Factors like rising disposable income, lower per capita consumption of tiles in India, pick up in real estate sector; rapid urbanization and improvement in rural economy augur well for the tile industry. The company has been launching new and latest products to increase its offerings and providing value addition to its customers. We expect it’s operational and profit margins to improve on back of better product mix, focus on B2C sales, higher capacity utilization and asset light JV expansion plan. We expect revenue and PAT to increase at CAGR of 16.3% and 32% respectively over FY17-20E. We recommend a Buy on the stock with a target price of Rs. 642.”

Conclusion

We committed the buffoonery of staying aloof from the stock in January 2015 even though we knew Dolly Khanna had grabbed a big chunk. Due to this, we lost out on massive gains of 250% which otherwise would have effortlessly come into our pockets. We have another chance to make amends now and we must ensure we don’t blow it up this time!

What’s your view on Indo Amines Ltd, I hold 1.34 percent shares, price of purchase Rs 15/-